In Transient

The article critiques contemporary knowledge from Grayscale, key developments like stablecoins and subnets, standout tasks, 2025 token launches, and forecasts of potential 3x progress by 2026 as regulation and actual income fashions take form.

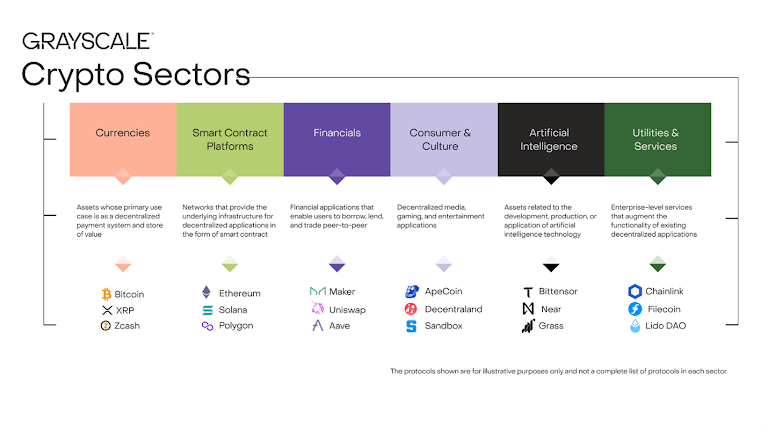

In simply two years, the AI crypto sector has expanded from $4.5 billion in 2023 to just about $20 billion in 2025. This represents a fourfold enhance in worth, pushed by technical breakthroughs, institutional consideration, and early however rising use instances. Regardless of its quick tempo, this section nonetheless holds a small share of the crypto panorama—solely 0.67% of the entire market.

By comparability, the Financials sector, which incorporates DeFi platforms and tokenized funding instruments, has reached round $519 billion. That hole highlights each the early nature of AI crypto and its potential to scale.

A new report by Grayscale (a digital asset administration agency centered on crypto funding merchandise), led by Analysis Director Zach Pandl and Analyst Will Ogden Moore, breaks down the important thing forces behind the expansion. From stablecoin integrations, and AI agent microtransactions, to distributed AI coaching and revenue-producing protocols, this sector is shifting from hype to basis.

This text explores what’s occurring throughout the AI crypto area, what’s coming subsequent, and the way its share of the Web3 economic system could develop considerably within the subsequent two years.

Progress and Token Efficiency

The AI crypto sector, which incorporates tokens constructed round synthetic intelligence applied sciences, has expanded quickly during the last two years. Its complete market cap grew from $4.5 billion in 2023 to just about $20 billion in 2025, marking a greater than fourfold enhance.

However the sector’s efficiency hasn’t been constant throughout all tokens. ElizaOS dropped sharply — down by 80%. These large variations present that whereas the sector is rising quick, it’s nonetheless early, unstable, and pushed by experimentation.

Stablecoins May Energy AI Agent Funds

AI brokers might want to make numerous quick, small funds. For that, stablecoins are preferrred — they’re low cost to ship, straightforward to program, and don’t change worth.

Some huge corporations are already engaged on this. Coinbase, a crypto trade and pockets platform, launched a brand new device to assist AI use stablecoins in funds. Meta, Stripe, and a number of other massive banks are exploring the identical path.

Within the U.S., lawmakers are discussing new payments just like the GENIUS stablecoin invoice and the crypto market construction invoice. If these go, extra instruments for AI and crypto may launch sooner.

Decentralized AI Coaching: Prime Mind Leads the Approach

One main pattern is distributed AI coaching. As an alternative of utilizing one huge knowledge middle, some tasks use idle GPUs all around the world to coach massive fashions. Prime Mind is doing simply that.

It has already constructed fashions with over 30 billion parameters, which is a excessive quantity even for giant corporations. This methodology is cheaper and doesn’t depend on only a few tech giants. If extra folks undertake this mannequin, coaching AI may develop into extra open and cost-effective.

