We’re excited to introduce Chainlink Sensible Worth Recapture (SVR)—a novel oracle answer designed to allow DeFi purposes to recapture the non-toxic Maximal Extractable Worth (MEV) derived from their use of Chainlink Value Feeds.

The preliminary model of Chainlink SVR was inbuilt collaboration with BGD Labs, Flashbots, and different contributors to the Aave DAO and can initially deal with enabling DeFi lending protocols to recapture oracle-related MEV from liquidations. Constructed on high of Chainlink infrastructure, SVR systematically reduces pointless third-party dependencies and eliminates the necessity to combine middleman sensible contracts, making it a really minimal elevate for current Chainlink Value Feed customers to undertake SVR.

This model of SVR-enabled Value Feeds leverages Flashbots MEV-Share and a novel onchain “Twin Aggregator” contract structure to offer effectivity and enhanced fallback safety. Chainlink SVR is presently reside on testnet and can quickly launch on Ethereum mainnet. A future, totally customized implementation is deliberate to introduce additional enhancements, together with elevated decentralization, a DON-based public sale system, enhanced fuel effectivity, and cross-chain capabilities.

The combination of Chainlink SVR by the Aave group is presently present process governance approval and will be learn on the Aave forum. The worth recaptured by SVR not solely gives DeFi protocols with a brand new income stream, however can be utilized to advertise the long-term financial sustainability of Chainlink oracles, in the end making certain DeFi protocols keep entry to extremely safe and dependable oracles.

How Oracles in DeFi Create MEV Alternatives

Maximal Extractable Value (MEV) refers back to the worth derived from the flexibility of block proposers (inside blockchain networks) to incorporate, exclude, or change the order of transactions within the blocks they produce. Immediately, these transaction ordering alternatives are recognized by searchers, who bid through a aggressive public sale for the appropriate to order transactions within the block. The worth is then captured by the contributors of the block constructing course of resembling searchers, builders, and validators.

As a sub-set of MEV, “Oracle Extractable Worth” (OEV) refers back to the MEV created in the course of the transmission of oracle reviews onchain and their subsequent consumption by onchain purposes. The most typical OEV alternative is seen with lending protocols, particularly in the course of the liquidation course of the place searchers compete for the appropriate to liquidate an at-risk place and earn a liquidation bonus reward. On Ethereum, the method of auctioning blockspace is usually achieved by means of Flashbot’s MEV-Boost, enabling searchers to backrun a value oracle report replace with a liquidation transaction through transaction bundling.

Immediately, the worth related to oracle-related MEV, resembling liquidations, is captured by the searchers, builders, and validators of a blockchain community, with none returning again the DeFi protocols, end-users, and oracles that initially generated the oracle-related MEV. Recapturing this non-toxic MEV would in the end return worth again to its originator.

Be aware: The time period “OEV” will be thought-about to be a misnomer, because it doesn’t check with oracles actively extracting worth away from customers, however relatively relating the existence of oracle-related MEV. We use the time period “OEV” right here because it’s commonplace to make use of in reference to the sort of MEV.

Why Chainlink SVR?

Chainlink Labs and the broader Chainlink group have been actively researching options round MEV for quite a few years, resembling analysis on Fair Sequencing Services (FSS) and Protected Order Flow (PROF). As a subset of MEV, we’ve additionally engaged in analysis round OEV and the way DeFi protocols can recapture this worth and to assist help the financial sustainability of oracles. We’ve analyzed numerous OEV designs so as to understand an answer that maximizes safety, reliability, and long-term financial viability.

From our analysis, we’ve efficiently developed an preliminary model of an OEV answer referred to as Sensible Worth Recapture (SVR). Chainlink SVR is constructed particularly for backrunning because it pertains to liquidations and can’t be used for frontrunning or sandwich assaults, that are poisonous types of MEV that hurt the person expertise and for which the Chainlink community and group has actively engaged in analysis on options to mitigate this downside for a few years.

