Chainlink’s Cross-Chain Interoperability Protocol helps liquid staking and restaking protocols scale by enabling them to permit their customers to stake their ETH immediately from layer-2 networks—considerably increasing the accessibility of liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) throughout the multi-chain ecosystem. This functionality is uniquely enabled by CCIP’s assist for Programmable Token Transfers, which allow the simultaneous switch of tokens and knowledge directions cross-chain.

Lido, a number one liquid staking protocol, not too long ago built-in CCIP to energy the brand new Lido Direct Staking rails, which allow customers to stake their ETH immediately from different blockchain networks and obtain wstETH, beginning with assist for Arbitrum, Base, and Optimism. The brand new Lido Direct Staking rails are being adopted by numerous DeFi frontends together with XSwap, OpenOcean, and Interport.

Along with Lido, a rising variety of protocols are additionally integrating Chainlink CCIP to go cross-chain and allow the staking/restaking of ETH from layer-2 networks:

On this weblog, we’ll dive into the completely different ways in which CCIP can allow the staking of layer-1 property from layer-2 networks and the advantages this may deliver to the LST/LRT ecosystem.

Unlocking The Multi-Chain Demand for LSTs/LRTs

Liquid staking has grow to be one of many largest sectors in DeFi, with over $40 billion in TVL. Restaking, and by extension liquid restaking, have additionally grown at an accelerated fee, with restaking representing roughly $13.7 billion in TVL (of which $10 billion is in liquid restaking kind).

Regardless of this progress, a key limitation going through each liquid staking and restaking protocols is the liquidity and availability of their respective LSTs / LRTs throughout the multi-chain ecosystem. Whereas many such protocols have made their respective LST/LRT tokens bridgeable throughout quite a lot of blockchains (in lots of circumstances by way of CCIP), the minting of latest LST/LRT tokens is usually restricted to a single blockchain the place the core (re)staking protocol contracts function.

Because of this, it’s typically troublesome for holders of layer-1 property on layer-2 networks to mint LST/LRT tokens. For instance, holders of ETH on layer-2 networks trying to (re)stake their ETH should manually bridge their ETH again to Ethereum mainnet (which can take as much as 7 days with optimistic rollups), stake their ETH in trade for his or her LST/LRT of selection, after which manually bridge their LST/LRT again to the layer-2 community.

Chainlink CCIP and its assist for Programmable Token Transfers may help compress all of those steps right into a single layer-2 transaction from the consumer’s perspective.

How CCIP Permits Cross-Chain Connections To Liquid Staking and Restaking Protocols

CCIP Programmable Token Transfers allow sensible contracts to switch tokens cross-chain together with knowledge directions on what the receiving sensible contract ought to do with these tokens as soon as they arrive on the vacation spot chain. This programmability is vital to enabling advanced cross-chain interactions, resembling cross-chain staking, because it permits customers on one blockchain to work together with and profit from sensible contracts on one other blockchain—with out ever leaving their most popular blockchain surroundings.

A staking protocol’s use of CCIP to allow (re)staking from layer-2 networks will be achieved in a number of alternative ways, relying on the pace and value preferences of the (re)staking protocol and its customers.

