In Temporary

Cryptocurrency change Gate.io launched a report, offering a abstract of Web3 on-chain exercise in April 2025.

Cryptocurrency change Gate.io launched a report, offering a abstract of Web3 on-chain exercise in April 2025. Solana maintained a median of over 93 million every day transactions, reaching a cumulative complete of two.4 billion by April 26, persevering with to steer all blockchains in utilization. Amongst capital stream knowledge throughout main chains, Ethereum recorded a web influx of over $904 million, rating first throughout the community. On the Bitcoin community, pockets addresses holding greater than 10,000 BTC confirmed cumulative scores between 0.9 and 1, indicating near-complete web accumulation. Moreover, Bitcoin’s UTXO web progress remained constructive, reflecting a gradual restoration in community exercise. As of April 28, Raydium’s LaunchLab had created 25,207 tokens, with a commencement fee of roughly 0.84%. In the meantime, the meme token $TRUMP triggered a wave of market enthusiasm, surging over 50% in value following the announcement of an unique golf dinner and White Home tour occasion, resulting in a notable enhance in each token holders and on-chain exercise.

On-Chain Knowledge Overview

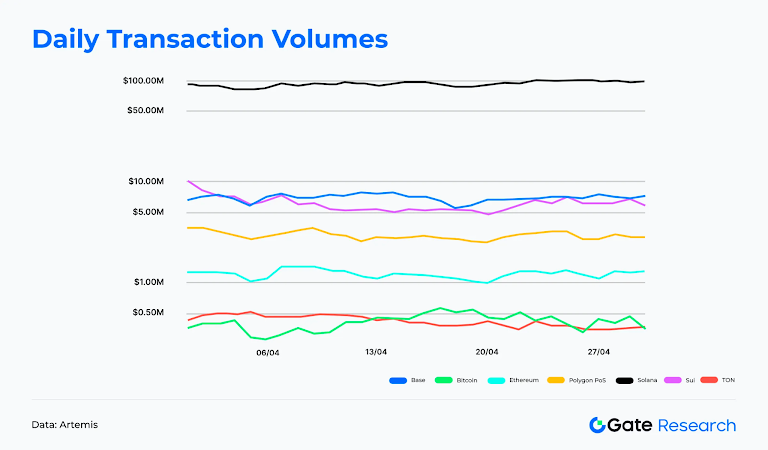

In April, Solana dominated all blockchains, averaging over 93 million every day transactions and reaching 2.8 billion cumulative transactions by April 30. Base and Sui point out sturdy exercise, as they recorded secure every day volumes of seven million and 6.1 million, respectively. Polygon PoS and Ethereum maintained regular tendencies, posting over 2.9 million and 1 million every day transactions, respectively. TON and Bitcoin remained decrease, fluctuating between 200k–400k transactions per day.

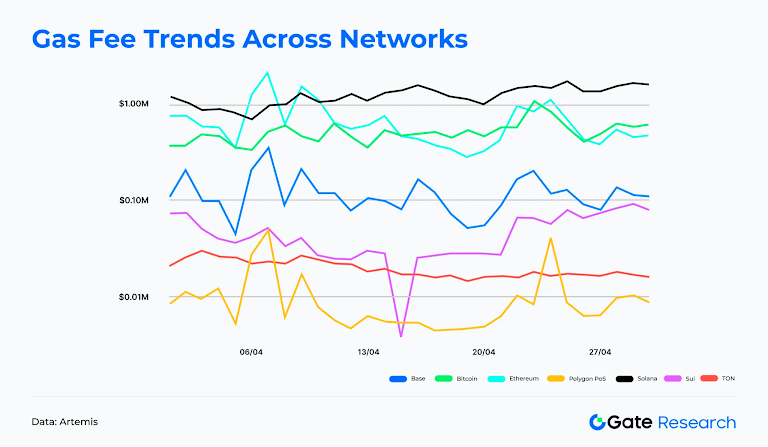

Whereas Solana held the highest place, rising chains like Base and Sui, although smaller in scale, demonstrated excessive interplay and powerful ecosystem momentum. Base benefited from the Coinbase ecosystem and meme coin exercise, sustaining over 7 million every day transactions and briefly reaching $350k in every day fuel income mid-April. This highlights its commercialisation potential. Sui sustained excessive engagement, averaging 6.1 million every day transactions, pushed by gaming, NFTs, and its Transfer-based developer ecosystem. Each chains are quickly increasing in low-fee, high-interaction environments, rising as main next-generation Layer 1s.

