Desk of Contents:

- Why AI Issues in Finance?

- Key Functions of AI in Finance

- Advantages of AI in Finance

- Challenges of AI in Finance

AI has been shifting ahead from simply one other buzzword; it has grow to be a brand new phenomenon in reworking the world and reshaping all industries reaching far into immediately’s finance. AI is the game-changer of effectivity, accuracy, and most significantly, innovation within the monetary enviornment. Be it robo-advisors managing investments, methods designed for fraud detection in transactions, and even AI-driven predictive fashions for credit score scoring, is enormously vital.

On this weblog, we’ll discover how AI is revolutionizing the world of finance, what key functions it flaunts, the challenges confronted, and what could lurk sooner or later. So, let’s see how AI is flipping the entire monetary panorama the other way up in a great way.

Why AI Issues in Finance?

Image Courtesy: advansappz.com

The advanced finance ecosystem calls for precision, pace, and reliability. Till now, monetary processes, whether or not private or institutional, have been largely handbook, depending on processes typically liable to inefficiencies and errors. Enter AI: a know-how that gives huge portions of knowledge, discovers patterns, and makes selections at unbelievable speeds.

Resolution-Making by Knowledge:

AI processes massive numbers of monetary data sooner than people and discovers insights and developments that people would take considerably longer to establish, culminating in smarter and speedier selections.

Price Effectivity:

AI saves expenditure on account of automation by performing repetitive processes like information entry, compliance checks, and monitoring transactions, which permit funds to unlock for strategic actions.

Improved Accuracy and Danger Administration:

AI minimizes Human errors in essential monetary transactions. AI makes detecting deceitful actions simpler and assessing dangers doable, thus offering excessive compliance and security.

Enhanced Buyer Expertise:

AI supplies extra personalised monetary providers, tailor-made funding recommendation to prompt buyer help by means of a chatbot, making monetary devices simpler for patrons to make use of.

Progressive Monetary Merchandise:

AI creates new monetary devices and providers, equivalent to robo-advisers, algorithmic buying and selling, or various credit score scoring strategies, and drives progress within the business.

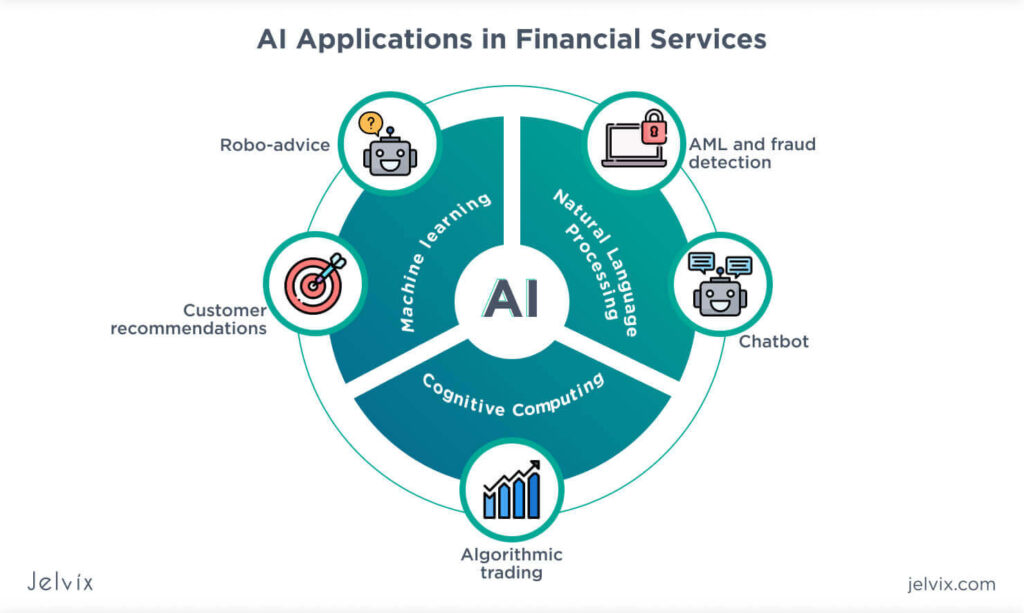

Key Functions of AI in Finance:

Image Courtesy: https://www.finalroundai.com/

Listed here are the important thing functions of AI in finance, showcasing its transformative impression throughout the business:

1. Fraud Detection and Prevention:

AI screens transactions in actual time, identifies uncommon patterns, and detects fraudulent actions earlier than they trigger hurt. For instance, MasterCard and PayPal entities attempt to authenticate monetary transactions by means of AI.

2. Robo-Advisors and Wealth Administration:

Robo-advisors present AI-managed personalised funding portfolios, monetary advisory providers, and rebalancing of property when market and particular person danger preferences change. Betterment and Wealthfront are normally cited examples.

