Desk of Contents:

- Core Ideas & Key Options of DeFi

- Main DeFi Platforms and Instruments

- Advantages and Dangers of DeFi

- DeFi Use Circumstances and Functions

1. Introduction to DeFi:

Welcome to the world of Decentralized Finance or DeFi, the place the ability of finance is shifting from massive establishments to the arms of on a regular basis individuals such as you and me. Simply think about a monetary world with none middlemen like banks, complicated payment buildings, and geographical restrictions. DeFi is a quickly evolving sector the place you possibly can take loans, make investments, commerce, and lower your expenses instantly between people. Sounds futuristic, proper? Properly, sure, the longer term is already right here with DeFi.

On this weblog, we’ll dive into the world of DeFi, discover what it’s, the way it works, and why is it capturing the eye of tech fanatics and establishments alike. By the top, we may have an thought of how DeFi has remodeled its method towards monetary providers. Prepared? Let’s get began!

What’s DeFi?

Image Courtesy: 101blockchains.com

So, what precisely is DeFi? Decentralized Finance, or DeFi, refers to a set of economic providers and merchandise constructed on blockchain expertise. In contrast to conventional finance, which depends on centralized establishments like banks or brokers, DeFi makes use of sensible contracts and blockchains to supply monetary providers on to customers.

Consider it like this: as a substitute of going to a financial institution to get a mortgage or deposit your cash, you work together with a decentralized community (typically utilizing cryptocurrencies) the place smart contracts deal with every little thing mechanically. No middlemen, no intermediaries—simply you, the protocol, and the neighborhood that drives it.

Who Invented DeFi? The Historical past and Evolution:

Let’s go on a fast journey by way of the historical past of DeFi. There isn’t a single inventor of DeFi, however there’s a time limit from which this all begins: in 2009, Satoshi Nakamoto created Bitcoin. The decentralized nature of Bitcoin provided the technological feasibility that financial services could exist outside a traditional banking system.

However, the idea of DeFi evolved incredibly with the introduction of Ethereum in 2015. Ethereum introduced the world to this phenomenon called a smart contract, self-executing contracts that automatically perform transactions based on predefined rules. This innovation marked a significant pathway to more elaborate financial applications.

The first DeFi project that gained major attention was MakerDAO in 2017, which allowed users to borrow the DAI stablecoin by locking up Ethereum as collateral. And that has also triggered this exponential expansion of the ecosystem. For example, Uniswap, Aave, and Compound are the leaders in decentralized lending, trading, and investment products.

Importance and growth of DeFi in the crypto space:

Here’s an in-depth exploration of the importance and growth of decentralized finance (DeFi) in the crypto space:

A. Democratization of access to finance:

DeFi opens financial services to a global audience not segmented by location, wealth, or access to traditional banks. While centralized financial institutions tend to deny services for credit scores, geography, or political reasons, DeFi stands open to everyone if they have an internet connection.

DeFi enables peer-to-peer saving, borrowing, lending, and investing directly without the need for intermediaries in areas where the infrastructure of banks is scarce. Decentralized infrastructures allow citizens from developing countries to access the global economy for a better life in their respective economies.

The new adoption studies on DeFi indicate that most users are from areas characterized by high inflation and low banking service. This, therefore, highlights the role DeFi plays in bringing economic inclusion.

B. Remove Intermediaries and Cut Costs:

While the existing financial services include banks, brokers, and exchanges, which all rely on intermediaries to carry out a transaction, it allows for an extra cost, inefficiency, and slowing down of a deal. In DeFi protocol, this smart contract automatically conducts transactions, so middlemen are not needed to be involved thereby cutting down some costs of a transaction.

Smart contracts are self-executing agreements coded on the blockchain, thereby automating lending and trading processes with lower fees. Users can then retain a higher percentage of earnings plus simplify complicated processes.

DeFi’s market has grown from leaping bounds. Currently, the value-locked TVL across various platforms has reached more than $50 billion, which reflects the increased demands of customers for cost-efficient alternatives to traditional finance.

