In Transient

Bitcoin tumbles to $82K on Fed fears and ETF outflows, Ethereum dips under $2.1K amid weak demand, and Toncoin struggles close to $2.7 with no reduction in sight.

Bitcoin (BTC)

Over the previous week, Bitcoin’s been on a tough experience, sliding from over $90,000 right down to round $82,500. On the 4-hour chart, it’s damaged clear via its 50-SMA at $87,406 and is now flirting with oversold RSI ranges (36.9). Let’s discover out what’s been behind this slide.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

One of many greatest blows got here from the much-hyped Trump “Strategic Bitcoin Reserve” announcement — which, ultimately, turned out to be a complete lot of nothing.

Souce: The White Home

Certain, the federal government stated it could maintain onto present Bitcoin, however there was no actual plan to purchase extra. Markets didn’t like that — cue a pointy “sell-the-news” transfer.

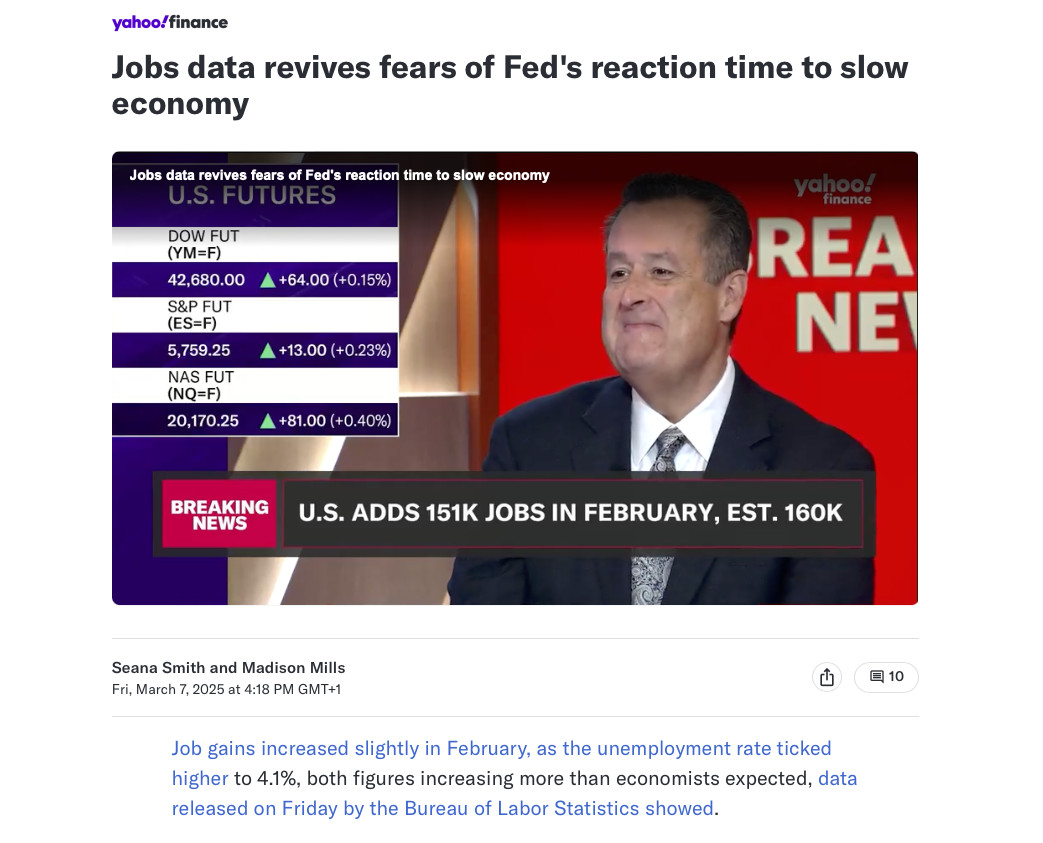

Supply: Yahoo! Finance

