In terms of buying and selling, there are such a lot of little issues We want we had identified sooner. The following tips would have saved me some huge cash misplaced on “training” (a.okay.a. expensive errors) and helped scale back stress, enhance focus, and improve my general consolation.

These aren’t your typical “don’t FOMO” or “take revenue” suggestions. As an alternative, you’ll be able to instantly apply these actionable, typically ignored methods to see a distinction. Let’s dive in.

1. Use A number of Crypto Exchanges

Open accounts on as many buying and selling exchanges as you’ll be able to handle. You don’t have to make use of all of them concurrently; simply hold them prepared. This lets you take a look at completely different platforms and discover the very best match in your buying and selling model.

Every change gives distinctive advantages like decrease charges, superior charting instruments, or higher options. A number of accounts additionally help you begin contemporary positions with out doubling down on dropping trades. This manner, you’ll be able to place a brand new place on one other platform as an alternative of including to a dropping one, serving to to take care of a optimistic psychological state.

2. Use Completely different Exchanges As an alternative of Subaccounts

Whereas many exchanges provide subaccount options to diversify buying and selling, managing these subaccounts will be inconvenient, particularly throughout risky buying and selling periods. Switching between subaccounts on the identical change will be clunky and sluggish.

As an alternative, use separate apps for every change. You may simply change between apps in your cellphone quite than fumbling by means of subaccounts. For instance, some Android units allow you to clone apps, making it even simpler to handle a number of accounts. Even utilizing two telephones will be higher than managing a number of subaccounts.

3. Maintain Your Trades Tidy Throughout Exchanges

In case you have open positions in a single change, attempt to not commerce different cash. As an example, if in case you have BTC trades on one platform, use a special change for ETH trades. This helps hold your buying and selling clear and manageable. It’s straightforward to get overwhelmed if a number of positions run on the identical platform, particularly when utilizing hedge mode.

Utilizing completely different exchanges for various trades retains issues organized, making it simpler to observe positions with out pointless muddle.

4. Use Your Referral Hyperlink

Everytime you create a second account on an change, don’t overlook to make use of the referral hyperlink out of your first account. Most exchanges provide round 10% cashback on referral buying and selling charges, which might improve over time.

You won’t discover buying and selling charges day by day, however getting a small kickback each time you commerce is a pleasant bonus. Plus, that is what number of merchants and influencers within the crypto house make further revenue.