C. Yield farming and decentralized lending:

DeFi is unique because it can offer financial incentives in the form of yield farming and decentralized lending. Users can use the provision of liquidity to DeFi protocols and thereby reap rewards in the form of interest rates or governance tokens, thereby augmenting returns on assets.

The importance of lending protocols in DeFi is that, unlike savings accounts, which are low-interest-yielding accounts, it offers nice yields through peer-to-peer lending that motivates people to hold their assets in the ecosystem of DeFi. It accelerates the growth of DeFi.

The increase of yield farming via protocols such as Compound and Aave has drawn millions of crypto investors seeking higher yields, thus bringing massive capital inflows into DeFi.

D. Innovative Financial Products and Tokenization:

DeFi has revolutionized finance by introducing innovative financial products, including decentralized exchanges (DEXs), synthetic assets, and tokenized derivatives. These products provide new ways to trade, invest, and hedge against market risks, offering flexibility unmatched by traditional finance.

Tokenization enables the creation of digital assets that represent real-world assets, such as stocks, real estate, or commodities, making these assets more accessible and tradeable on the blockchain. This democratization of investment expands access and liquidity to new asset classes.

DeFi’s continued product innovation and collaboration with other sectors, like decentralized autonomous organizations (DAOs) and NFT projects, highlight its growth and growing influence in transforming traditional markets.

E. Increased Security and Transparency

DeFi leverages blockchain technology’s inherent transparency and security features. Transactions on decentralized platforms are publicly recorded on a distributed ledger, ensuring traceability and minimizing fraud risk. Users have control over their funds without reliance on centralized custodians.

With transparency, users can verify smart contract operations and financial data. This level of openness builds trust and accountability in DeFi protocols, a significant departure from traditional opaque banking operations. Audits and open-source smart contracts further strengthen security, although they come with their own risks.

As awareness around financial security and data privacy increases, DeFi has grown to represent a key pillar in creating trustless, censorship-resistant financial systems, reflected by increasing institutional interest and billions of dollars in trading volume across DEXs.

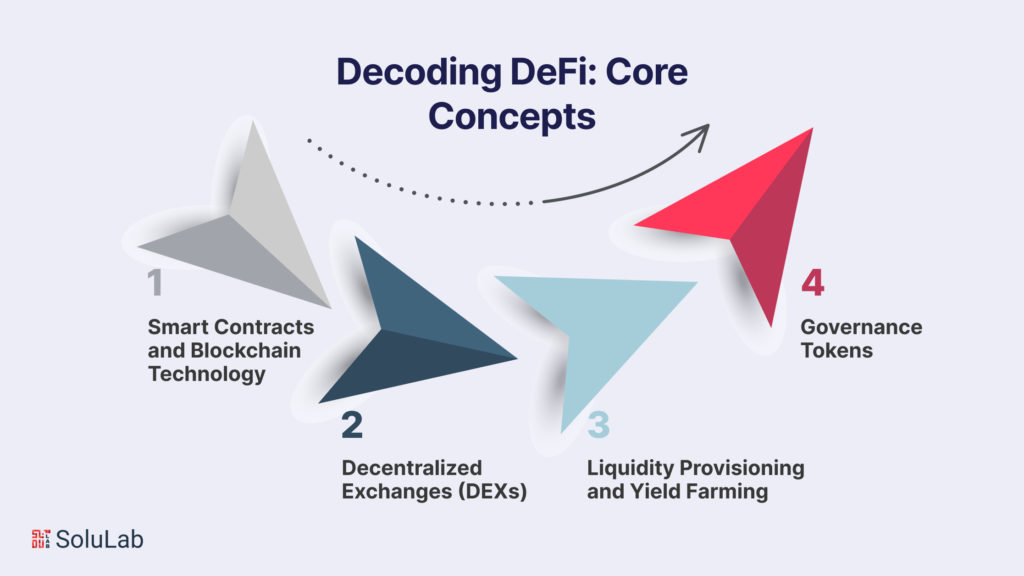

2. Core Concepts & Key Features of DeFi:

Picture Courtesy: solulab.com

DeFi is an exciting space where decentralization meets innovation, and it’s growing at an exponential rate. Let’s break down the core concepts of DeFi in simple terms to help you understand why it’s so important and how it works.