Solana dominated fuel income in April with a median of $1.2 million per day, totaling $37.5 million by month-end. Bitcoin and Ethereum adopted, every incomes about $500,000–700,000 per day. Base noticed a powerful mid-month peak of practically $350,000. Sui, Polygon PoS, and TON remained under $50k in every day charges, staying at low ranges. General, main chains proceed to steer in charge earnings, whereas rising chains like Base are steadily exhibiting business potential.

In April, Solana persistently processed a median of 93 million every day transactions whereas sustaining over 4 million every day energetic addresses, with a month-to-month common of roughly 4.5 million. This underscores that the community’s exercise is just not merely pushed by bots or remoted protocols however is supported by a strong and various consumer base. On April 11, energetic addresses peaked at over 6.2 million, additional emphasising a big spike in ecosystem engagement.

Moreover, Solana generated a median of over $1.2 million in every day fuel charges, far exceeding most different blockchains. This displays that the community’s excessive transaction quantity is just not solely frequent but in addition supported by real charge technology, somewhat than synthetic transaction inflation. This pattern is carefully tied to MEV reward mechanisms, akin to Jito, which incentivise high-frequency merchants and arbitrage bots, driving up transaction charges. Platforms like Pump.enjoyable proceed to draw meme coin creators, whereas aggregators like Jupiter facilitate high-volume swap transactions, sustaining elevated ranges of on-chain interplay.

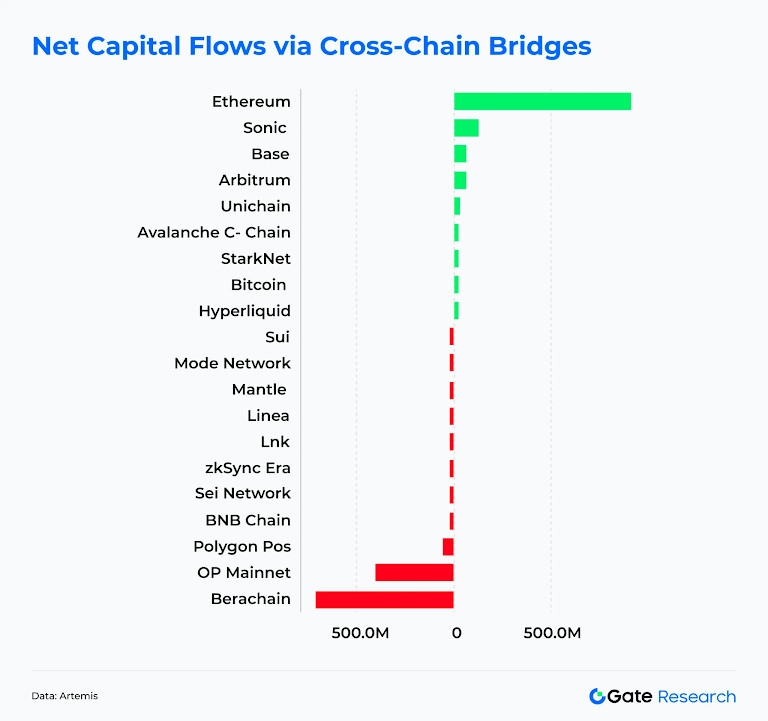

As of April 28, Ethereum recorded over $904 million in web inflows, rating first amongst all blockchains and reversing three consecutive months of capital outflows. This return of capital reaffirmed Ethereum’s function as the first “retailer of worth” chain. The influx pattern possible displays enhancing market danger urge for food, stabilization of Layer 2 actions, and rising ETF optimism, all of which attracted long-term capital again to the mainnet.

Amongst rising blockchains, Sonic stood out by attracting over $124 million in web inflows in April, climbing to second place. This displays rising market recognition of Sonic’s high-performance structure and low transaction prices, which have drawn new capital into its ecosystem. Base and Arbitrum recorded roughly $64.8 million and $62.1 million in web inflows, respectively, exhibiting continued constructive flows into sure L2 networks supported by secure developer exercise and consumer progress. Smaller ecosystems like Sui and Hyperliquid maintained modest web inflows, indicating continued capital attraction in vertical segments akin to buying and selling and gaming.