We imagine Chainlink SVR is greatest suited to supply a local MEV recapture answer, as Chainlink Value Feeds already assist safe most of the largest DeFi protocols and have a confirmed observe document of safety and reliability. In integrating a Chainlink-powered MEV recapture answer, DeFi protocols can retain this Chainlink safety and reliability whereas additionally additional growing the financial sustainability of themselves and the Chainlink infrastructure they depend on.

A number of the notable advantages of Chainlink SVR embrace:

- SVR is underpinned by the identical time-tested and battle-hardened decentralized oracle community (DON) infrastructure that has powered Chainlink Value Feeds for the previous 5+ years—which have efficiently secured $75 billion in DeFi TVL at its peak and enabled $17 trillion in transaction worth.

- SVR reduces pointless third-party vendor dangers to protocols already consuming Chainlink Value Feeds, lowering their general assault vector and stopping pointless third events from siphoning financial worth.

- SVR doesn’t require DeFi protocols to combine middleman contracts or to “wrap” Chainlink Value Feeds, making certain extra environment friendly sensible contract workflows that take away the necessity for DeFi protocols to materially change how they devour oracle information.

- With Chainlink being essentially the most extensively used oracle answer throughout DeFi, SVR can drive economies of scale the place essentially the most alternatives and highest income potential for searchers and subsequently DeFi protocols exists.

Primarily based on real-world testing, we imagine Chainlink SVR can anticipate to realize a practical worth recapture price of roughly 40% (i.e., for each $100 that might have been leaked through liquidation MEV, $40 was recaptured). Whereas some various options have claimed to realize the next effectivity price for recapturing liquidation MEV, we’ve got not seen conclusive real-world information to showcase this. We imagine that 40% is a conservative however real looking estimate—actual life efficiency will likely be wanted to assemble precise information.

The preliminary model of SVR is just the start. Over time, Chainlink SVR goals to transition right into a extremely configurable, extremely decentralized, generalizable, and cross-chain OEV answer constructed totally on Chainlink’s battle-tested infrastructure. We’re excited to see protocols maximize MEV income recapture throughout any supported chain whereas additionally eliminating pointless dangers and timing delays launched by various OEV options.

How The Preliminary Model of Chainlink SVR Works

The preliminary implementation of Chainlink SVR will encompass a parallel set of Chainlink Value Feeds, powered by the identical established DON structure that secures current Value Feeds.