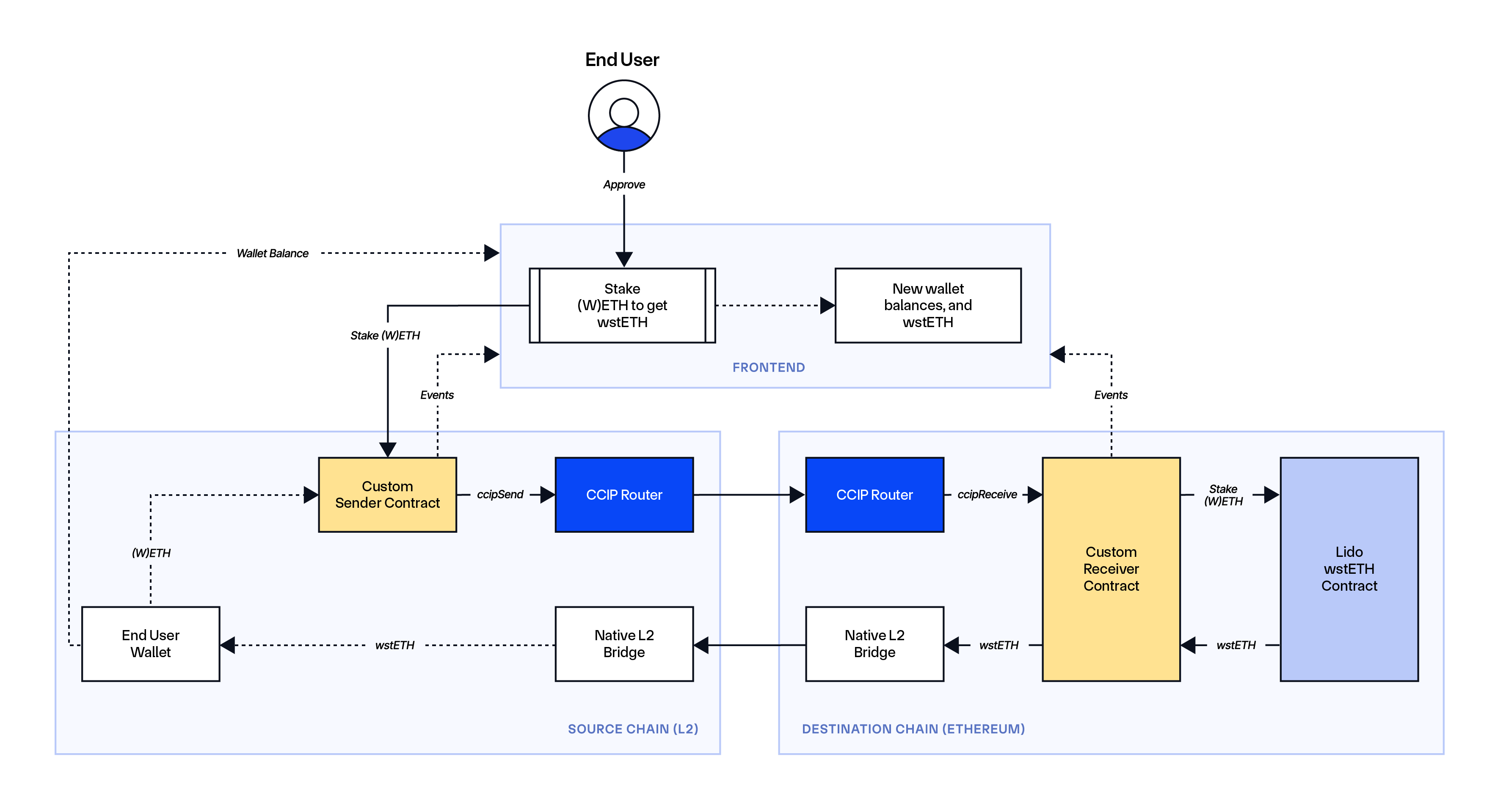

Direct Strategy

The way it works on Ethereum: Within the direct method, an end-user initiates a staking interplay on a layer-2 community, after which their ETH, together with knowledge directions on what to do with the tokens, are despatched to Ethereum by way of CCIP. A receiving sensible contract on Ethereum receives the ETH, stakes it right into a liquid (re)staking protocol, and the newly minted LSTs/LRTs representing that staked place are then bridged again to the consumer’s pockets deal with on the layer-2.

Advantages/Challenges: This method is extremely cost-effective for (re)staking protocols to assist because it includes no liquidity administration operations, however customers should wait till all cross-chain transactions concerned within the course of have been accomplished with a purpose to obtain their LST/LRT tokens on the layer-2 community (customers obtain their LST/LRT in a separate transaction later in time asynchronously).

Examples:

- Lido’s Direct Staking rails use CCIP to assist the direct staking methodology of staking ETH for wstETH from layer-2 networks, along with the liquidity pool method.

- EigenPie is integrating CCIP to allow its customers to restake ETH for egETH from layer-2 networks.

- StakeStone is integrating CCIP to allow its customers to stake ETH for STONE from layer-2 networks.