Conversely, Berachain skilled the biggest web outflow of any chain, totaling $704 million. OP Mainnet and Polygon PoS additionally noticed web outflows of $400 million and $57 million, respectively, suggesting short-term capital rotation to different blockchains or off-chain markets. General, April marked a structural restoration in capital flows—Ethereum reclaimed dominance, Sonic emerged as a powerful contender, whereas some early sizzling tasks confronted renewed redistribution pressures, signalling a refined shift within the aggressive panorama of public blockchains.

The next part selects and analyzes a number of key Bitcoin indicators to summarise market tendencies.

In line with Glassnode knowledge, in the course of the current Bitcoin value rebound, giant holders have clearly proven a steady shopping for sample:

- Pockets addresses holding greater than 10,000 BTC have cumulative scores between 0.9 and 1, indicating they’re virtually totally in web shopping for mode.

- Addresses holding between 1,000 and 10,000 BTC have scores between 0.7 and 0.8, exhibiting that this group is actively accumulating.

- Mid-sized holders with 10 to 1,000 BTC have seen their scores rise to round 0.5, indicating a shift from impartial to barely shopping for.

This means that in Bitcoin’s rebound after the mid-April correction, giant funds (whales) have re-entered the market first and are persistently accumulating, serving to to revive market confidence. These entities typically have vital affect on value tendencies, and their concentrated shopping for exercise is mostly seen as a key sign of a medium- to long-term uptrend.

UTXO (Unspent Transaction Output) is probably the most basic accounting unit in Bitcoin. It may be considered “change” that has not but been spent and is managed by the non-public key of the corresponding deal with till it’s used within the subsequent transaction. This mechanism ensures transparency and traceability of the blockchain and is the core of Bitcoin’s decentralized construction. The full variety of UTXOs displays on-chain exercise. A rise normally signifies an increase in transaction frequency, extra new addresses, or extra dispersed funds, representing a extra energetic community. A lower may recommend transaction consolidation, fewer customers, or a wait-and-see market, signalling declining utilization.

In line with Glassnode on-chain knowledge, since April 11, the online progress of UTXOs has continued to show constructive, with a transparent enhance in inexperienced bars, indicating that community exercise is steadily recovering and on-chain transactions have gotten extra frequent. In the meantime, the full variety of UTXOs has additionally begun to rise, echoing the upward pattern in Bitcoin value. This will recommend that the market is getting into a brand new progress cycle or an early restoration section. This metric is a vital indicator of capital stream and consumer engagement and is commonly seen as a number one sign of market sentiment and on-chain well being.

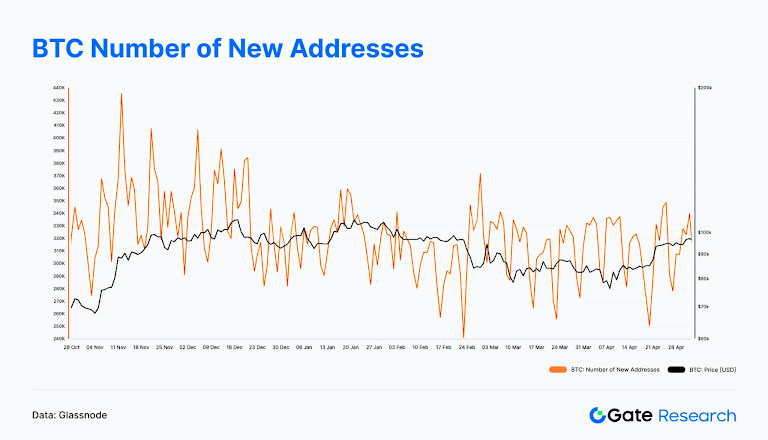

Notably, though UTXO web progress turned constructive in April, reflecting elevated on-chain transaction exercise, the variety of new addresses didn’t see a big rise. In line with Glassnode, the variety of new addresses throughout April largely remained throughout the vary of 300,000 to 350,000 per day, with none notable breakout. This means that the present on-chain restoration is pushed extra by the return and elevated exercise of present customers somewhat than by an inflow of latest traders.