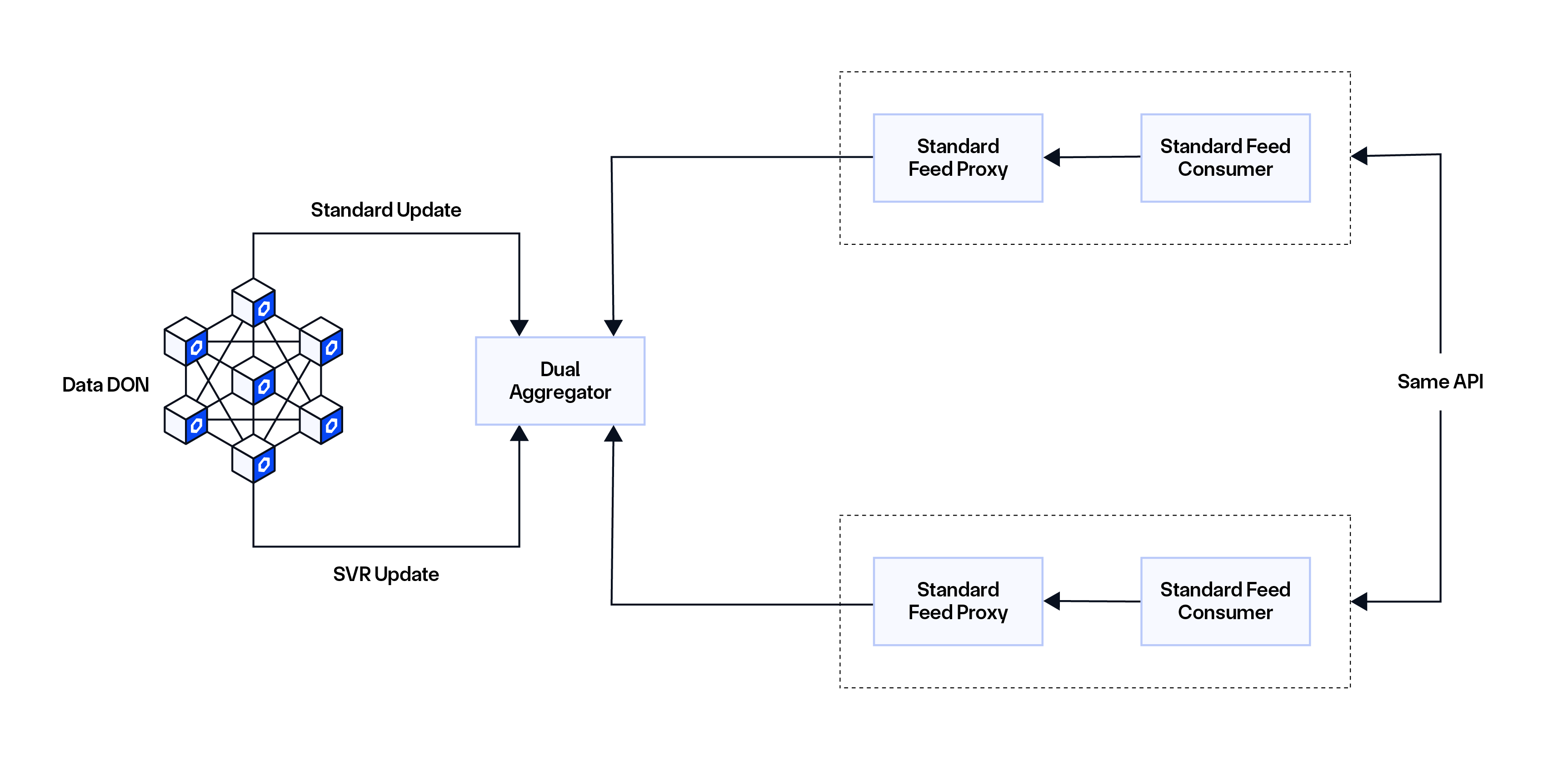

SVR-enabled Chainlink Value Feeds will likely be deployed so as to recapture liquidation-related MEV for lending protocols that combine the answer, whereas additionally retaining the usual Chainlink Value Feeds as a fallback. The “Twin Aggregator” Value Feed design permits a single Chainlink Knowledge DON to provide oracle reviews precisely the identical as they do at the moment whereas transmitting the oracle report onchain through completely different strategies. SVR Feeds are based mostly on current Chainlink contracts and interfaces, tremendously lowering the mixing burden on current Chainlink customers since minimal code modifications are required (doubtlessly whilst minimal as pointing to the brand new aggregator or SVR feed).

The oracle report despatched to the SVR-enabled Value Feed will transmit updates onchain through Flashbots MEV-Share, the place the appropriate to bundle a liquidation transaction with the oracle report replace is auctioned to searchers in a permissionless method. In parallel, the identical oracle report can be transmitted onchain through the general public mempool to the prevailing normal Value Feeds, which serves as a fallback to mitigate potential danger situations. Customers of the usual Value Feed are utterly unaffected by something SVR-related, as it’s opt-in.

Within the case of a transmission failure by the SVR-enabled Value Feed (i.e., MEV-Share failure), there’s a fail-safe mechanism to make sure that the feed can nonetheless report a value to the DeFi protocol. When the SVR-enabled Value Feed is set to be stale by a configurable time interval, it is going to return the newest value report from the usual Value Feed earlier than the cutoff level. This delay is critical to keep away from liquidators extracting worth by bypassing the worth recapture mechanism supplied by Chainlink SVR.