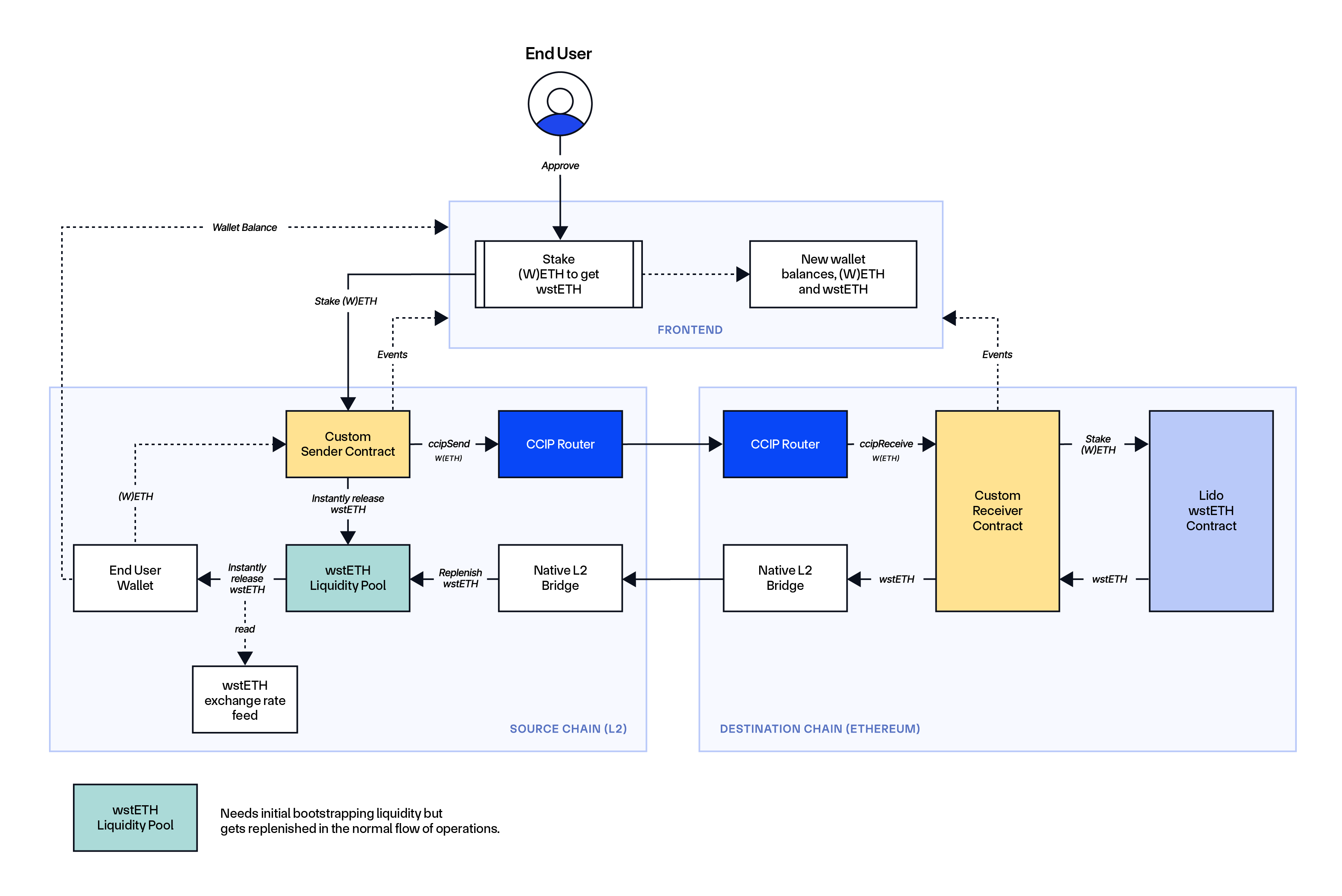

Liquidity Pool Strategy

The way it works on Ethereum: Within the liquidity pool method, an end-user initiates a staking interplay on a layer-2 community and instantly receives an LST/LRT from the (re)staking protocol’s liquidity pool. That is achieved by utilizing an trade fee knowledge feed to report the (re)staking protocol’s inside trade fee for the LST/LRT on that L2 or by utilizing CCIP to bridge the trade fee knowledge. As soon as the ETH deposited by the consumer into the (re)staking protocol’s liquidity pool is shipped to Ethereum by way of CCIP together with the directions for the receiving sensible contract to (re)stake, the newly minted LST/LRT is then bridged again to layer 2 to replenish the liquidity pool.