Actual Income from AI Initiatives

Many crypto tasks are nonetheless in early testing. However some within the AI sector are already making actual income.

One instance is Grass. It collects net knowledge and sells it to AI corporations. In line with Grayscale, Grass earns tens of hundreds of thousands of {dollars} per 12 months. It’s additionally engaged on a shopper product, which may usher in much more customers and cash.

One other mission is Virtuals, which lets AI brokers commerce. Over the previous 12 months, it introduced in about $30 million in buying and selling charges. These numbers present that AI in crypto isn’t just principle — some tasks are already working and incomes.

New Tokens Are Coming in 2025

Grayscale additionally factors to new tokens coming later this 12 months. These embrace:

- Gensyn, a platform for machine studying energy;

- Prime, constructing instruments to run AI fashions and transfer knowledge;

- Nous Analysis, a bunch centered on open-source fashions and community-driven networks.

These upcoming launches may convey extra builders and cash into the AI crypto area.

The Sector Is Nonetheless Small In comparison with the Complete Market

Even with robust progress, the AI crypto sector continues to be small. Its $20 billion market cap is far lower than different components of crypto:

- Layer 1 chains: over $800 billion;

- Stablecoins: greater than $130 billion;

- DeFi and Financials: round $519 billion.

However Grayscale believes this can be a good factor. Like DeFi in 2020, the AI sector is younger, filled with concepts, and able to evolve.

Large Firms Be part of as Guidelines Turn into Clearer

Extra huge names are coming into the area. Meta, Stripe, and Coinbase are all constructing instruments that join AI and crypto. Banks and fee programs are additionally becoming a member of. That is occurring as guidelines and legal guidelines get clearer.

Grayscale says this shift reveals AI in crypto is not nearly hype. It’s about constructing actual instruments and companies — issues folks can use.

AI Crypto Sector Is Changing into a Key Layer of Web3

The bounce from $4.5B to $20B indicators a basic change, not a short lived spike. With actual companies like Grass and Virtuals already creating wealth, the area is gaining traction quick.

As Jensen Huang, CEO of Nvidia, stated:

“AI inference token technology has surged tenfold in only one 12 months, and as AI brokers develop into mainstream, the demand for AI computing will speed up. Nations all over the world are recognizing AI as important infrastructure—similar to electrical energy and the web.”

This area isn’t simply rising. It’s laying the inspiration for the way digital instruments and finance will work collectively sooner or later. For buyers, builders, and establishments, the AI crypto sector is shortly changing into some of the energetic and forward-moving components of the Web3 world.

Forecast: What’s Coming in 2025 and Past?

Grayscale believes the AI crypto sector may develop to $50–75 billion by the tip of 2026. That might be round 2–3.5% of the entire crypto market, up from immediately’s 0.67%.

What may drive this?

- Extra stablecoin-based funds by AI;

- A rising want for decentralized compute networks;

- Initiatives incomes cash by means of real-world use;

- Legal guidelines that make it simpler for corporations to hitch.

If decentralized AI coaching stays cheaper and extra scalable, it may compete with immediately’s cloud giants.

These shifts recommend that AI in crypto is shifting from experimental ideas to infrastructure-level innovation. The main focus is not simply on hype or hypothesis. As an alternative, builders are fixing actual technical bottlenecks — from compute entry to fee logic — whereas buyers are anticipating fashions that may scale and monetize.

Whether or not AI crypto reaches $50 billion or extra, the following wave gained’t be outlined by token launches alone. It’s going to come all the way down to utility, sustainability, and the way effectively these networks combine with the evolving web and regulatory frameworks. The foundations are being laid now — and 2025 stands out as the 12 months they start to carry weight.

Disclaimer

Consistent with the Trust Project guidelines, please observe that the knowledge offered on this web page just isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt unbiased monetary recommendation you probably have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.