A. Decentralization:

Decentralization is the core philosophy of DeFi. Banks and financial institutions own money in traditional finance. DeFi, runs directly on the blockchain, like Ethereum, resulting in no central authority for the user’s assets-thus, user control. It is about removing intermediaries and ensuring openness, security, and privacy for everyone.

B. Smart Contracts:

Think of smart contracts as just pieces of code for self-executing agreements on a blockchain with the terms of agreement put in place, and carried out automatically, without interference from a middleman. It’s literally setting up a contract between you and the machine where one never forgets and goes exactly where it was led to by the contract!

C. Decentralized Exchanges (DEXs):

DEXs enable users to trade their cryptocurrencies with one another directly without some intermediary authority, be it Binance or Coinbase. These are run on smart contracts wherein the transactions occur directly on the blockchain. A very popular version of DEXs includes Uniswap and SushiSwap, which are taking the crypto world storm with greater freedom and control of your trades.

D. Yield Farming and Liquidity Pools:

So that’s one of the cool things you can do in DeFi- earn some passive income. The very concept of yield farming is earning some rewards by providing liquidity to DeFi platforms. When you stake your crypto into a liquidity pool, you help make trades and transactions possible; you get interest or tokens in return. It is like putting your money to work for you, without needing you to do anything!

E. Stablecoins:

Stablecoins are cryptocurrencies engineered to keep a stable value, typically pegged to the traditional currency like the US dollar. The best of both worlds – stability offered by traditional currency and blockchain benefits – does promise real meaning in the form of stablecoins. Like USDC and DAI, with lending, borrowing, or even trading, you cannot suffer at the hands of extreme volatility witnessed with some cryptocurrencies such as Bitcoin and Ethereum.

F. Lending and Borrowing:

Imagine being able to borrow money or earn interest on your assets, without going to a bank. Well, that is the power of DeFi lending and borrowing platforms! Services like Aave and Compound allow you to lend your crypto to others in exchange for interest or borrow assets by collateralizing your own. It’s decentralized peer-to-peer finance at its finest, with no banks or credit scores involved.

G. Governance Tokens:

In DeFi most of the platforms use governance tokens which allow users to express opinions about the direction they see the protocol in. You can even vote on proposals about upgrades, changes, and new features by holding such tokens. It is a democratic way of decision-making and therefore demonstrates control of the community over the future platform.

Decentralized Finance Explained: A New Era in Finance

Decentralized finance (DeFi) is transforming the way we think about financial systems. It’s a set of financial services built on blockchain technology, offering alternatives to traditional banks and financial institutions. Instead of relying on central authorities, DeFi operates on smart contracts and decentralized applications (dApps), enabling direct, peer-to-peer transactions without intermediaries.

With DeFi, you can lend, borrow, trade, and invest in digital assets directly from your wallet, enjoying benefits like reduced fees, faster transactions, and increased accessibility. Key concepts include decentralized exchanges (DEXs), yield farming, stablecoins, and governance tokens, all of which empower users with more control over their financial activities.

In essence, Decentralized Finance Explained means financial freedom, security, and innovation, all driven by the blockchain. As DeFi continues to grow, it’s clear that it’s more than just a trend – it’s the future of finance.

3. Major DeFi Platforms and Tools:

Picture Courtesy: kryptochannel.com

The DeFi (Decentralized Finance) ecosystem is thriving, with various platforms and tools empowering users to take control of their financial activities without relying on traditional banks or intermediaries. Here’s an overview of some of the most popular platforms that are driving innovation in this space:

A. Uniswap:

Uniswap is a decentralized exchange (DEX) built on Ethereum that allows users to trade tokens directly from their wallets. It uses an automated market maker (AMM) model, which relies on liquidity pools rather than traditional order books. This means users can trade without intermediaries, directly swapping tokens at prices determined by the pool’s supply and demand.