Chainlink Automation can be utilized to allow transaction batching, the place after a specific amount of ETH is collected within the liquidity pool (or a sure period of time has handed), CCIP is triggered to switch a batch of ETH to Ethereum the place a receiving sensible contract can (re)stake that ETH into an LST/LRT format and bridged again to the layer-2 to replenish the liquidity pool, decreasing the liquidity administration prices for the (re)staking protocol.

Advantages/Challenges: This methodology permits customers to immediately obtain LSTs / LRTs throughout the similar atomic transaction they provoke a staking interplay, however requires (re)staking protocols to bootstrap a liquidity pool—which might grow to be self-sustaining via the replenishing course of. For this method, the (re)staking protocol should handle liquidity for its LST/LRT on the layer-2 networks the place the function is made out there. If a consumer makes an attempt to stake a considerable amount of ETH, there must be sufficient out there liquidity within the pool or in any other case present a fallback to the direct method of utilizing CCIP to stake from layer-2 networks.

Examples:

- Lido’s Direct Staking rails use CCIP to assist the liquidity pool methodology of staking ETH for wstETH from layer-2 networks, along with supporting the direct method.

- Frax is integrating CCIP to allow its customers to stake ETH for sfrxETH from layer-2 networks. If liquidity within the layer-2 liquidity pool is inadequate to cowl a staking transaction, Frax will even assist the direct staking method with CCIP.