This structural attribute signifies that the market remains to be in a restore section dominated by incumbent customers, with new consumer adoption but to indicate a transparent enlargement pattern. Though general on-chain metrics are enhancing, sustained value appreciation would require shut monitoring of whether or not new deal with progress picks up alongside rising costs, as a strategy to validate whether or not the market has entered a brand new section pushed by incremental capital inflows.

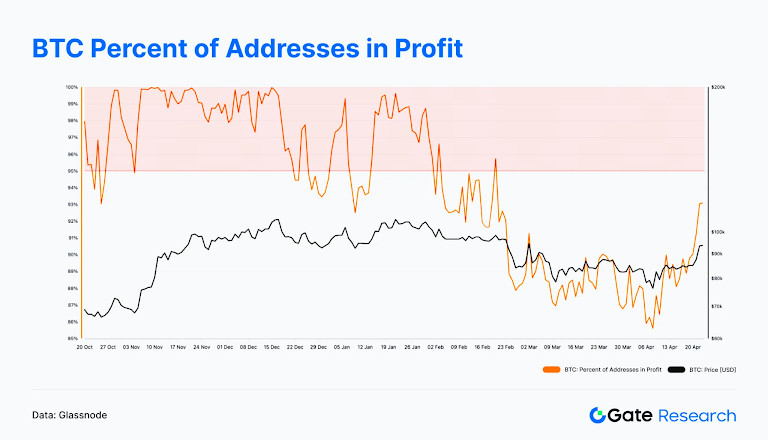

As present customers return and enhance their interplay frequency, market sentiment has steadily improved alongside the value rebound. This may be additional noticed by means of adjustments within the share of addresses in revenue. In line with Glassnode, in the course of the current Bitcoin value rebound, the proportion of addresses holding cash at a revenue has risen in parallel. This metric—Proportion of Addresses in Revenue—represents the proportion of addresses the place the present value exceeds the typical buy value, serving as a gauge of the market’s general profitability standing.

The chart reveals that since mid-April, as Bitcoin costs climbed, this ratio has quickly rebounded and now stands at 93%. Which means that the vast majority of traders have returned to a worthwhile state, and the unrealised losses from earlier corrections are shortly diminishing. This pattern usually signifies that market sentiment is shifting from pessimism towards neutrality and even gentle optimism. Such an atmosphere may also help spur new shopping for momentum, though it might even be accompanied by some profit-taking. If costs proceed to carry at elevated ranges and drive this ratio even greater, the market could also be getting into the early stage of a brand new upward cycle.

On-chain exercise in April exhibited divergence throughout ecosystems. Solana maintained its dominance in each transaction quantity and fuel income, showcasing its sturdy Layer 1 capabilities. Base and Sui noticed an increase in exercise, signalling rising potential. Ethereum, whereas main in capital inflows, noticed comparatively secure on-chain exercise, whereas networks like Berachain and Polygon PoS confronted capital outflow pressures. General, main chains consolidated their positions whereas competitors amongst rising chains intensified.

Aggregated on-chain knowledge means that Bitcoin is at present within the early levels of a structural rebound, with giant holders re-entering and steadily accumulating positions, appearing as a serious driver of the current value restoration. UTXO web progress has turned constructive since mid-April, with each transaction frequency and community exercise rising in parallel, indicating a restoration in on-chain momentum. Nonetheless, Glassnode knowledge reveals that new deal with progress remained flat in April, hovering between 300,000 and 350,000 per day. This suggests that the present restoration remains to be primarily pushed by present customers somewhat than new capital inflows.

On the similar time, the proportion of addresses in revenue quickly rebounded to 93%, reflecting that almost all traders have returned to a worthwhile state. Panic sentiment has subsided, and general market temper is steadily shifting towards neutrality and gentle optimism. If each value and on-chain exercise proceed to strengthen, accompanied by an uptick in new consumer progress, the market may even see further inflows and enter the following leg of its upward cycle.