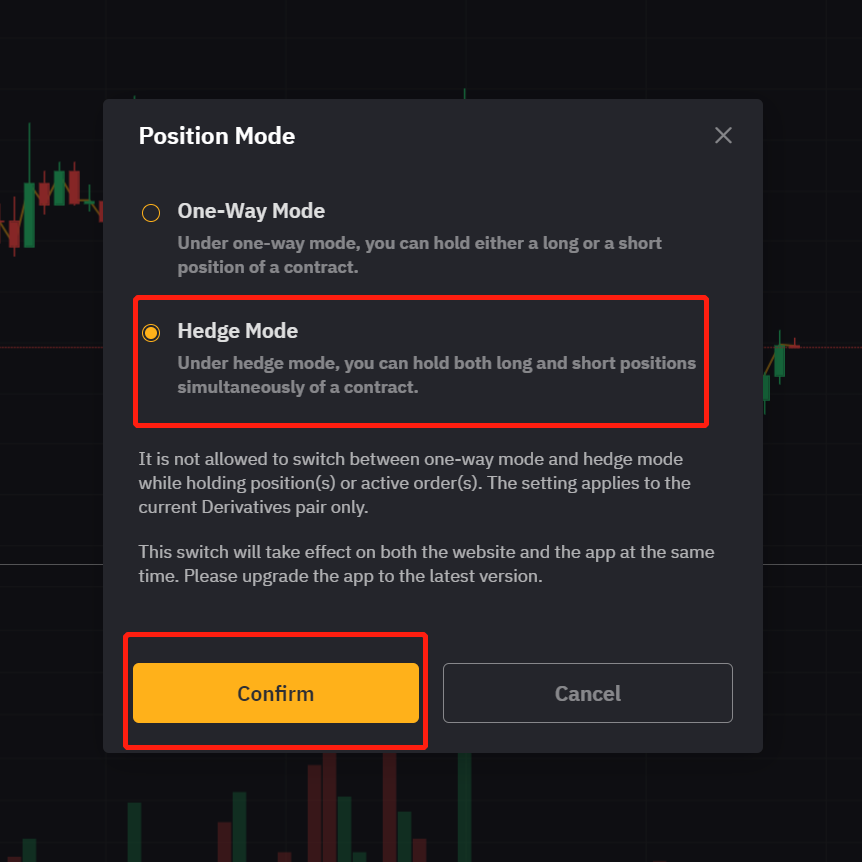

5. Flip On Hedge Mode

Most exchanges default to One-Means mode, limiting your choices to both liquidation or cease loss when issues go south. Switching to Hedge mode means that you can maintain each lengthy and quick positions concurrently, providing extra flexibility in managing danger.

Hedge mode can prevent cash and defend your trades throughout risky market swings, making it a vital setting to discover when you haven’t already. It’s a easy change that may present important advantages.

6. Maintain Your Ongoing Trades Non-public

One in all my greatest guidelines is retaining my ongoing trades to myself till I’ve a minimum of made some income. Posting about your trades in real-time, particularly if in case you have a social media following, can result in ego-driven choices.

You would possibly really feel pressured to defend your place when publicly sharing your trades, even when it’s not understanding. This stubbornness can value you greater than cash—it may mess together with your mindset. Maintain your buying and selling personal, keep versatile, and deal with making worthwhile choices, not proving some extent.

Amongst all of the technical evaluation instruments, the Fibonacci retracement is one we swear by. Whereas it doesn’t predict market course, it’s glorious at figuring out potential help and resistance ranges the place costs would possibly pause or reverse.

Drawing the strains appropriately may help you discover superb entry factors, even when you missed the preliminary transfer. Utilizing Fibonacci retracement can considerably enhance your buying and selling by supplying you with a clearer image of the place the market would possibly react subsequent.

Conclusion

Buying and selling isn’t nearly massive methods and grand theories; it’s typically the little issues that take advantage of distinction. By making use of these lesser-known suggestions—like utilizing a number of exchanges, retaining trades tidy, and mastering key instruments like Hedge mode and Fibonacci—you can also make buying and selling smoother, much less demanding, and finally extra worthwhile.

Buying and selling methods evolve with market situations, so at all times continue to learn and adjusting. The bottom line is to maintain enhancing, even when it’s simply small tweaks right here and there.

FAQs

1. Why ought to I take advantage of a number of exchanges as an alternative of only one?

Utilizing a number of exchanges helps you to discover the very best match in your buying and selling model, keep away from doubling down on dropping trades, and hold your positions organized throughout completely different platforms.

2. What’s the good thing about utilizing Hedge mode?

Hedge mode means that you can maintain each lengthy and quick positions concurrently, providing extra flexibility and danger administration choices in comparison with One-Means mode.

3. How does utilizing referral hyperlinks profit me?

Utilizing your personal referral hyperlink when creating new accounts can earn you cashback on buying and selling charges, including as much as a pleasant bonus over time.

4. Why ought to I hold my ongoing trades personal?

Maintaining trades personal helps you keep versatile and prevents ego-driven choices. Public trades can stress you into defending positions quite than making worthwhile changes.

5. How does Fibonacci retracement assist in buying and selling?

Fibonacci retracement helps determine key help and resistance ranges, supplying you with a greater sense of the place costs would possibly pause or reverse, aiding to find higher entry and exit factors.

You might also like

More from Web3

Binance Labs backed Web3 Startup with prominent founders Mario Ho and Jackson Wang to Launch Non-Fungible RWA Protocol Ecosystem

Disclosure: It is a sponsored submit. Readers ought to conduct additional analysis previous to taking any actions. Learn more …

SOL Strategies Files $1B Shelf Prospectus to Boost Solana Investment ‘Flexibility’

In short SOL Methods filed a $1 billion preliminary base shelf prospectus to increase its capital-raising choices. The submitting provides the …