Primary Use: Token trading and liquidity provision.

B. Aave:

Picture Courtesy: globalhappenings.com

Aave is a decentralized lending and borrowing protocol that allows users to earn interest on deposits and borrow assets against collateral. A key feature of Aave is its flash loans, which enable users to borrow without collateral if the loan is repaid within the same transaction. This opens up unique arbitrage and liquidity opportunities.

Primary Use: Lending, borrowing, and flash loans.

C. Compound:

Compound is another popular DeFi lending platform that enables users to lend and borrow cryptocurrencies. When users lend assets to the platform, they receive cTokens in return, which represent their claim on the assets and any accrued interest. Compound’s protocol automatically adjusts interest rates based on supply and demand for each asset.

Primary Use: Crypto lending and borrowing.

D. Yearn Finance:

Picture Courtesy: cardanolibrary.net

Yearn Finance is a yield aggregator designed to maximize returns on deposited funds by automatically moving assets between various DeFi protocols to optimize yields. It offers “Vaults” where users can deposit assets, and the protocol will deploy those funds across multiple DeFi projects based on a strategy that seeks the highest returns.

Primary Use: Yield farming and yield optimization.

E. Synthetix:

Picture Courtesy: blockchainwelt.de

Synthetix is a protocol for creating and trading synthetic assets that mimic the value of real-world assets like stocks, commodities, and fiat currencies. Using smart contracts, Synthetix enables users to gain exposure to assets without directly owning them, thereby broadening DeFi’s reach beyond cryptocurrencies.

Primary Use: Synthetic asset creation and trading.

F. MakerDAO:

Picture Courtesy: u.today

MakerDAO is the protocol behind the DAI stablecoin, a decentralized stablecoin pegged to the US dollar. It allows users to create DAI by collateralizing other cryptocurrencies in a Maker Vault.

Primary Use: As a key player in the stablecoin space, MakerDAO helps stabilize the volatile crypto market and facilitates lending, borrowing, and trading with greater price predictability.

G. Curve Finance:

Picture Courtesy: fxprofitsignals.com

The curve is a decentralized exchange optimized for stablecoin trading and low-slippage swaps. It focuses on stablecoins and tokenized assets with similar value, like wrapped tokens.

Primary Use: By offering low fees and minimal slippage, Curve is an essential platform for liquidity providers and traders looking for efficient stablecoin trades, making it a major player in the DeFi sector.

DeFi Pulse and Its Significance:

Picture Courtesy: moralismoney.com

DeFi Pulse is a leading analytics and ranking platform for decentralized finance projects. It tracks and displays key metrics for the DeFi ecosystem, offering insights into the total value locked (TVL) across different protocols, lending and borrowing rates, market dominance, and more. The TVL metric, which represents the total amount of assets staked in DeFi projects, serves as a critical indicator of the sector’s health and growth.

Significance of DeFi Pulse:

DeFi plays a significant role in the DeFi market. Let’s get to know about that.

Market Insights:

DeFi Pulse provides a comprehensive overview of the DeFi market, including the top-performing platforms, trends, and growth statistics. This makes it an invaluable tool for investors, researchers, and enthusiasts who want to keep up with the evolving DeFi space.

Transparency:

By offering real-time data and analytics, DeFi Pulse promotes transparency in the DeFi ecosystem. It allows users to make informed decisions based on accurate and up-to-date information.

Tracking Performance:

The platform ranks projects based on their TVL, giving users a sense of which protocols hold the most assets and, by extension, user trust and market activity. This helps users discover new platforms, track their favorite projects, and understand shifts in market dominance.

4. Benefits and Risks of DeFi: Understanding the Pros and Cons

Decentralized finance (DeFi) has revolutionized the way we access, manage, and grow our wealth, but it also comes with challenges and risks. By understanding both the advantages and drawbacks, you can make more informed decisions about participating in this rapidly evolving space.