3. Algorithm Trading:

Artificial intelligence could analyze market data and carry out transactions in milliseconds based on analytics. Therefore, the whole system can tackle emotional biases and transactions become extremely efficient. The black rock is a giant user of AI to optimize its trading strategies.

4. Credit Scoring and Lending:

AI analyzes social media behavior and payment histories in addition to all the traditional data for credit risk evaluation. Most importantly, AI can enable faster decisions for loans as well as fairer ones. Upstart is one example of making use of such AI technology for its lending purposes.

5. Risk Management:

AI could use predictive analytics to identify potential risks, simulate financial scenarios for resilience, and dynamically adapt strategies to limit losses in turbulent markets.

Benefits of AI in Finance:

Picture Courtesy: matellio.com

The advantages of using AI in finance are compelling:

1. Efficiency Boost:

With repetitive procedures like data entry, transaction processing, and compliance checking, AI is able to speed up life for financial institutions and make them more efficient.

2. Improvement Accuracy:

AI achieves better risk management, compliance, and overall financial reliability by significantly minimizing human errors in calculations, analyses, and decision-making.

3. Cost Saving:

Operational costs are minimized through reduced employment and optimized workflows, while enabling companies to allocate resources strategically while providing services of high quality.

4. Personalized Customer Experience:

AI customizes financial goods and services to the various specific needs of different customers, offering personalized investment advice, as well as bank experiences and good customer response.

5. Fraud Detection and Security:

AI systems detect fraudulent transactions and cyber threats in real-time, enhancing the security of sensitive financial data and protecting customers and institutions from significant losses.

6. Data Driven Decisions:

With the capacity to sift through huge amounts of data, AI can give out practical business recommendations offering financial houses opportunities to make more defined investments, anticipate market movements, and streamline directions of strategies.

7. Innovations in Financial Products:

AI will move ahead in the creation of modern tools such as robo-advisors, algorithmic trading conditions, and alternative credit scoring systems, expanding the possible future of services in finance.

8. Scalability and Flexibility:

AI allows the financial infrastructure to be totally scalable and adaptive to new situations such as increased volumes of transactions or changing compliance requirements in a seamless manner.

Challenges of AI in Finance:

No revolution comes without challenges. While AI holds immense promise, it also raises concerns:

Data Privacy and Security:

AI relies heavily on data, making financial institutions vulnerable to breaches. Protecting sensitive customer data and ensuring compliance with privacy regulations like GDPR is a major concern.

Algorithmic Bias:

AI systems can inherit biases from training data, leading to unfair outcomes in areas like lending or credit scoring. Addressing and mitigating these biases is critical for ethical AI use.

Regulatory and Compliance Issues:

The fast-paced evolution of AI in finance often outpaces regulatory frameworks. Lack of clear guidelines can make compliance difficult, leading to potential legal risks for institutions.

Integration and Implementation Costs:

Adopting AI technologies requires significant investment in infrastructure, training, and resources, which can be a barrier for smaller financial institutions.

Transparency and Explainability:

AI models, especially deep learning systems, can act as “black boxes,” making it challenging to explain decisions to regulators, customers, or stakeholders.

Cybersecurity Risks:

While AI enhances security, it can also be exploited by malicious actors for sophisticated cyberattacks, requiring constant vigilance and advanced defenses.

Workforce Displacement:

AI-driven automation may lead to job displacement in routine roles, creating challenges for workforce adaptation and retraining.

Dependence on Quality Data:

AI performance is highly dependent on the quality and quantity of data. Poor or incomplete data can lead to inaccurate predictions or unreliable outcomes.

The rise of AI in finance isn’t just for corporations or Wall Street traders; it’s for everyone. Whether you’re an investor, a small business owner, or just someone managing personal finances, AI has something to offer. By embracing AI tools and understanding their potential, you can make smarter decisions and stay ahead of the curve.

Your Turn! What’s your take on AI in finance? Have you tried using any AI-powered financial tools? Share your experiences in the comments below. Let’s discuss how we can all make the most of this exciting technological revolution!

For more insights and updates on Metaverse, DeFi, Blockchain, NFT & Web3, be sure to subscribe to our newsletter. Stay informed on the latest trends and developments in the decentralized world!

You might also like

More from Web3

Best Short-Form AI Video Generator? Kling 2.1 vs Google Veo 3

In short Kling 2.1 launched to compete immediately with Google's Veo 3 within the AI video era market. Testing reveals Kling …

EKOUAER Launches Wedding Season Special Edition and Joins The Knot Registry

New York, NY, June 01, 2025 (GLOBE NEWSWIRE) — Because the 2025 marriage ceremony season approaches, EKOUAER is proud to …

Best SEO Tool (June 2025): Moz Named Top SEO Software by Software Experts

NEW YORK CITY, June 01, 2025 (GLOBE NEWSWIRE) — Software program Specialists has acknowledged Moz because the Greatest search …