Trending Tasks & Token Exercise

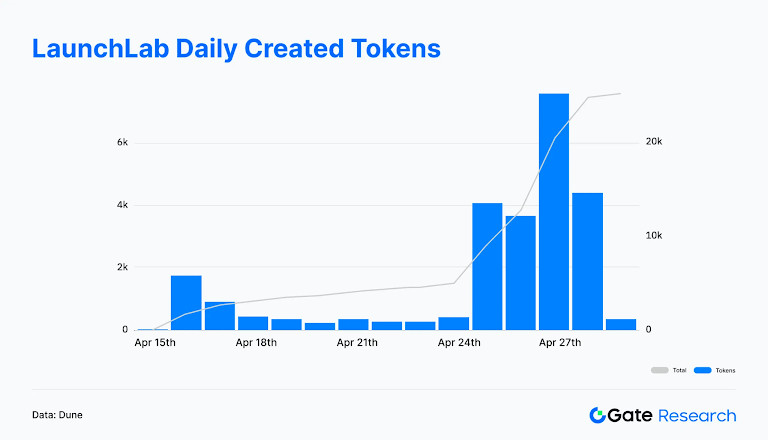

On April 16, Raydium, the main decentralized change within the Solana ecosystem, formally launched its token issuance platform, LaunchLab, providing creators and builders a low-barrier, censorship-free device for on-chain token launches and liquidity initialization. Customers can difficulty tokens utilizing numerous pricing curves (linear, exponential, logarithmic) and quote property (akin to SOL), with integration into AMM V4 and token locking mechanisms. Creators can even proceed to obtain 10% of AMM buying and selling charges even after their tokens “graduate.”

Within the practically two weeks since its launch, as of April 28, LaunchLab had created a complete of 25,207 tokens, of which solely 211 (0.84%) efficiently raised funds and moved into AMM liquidity swimming pools, indicating a excessive threshold for fulfillment. Token creation peaked on April 27, with over 7,500 tokens created in a single day; in the meantime, the very best variety of graduating tokens appeared on April 25 and 26, with greater than 110 tokens graduating over these two days. General, whereas LaunchLab has lowered the brink for token issuance, the success of tasks nonetheless closely is dependent upon staff power and market recognition.

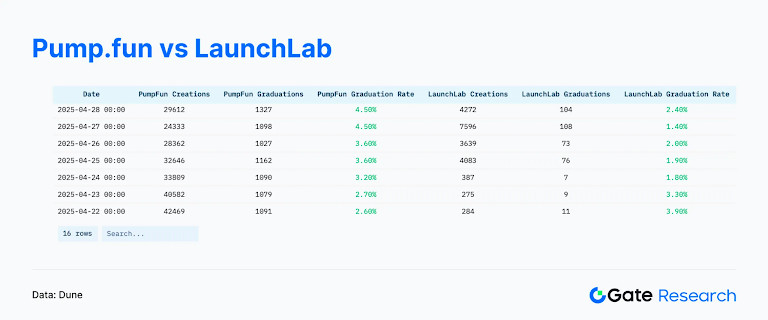

As of April 28, there was a transparent distinction between the 2 most important token issuance platforms on the Solana chain:

- Pump.enjoyable created 29,612 tokens, with 1,327 efficiently graduating — a commencement fee of 4.5%.

- Raydium’s LaunchLab created 4,272 tokens, with 104 efficiently graduating — a commencement fee of two.4%, considerably decrease than Pump.enjoyable.