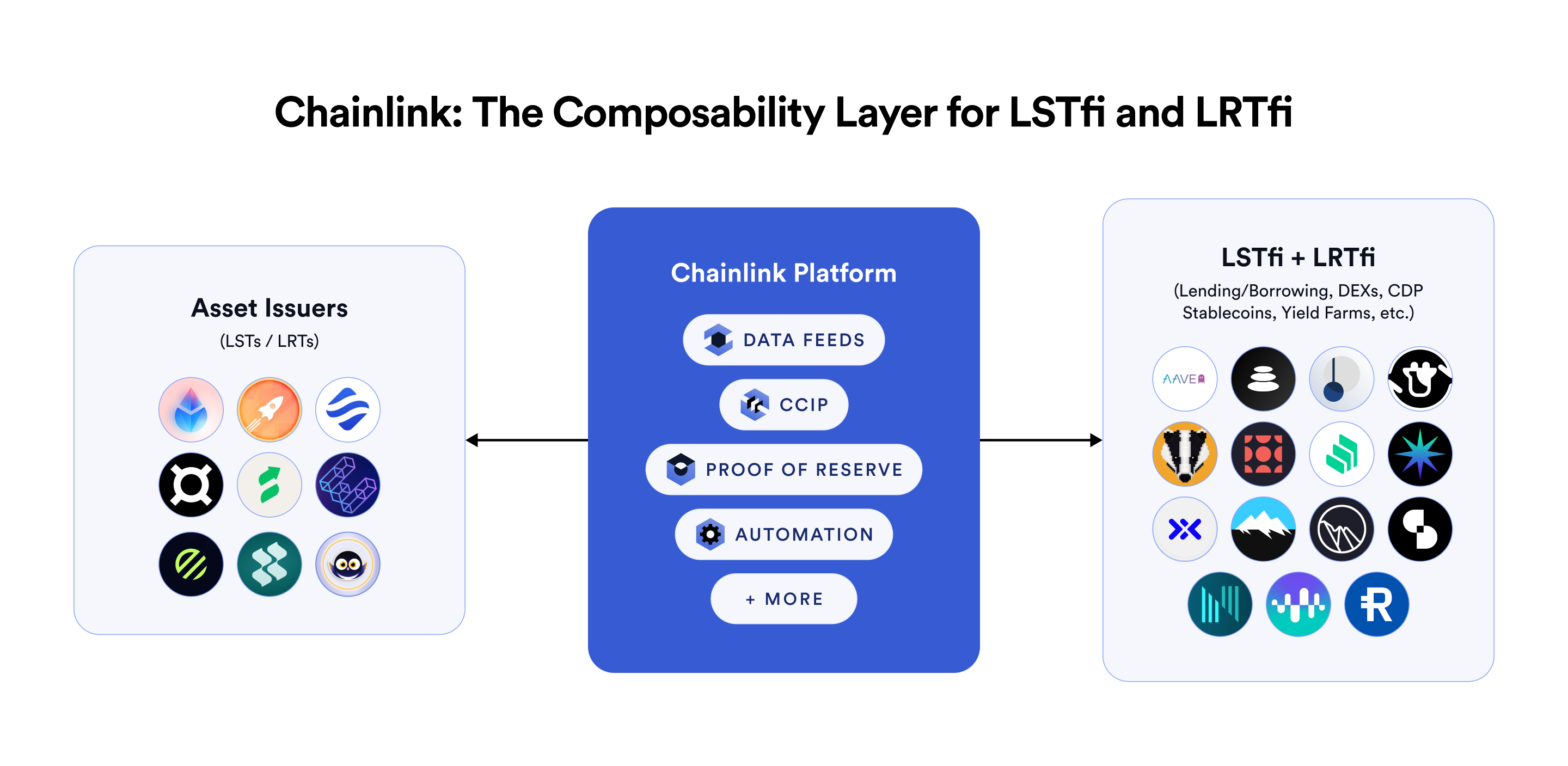

The Chainlink Platform For Liquid Staking and Restaking Protocols

CCIP affords builders flexibility to energy all variations of cross-chain (re)staking for LST/LRT protocols. Notably, these capabilities are powered by the Chainlink platform, which permits superior performance via the mixture of industry-standard providers, and with little-to-no extra belief assumptions when utilizing a number of providers:

- CCIP unlocks programmable token transfers that allow worth and messages to be despatched inside a single transaction.

- Data Feeds relay the inner redemption charges for LSTs/LRTs throughout chains.

- Proof of Reserve verifies the reserves backing LSTs/LRTs.

- Automation helps dependable liquidity pool rebalancing operations.

You may learn extra about Chainlink’s assist for the staking and restaking ecosystems in How the Chainlink Platform Unlocks LST and LRT Adoption in DeFi. For a deeper technical dive, take a look at CCIP Masterclass: Cross-Chain Staking Edition.

If you’re a DeFi protocol or conventional monetary establishment and need to discover how CCIP Programmable Token Transfers can unlock your cross-chain and tokenization use circumstances, reach out to our team of experts. If you’re a developer and need to get began with CCIP Programmable Token Transfers, take a look at the Chainlink documentation for extra technical assets.

Disclaimer: This put up is for informational functions solely and accommodates statements in regards to the future, together with anticipated product options, improvement, and timelines for the rollout of those options. These statements are solely predictions and replicate present beliefs and expectations with respect to future occasions; they’re primarily based on assumptions and are topic to danger, uncertainties, and modifications at any time. There will be no assurance that precise outcomes is not going to differ materially from these expressed in these statements, though we imagine them to be primarily based on cheap assumptions. All statements are legitimate solely as of the date first posted. These statements might not replicate future developments on account of consumer suggestions or later occasions and we might not replace this put up in response. Please assessment the Chainlink Terms of Service, which supplies essential data and disclosures.

You might also like

More from Web3

Airport And Marine Port Security Market Report 2025-2034: Industry Overview, Trends, And Forecast Analysis

Airport And Marine Port Safety The Airport And Marine Port Safety Market Report by The Enterprise Analysis Firm delivers …

Bitcoin Price Holds Steady Ahead of Trump’s ‘Liberation Day,’ Jobs Report

Bitcoin was broadly flat on Wednesday because the crypto markets await particulars of Donald Trump's deliberate tariffs.The White Home …

Eggmed Launches Next-Gen EHR Focused on Continuous Care Between Sessions

Picture: https://lh7-rt.googleusercontent.com/docsz/AD_4nXd4fmsJ946b3m8KK5a6FgLMcmovDGDaWFFW-UFiz6KAx0wACn9o9FYWrBtDXgCb0FYepLJ1dlnGZxjw5EmwF1HuTmD38s6_4jwka0QpFfyiEftTfsQmg4vLj19yA-GVJEcxVou6ug?key=jK9hncucen9R_biM2d1UtRfqNew York, NY – 1 April, 2025 – Eggmed [https://www.eggmed.com/], a digital well being startup, has launched …