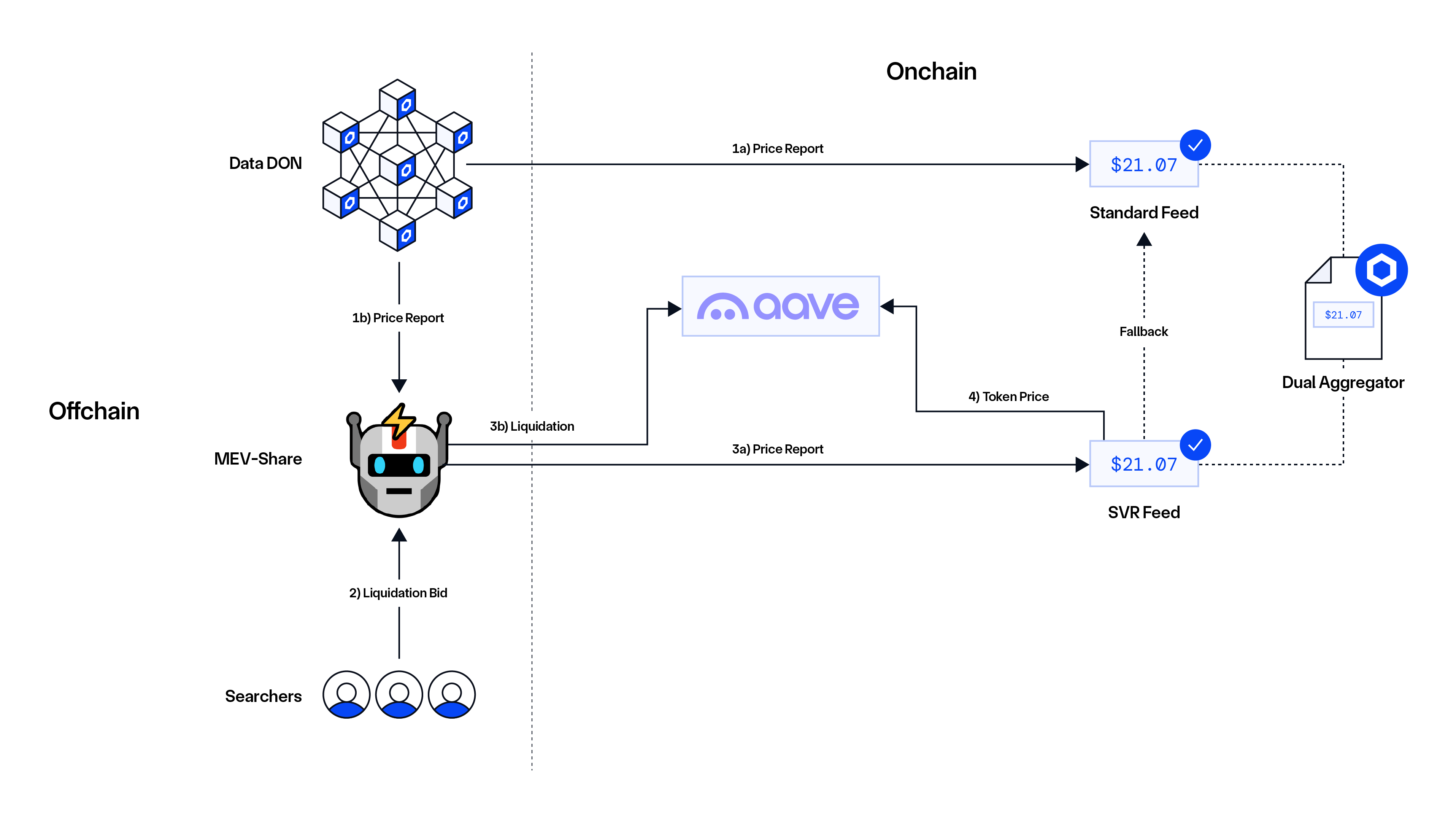

The determine under gives a high-level overview of how SVR is proposed to be built-in inside Aave V3 on Ethereum.