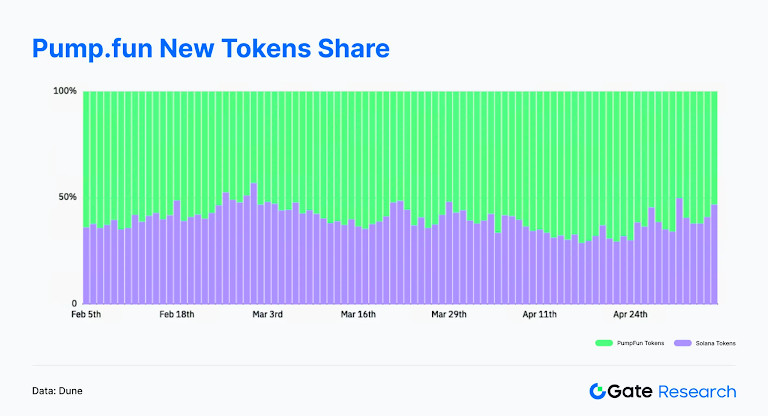

Pump.enjoyable has lengthy dominated the bulk share of latest token issuance on the Solana community. Even after LaunchLab’s debut, Pump.enjoyable maintained a excessive market share. Significantly in early March and late April, Pump.enjoyable’s every day issuance share exceeded 65%, underscoring its continued management in each issuance quantity and consumer exercise. Whereas LaunchLab presents extra versatile issuance mechanisms and financial incentives, Pump.enjoyable stays the main token issuance platform on Solana by way of penetration and market dominance.

General, LaunchLab, as a newly launched token issuance platform by Raydium, has quickly attracted numerous creators and venture groups, demonstrating sturdy ecosystem enchantment and on-chain innovation vitality. Though its commencement fee remains to be at an early stage, the platform has efficiently lowered issuance boundaries, diversified Solana’s on-chain functions and property, and laid a strong basis for the incubation and progress of future high quality tasks. As market mechanisms enhance and the neighborhood matures, LaunchLab is predicted to turn out to be an vital driver for monetary innovation and consumer engagement on the Solana blockchain.

$TRUMP — The TRUMP token is a meme coin themed round a political determine, deployed on high-performance blockchains akin to Solana. It’s favoured by builders as a result of its low transaction prices and straightforward issuance mechanism. The token is derived from the general public picture of the present U.S. President Donald Trump, and is extensively used within the PolitiFi (political finance) sector. By mixing neighborhood tradition, trending matters, and social media advertising, it has efficiently captured market consideration.

The most recent surge in $TRUMP’s value was largely pushed by market information. On April 24, President Trump introduced he would host a dinner in Could at a golf membership close to Washington D.C. for the highest 220 holders of $TRUMP, with an unique reception and White Home tour supplied to the highest 25 holders. The announcement shortly went viral on social platforms, igniting market sentiment and driving the token’s value up over 50% inside a brief interval, positioning it as one of many hottest meme cash of the season.

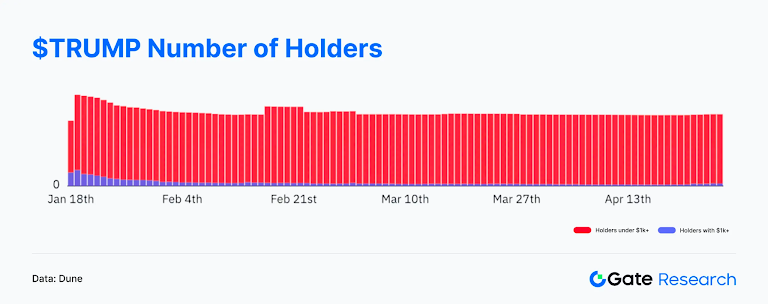

This occasion not solely considerably elevated $TRUMP’s on-chain exercise but in addition renewed curiosity within the PolitiFi sector’s potential. Buyers started actively competing for rating in token holdings and paying shut consideration as to if related benefit-based incentives would seem sooner or later. On-chain knowledge reveals that because the announcement on April 24, the variety of addresses holding greater than $1,000 price of $TRUMP rose from roughly 18,000 to 21,900 — a rise of over 21%. The full variety of token-holding addresses additionally climbed from 640,000 to 643,000, additional proving that market enthusiasm had expanded from the core neighborhood to a broader consumer base. This demonstrates the sturdy viral and enticing energy of political meme cash when pushed by topical occasions.

Notably, in accordance with Chainalysis, since its launch, the $TRUMP token’s founding staff has amassed over $320 million in income from transaction charges, reflecting not solely its hype-driven enchantment but in addition its substantial capital-generation capability. On Could 5, Trump as soon as once more promoted the upcoming Could 22 dinner, additional fueling market consideration and narrative momentum. This phenomenon underscores the diversification of capital flows in crypto markets whereas serving as a reminder for traders to keep up danger consciousness and punctiliously assess the long-term worth and sustainability of such high-volatility property.

Disclaimer

Consistent with the Trust Project guidelines, please word that the knowledge offered on this web page is just not meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you may afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.