Benefits of DeFi over Traditional Finance:

Picture Courtesy: blog.coinremitter.com

The most important benefits of DeFi are –

A. Financial Inclusion:

DeFi offers access to financial services to anyone with an internet connection, removing barriers imposed by traditional banking systems. No more waiting on bank approvals or credit scores – you’re in control.

B. Transparency and Security:

Transactions are recorded on public blockchains, making every action traceable and providing unparalleled transparency. The decentralized nature of DeFi also reduces the risk of censorship or manipulation.

C. Lower Costs:

By eliminating middlemen and traditional gatekeepers, DeFi significantly reduces transaction fees, making financial services more affordable.

D. Decentralized Control:

Unlike traditional banks that hold custody over your funds, DeFi allows you to retain full control of your assets through non-custodial wallets and decentralized protocols.

E. Flexible and Innovative Products:

DeFi introduces unique opportunities, including yield farming, liquidity mining, and the creation of synthetic assets, pushing the boundaries of what’s possible with your money.

Potential Risks and Challenges in DeFi:

There are plenty of risks and challenges while you are using DeFi. So, you just need to be aware of these potential risks and challenges of using DeFi:

A. Smart Contract Vulnerabilities:

While DeFi is built on code, bugs or security loopholes can be exploited, leading to significant losses or hacks. Trusting code alone can be risky.

B. Regulatory Uncertainty:

DeFi operates in a largely unregulated environment, meaning sudden government actions or legal changes can impact user operations and platform compliance.

C. Market Volatility:

The crypto market is known for its extreme volatility, which can affect both the stability and value of assets used in DeFi protocols.

D. Liquidity Risks:

Low liquidity in certain DeFi protocols may result in price slippage and difficulties when executing large transactions or exiting positions.

E. Scams and Fraud:

DeFi’s open nature has attracted bad actors who exploit inexperienced users through fraudulent schemes or rug pulls, making it important to research and exercise caution.

5. DeFi Use Cases and Applications: Transforming Finance and Beyond

Decentralized Finance (DeFi) is changing the face of traditional finance by offering open, permissionless, and decentralized financial services on blockchain networks. Here’s a quick overview of its key use cases, real-world applications, and how it’s transforming industries:

A. Lending and Borrowing:

Users can lend or borrow cryptocurrencies without intermediaries, earning interest or accessing loans with overcollateralized assets.

Example: Aave and Compound allow users to deposit crypto into liquidity pools and earn interest or use their assets as collateral for loans.

B. Decentralized Exchanges (DEXs):

DEXs enable peer-to-peer trading of cryptocurrencies directly from wallets, with no central authority.

Example: Uniswap allows users to swap tokens seamlessly without a middleman.

C. Stablecoins:

Stablecoins are pegged to stable assets like fiat currencies, offering a stable store of value in the crypto ecosystem.

Example: Dai is a stablecoin pegged to the US dollar, offering stability within DeFi systems.

D. Yield Farming and Staking:

Users earn rewards by providing liquidity or staking assets in DeFi protocols, often earning high returns.

Example: Platforms like Yearn Finance optimize yield farming strategies for users.

E. Insurance:

Decentralized insurance platforms cover smart contract failures, hacks, or other risks, offering transparency and fair premiums.

Example: Nexus Mutual provides insurance for DeFi protocols, mitigating smart contract risks.

F. Payments and Remittances:

DeFi allows borderless, low-cost payments and remittances, bypassing traditional fees and intermediaries.

Example: Projects like Celo enable fast, cost-effective mobile payments for underserved populations.

Real-World Applications of DeFi:

DeFi’s applications extend beyond crypto trading, reaching real-world users with innovative solutions. For example, Microloans offered through platforms like Goldfinch empower borrowers in underserved regions, while tokenized real estate projects such as RealT allow fractional ownership of property.

How DeFi is Transforming Various Industries:

Here’s how DeFi is transforming the whole web3 industry.

A. Finance and Banking:

DeFi offers people around the world access to financial services, regardless of their location or traditional banking status. It’s promoting financial inclusion and creating new ways to invest, save, and access credit.

