In Temporary

The AI revolution is characterised by unprecedented value discount, with AI fashions’ efficiency prices lowering half each 4 months, in comparison with Moore’s Regulation in semiconductors.

A brand new white paper launched by Cathie Wooden’s funding agency, ARK Make investments, sheds gentle on the intricate dynamics as outstanding enterprise figures navigate the AI panorama.

The Transformation in AI Prices

An unparalleled price of value discount is on the core of the AI revolution. The white paper’s author and chief futurist at ARK Invest, Brett Winton, emphasizes that the price of operating AI fashions with comparable efficiency has been reduce in half each 4 months. That is the best cost-decrease curve within the historical past of know-how, and it’s predicted to proceed for the subsequent ten years.

Winton compares this to Moore’s Law within the semiconductor enterprise, the place costs usually drop by half each 18 to 24 months, to place issues into perspective. The ramifications are apparent: the speed of the AI revolution is 4 to 6 occasions faster than that of the semiconductor revolution, which has been the engine of technological development for many years.

Established IT companies face a double-edged sword because of this quick value drop. On the one hand, it provides an opportunity to utilize progressively potent AI capabilities at declining prices. Nonetheless, it additionally makes it simpler for startups and smaller rivals to enter the market, which could problem the large companies’ hegemony.

The Disruptive Applied sciences’ Qualities

According to ARK Invest, disruptive know-how platforms have three key traits: they penetrate new or underserved industries, have important value drops, and have enterprise fashions that take time to monetize and will not appear financially interesting at first.

These qualities foster an environment wherein extra agile, smaller companies would possibly problem the business giants’ dominance—even when these corporations are conscious of the potential of the know-how and are making efforts to make use of it for their very own monetary benefit.

Since AI has every of those traits, it’s the final disruptive know-how. Its potential purposes span a variety of areas, lots of that are presently underserved by present applied sciences, and its quick value drops are already obvious. Moreover, loads of AI-driven enterprise fashions comply with the pattern of disruptive know-how by inserting extra emphasis on consumer acquisition and knowledge gathering than on fast monetization.

The Huge Tech Strategy to AI

Each Apple and Google have taken a cautious strategy to integrating AI in gentle of this disruptive potential. In keeping with Winton, established tech companies often use this tactic, letting startups “de-risk” progressive concepts earlier than utilizing them broadly.

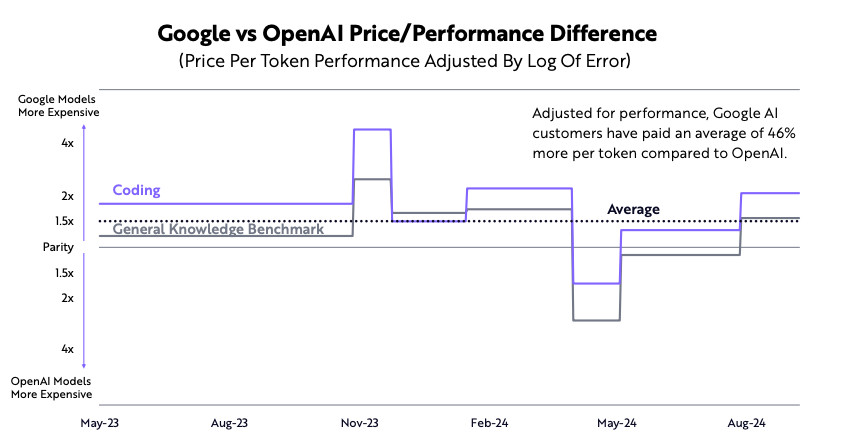

This technique is proven by Google’s dealing with of huge language fashions. The enterprise waited to make its refined language mannequin accessible to the general public till after OpenAI had been accessible for greater than three years. Even but, Google’s efficiency was not so good as OpenAI’s, and customers needed to pay greater than 40% extra for Google’s most refined mannequin than for OpenAI’s best one.

Picture: ARK Make investments

Regardless of its repute for rigorous product improvement, Apple has not but launched a serious language mannequin. The enterprise will seemingly launch its first cutting-edge AI-powered items within the fall of 2024, far later than lots of its rivals.

There are advantages to this methodical strategy. As Winton factors out, transporting items that exhibit erratic conduct could also be slightly unsettling for many who take care of a well-built repute. The inspiration of each Google and Apple’s success has been the availability of reliable, user-friendly items and companies. AI’s capability to yield surprising or undesirable outcomes poses a critical risk to customers’ religion within the firm and its model.

The Alternative for New Entrants

As a result of AI’s disruptive nature and rapidly dropping costs, there are various potential for brand spanking new gamers to problem the dominance of well-established tech giants. Smaller companies and startups could also be higher geared up to take full use of AI’s promise since they’re much less constrained by legacy programs and might transfer quickly.

This isn’t simply an AI dynamic. All through know-how’s historical past, spurts of quick improvement have often resulted within the ascent of latest market leaders on the expense of extra established companies. New dominating corporations emerged with every shift from mainframe computer systems to non-public computer systems after which to cell gadgets.

There could be an identical pattern to the AI transformation. Companies that may rapidly experiment, iterate, and alter to the altering AI panorama would possibly profit tremendously. In consequence, the tech sector might develop into extra vibrant and aggressive, with new corporations rising to problem the established powerhouses like Apple and Google.

Managing Innovation and Threat in Steadiness

The problem for Apple and Google is discovering the best combine between danger administration and innovation. These companies have made billions of customers worldwide completely satisfied by offering polished, reliable items and companies. Their cautious strategy to integrating AI is indicative of an intensive comprehension of the potential hazards concerned with utilizing unexpected know-how on a big scale.

Alternatively, being overly cautious might result in misplaced probabilities. Since AI is creating so rapidly, main modifications within the technological atmosphere would possibly happen inside months. Companies who take a very long time to regulate run the hazard of getting to play catch-up in a market that has superior.

Moreover, due to the character of AI improvement, enhancements often come through widespread implementation and real-world enter. Apple and Google might be decreasing their capability to acquire the knowledge and understanding required to boost and develop their AI programs in the event that they postpone the discharge of AI-driven options and merchandise.

Disclaimer

In step with the Trust Project guidelines, please observe that the knowledge offered on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional info, we advise referring to the phrases and situations in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover.

About The Writer

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Victoria d’Este

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.