The stream within the determine works as follows:

- The Chainlink Knowledge DON produces a value oracle report precisely as at the moment (i.e., by a heartbeat or deviation threshold). Nonetheless, the value report is transmitted twice, from completely different accounts.

- One value report is transmitted to the usual Value Feed through the general public mempool (the identical as at the moment).

- One other value report is transmitted to an SVR Value Feed contract by means of a Flashbots Defend RPC endpoint.

- MEV-Share is an open-source protocol that selectively shares information about transactions, resembling value oracle updates, with searchers who bid to incorporate the transactions in bundles shared with builders. Builders then choose the very best searcher bid and embrace the related backrun and liquidation transactions in a block. If no bid is positioned, then the value oracle report is revealed onchain with none backrunning liquidation transaction.

- When the value report and the backrunning liquidation transactions are revealed onchain, then:

- The value report updates the SVR Value Feed.

- The backrunning transaction makes use of the value replace to liquidate the related positions.

- A lot of the worth is recaptured by Aave and Chainlink.

- Within the described instance, the SVR feed returns an up to date value. Nonetheless, if no recent value is out there (e.g. if MEV-Share fails), the feed contract related to Aave has a fail-safe mechanism that returns a value from the usual Chainlink Value Feed at an adjustable delay.

Economics

The oracle-related MEV recaptured by Chainlink SVR is deliberate to be cut up at an ordinary price between integrating DeFi protocols and the Chainlink Community, with 60% of the worth going towards the DeFi protocol and 40% to the Chainlink ecosystem. This cut up gives DeFi protocols with a further income stream whereas additionally supporting the financial sustainability of Chainlink oracles by overlaying transaction fuel prices and different ongoing infrastructure bills. Be aware that these values could also be topic to alter sooner or later, with the purpose of producing sustainable economics between DeFi protocols and the oracles that energy them.

Due to the deep, long-standing partnership between the Chainlink and Aave communities and Aave’s position as a launch companion, the near-term income cut up proposed to Aave will likely be 65% to the Aave ecosystem and 35% to the Chainlink ecosystem for the primary six months, ranging from in-production integration—topic to the Aave group’s governance approval.

We anticipate that Chainlink SVR will likely be one of many first Chainlink companies related to the Payment Abstraction system, topic to the outcomes of safety audits and deployment standing. Fee Abstraction is a system of onchain sensible contracts that assist considerably scale back billing and fee friction for customers and builders interacting with Chainlink companies. The system is designed to transform payment tokens into LINK through current Decentralized Trade (DEX) contracts.

Concerned about Recapturing MEV By way of Chainlink SVR?

If you happen to’re a DeFi protocol and are concerned with integrating Chainlink SVR to recapture MEV, reach out or follow us for extra updates sooner or later.

—

Disclaimer: This put up is for informational functions solely and comprises statements in regards to the future, together with anticipated product options, growth, and timelines for the rollout of those options. These statements are solely predictions and replicate present beliefs and expectations with respect to future occasions; they’re based mostly on assumptions and are topic to danger, uncertainties, and modifications at any time. There will be no assurance that precise outcomes is not going to differ materially from these expressed in these statements, though we imagine them to be based mostly on affordable assumptions. All statements are legitimate solely as of the date first posted. These statements might not replicate future developments resulting from person suggestions or later occasions and we might not replace this put up in response. Please evaluation the Chainlink Terms of Service, which gives necessary info and disclosures.

You might also like

More from Web3

AI Pro University Helps Over 5,000 Students Learn AI Fast – Without Tech Skills

Orlando, FL – A brand new on-line college referred to as AI Professional College helps common individuals discover …

Congress Rolls Out New Crypto Market Structure Bill—What Does It Actually Do?

Briefly Lawmakers in Congress have formally launched a crypto market construction invoice referred to as the Digital Asset Market Readability …