B. Insurance:

Decentralized insurance protocols like Nexus Mutual provide a transparent, decentralized alternative to traditional insurance, with smart contracts automatically paying claims when conditions are met.

C. Gaming and NFTs:

DeFi is merging with the gaming world, enabling play-to-earn economies where players earn tokenized assets, as well as NFT-based in-game items that can be traded or monetized in open marketplaces.

D. Supply Chain Management:

DeFi-based supply chain solutions enhance transparency and reduce inefficiencies by tracking the movement of goods using blockchain, creating a tamper-proof record of transactions and contracts.

6. Future of DeFi:

Picture Courtesy: Cointelegraph

The future of DeFi holds has both exciting potential and complex challenges. As DeFi continues to mature, we’re likely to see greater integration with traditional finance, making it accessible to a broader range of users. Emerging trends, like cross-chain interoperability, could bridge different blockchains, enabling seamless transactions across platforms. Additionally, as DeFi gains more mainstream traction, regulatory frameworks may develop to address security concerns, bringing much-needed stability and consumer protection to the space.

However, DeFi’s future isn’t without hurdles. Security will continue to be a primary focus, as protocols work to protect users against hacks and malicious attacks. On the innovation side, DeFi is likely to drive new financial products and services, revolutionizing everything from asset management to insurance. With more eyes on the space, DeFi could eventually become a global financial standard, empowering people worldwide with unprecedented control over their finances.

Emerging Trends and the Future Outlook of DeFi:

Emerging trends shaping DeFi include cross-chain interoperability (connecting multiple blockchains), decentralized identity solutions for more secure user verification, and the rise of layer-2 scaling solutions to reduce transaction costs. Additionally, “Real-World Asset (RWA) tokenization” is gaining momentum, making traditional assets like real estate tradable on decentralized markets.

Platforms like Aave are introducing real-world asset markets, enabling loans backed by tokenized real estate or bonds.

Expert Opinions and Predictions:

Experts predict that DeFi will evolve to become more user-friendly, interoperable, and regulated, bridging traditional finance with decentralized systems. Some believe that DeFi’s flexibility will drive mass adoption of decentralized finance in global economies, while others stress caution due to risks like regulation and security vulnerabilities.

Vitalik Buterin, co-founder of Ethereum, emphasizes scaling solutions and regulatory clarity as critical factors for DeFi’s continued success.

7. Conclusion: Embracing the Future of DeFi

As we’ve explored, the future of decentralized finance (DeFi) is filled with immense potential and exciting opportunities. The key trends driving DeFi’s evolution include greater cross-chain interoperability, the integration of real-world assets into decentralized markets, and the continued development of user-friendly platforms. Experts predict that as DeFi grows, it will lead to more financial inclusion, improved accessibility, and a shift toward a decentralized financial ecosystem, all while facing challenges like regulation and security.

DeFi’s rapid expansion is redefining traditional financial systems. Emerging trends like cross-chain interoperability and Real-World Asset tokenization are set to reshape DeFi. Expert predictions highlight the need for scalability, regulatory clarity, and wider adoption of decentralized platforms. The future of DeFi offers exciting possibilities, and staying ahead of these trends is crucial for anyone interested in the evolving world of finance.

Now is the time to explore the opportunities that DeFi offers. Dive into the world of decentralized finance and stay updated with the latest developments to make informed decisions. Don’t miss out on the future of finance—subscribe to our newsletter for regular updates and expert insights on all things Web3 world.

You might also like

More from Web3

Meet SharpLink: The MicroStrategy of Ethereum

How do you save an ailing publicly traded firm in 2025? One reply, and an more and more in …

India CCTV Market Poised to Reach USD 12.25 Billion by 2030, Driven by Government Initiatives and Technological Advancements

India CCTV Market Measurement & Developments | Mordor Intelligence Mordor Intelligence has revealed a brand new report on the …

Coinbase to Open New San Francisco Office After Dropping HQ Model

Crypto trade Coinbase has signed a lease for workplace house in San Francisco's Mission Rock improvement, marking the crypto …