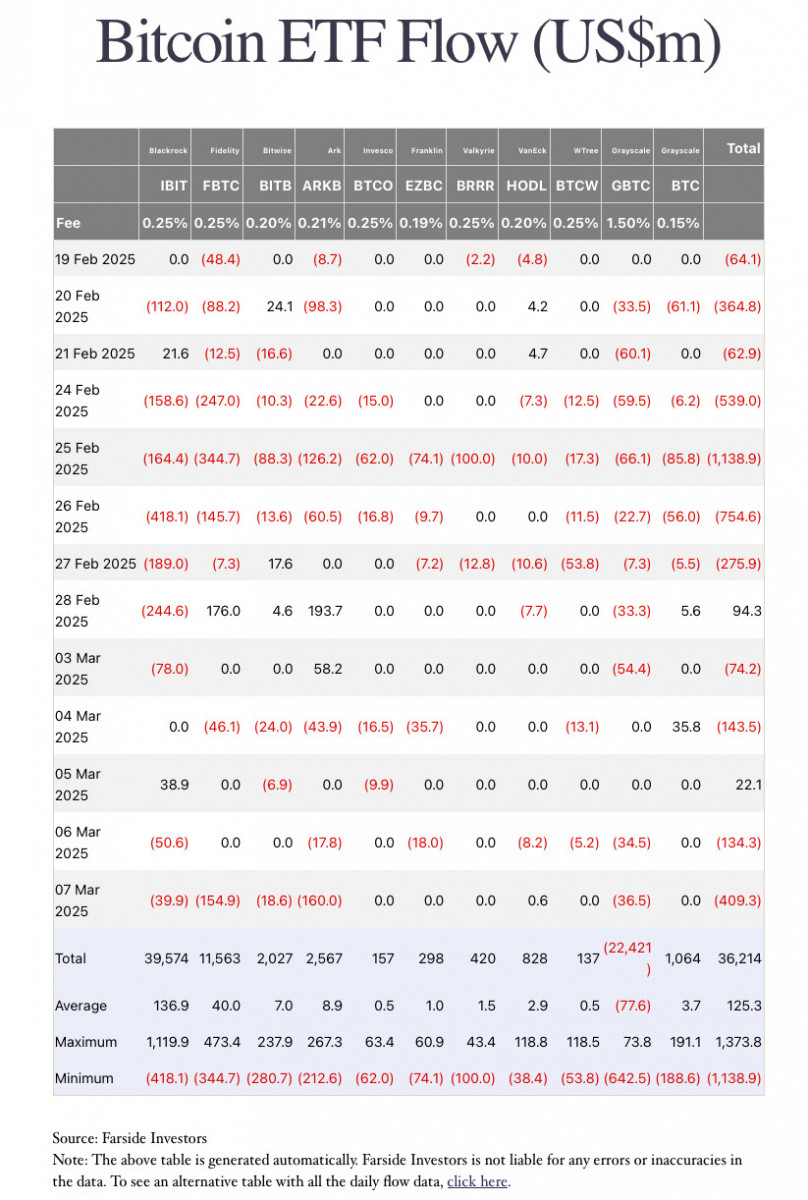

On the similar time, robust US jobs knowledge and protracted inflation alerts have just about crushed hopes for fast Fed price cuts, which is placing threat belongings like Bitcoin beneath much more stress. To make issues worse, ETFs noticed over $370 million in outflows following Trump’s speech, and now there are whispers concerning the authorities doubtlessly offloading a few of its Bitcoin stash — all of which has merchants spooked a few provide glut.

Supply: Farside Traders

Bitcoin did take a fast dip to $80,000, however for now, that degree is performing as a fragile ground. Nonetheless, if broader sentiment retains souring, we may simply see that ground give method. Merchants are actually laser-focused on the $78,000 to $82,000 vary — if Bitcoin breaks under that, issues may get lots messier.

Ethereum

Ethereum hasn’t fared significantly better than Bitcoin — it’s been dragged down from over $2,400 to round $2,070, as proven within the chart you shared. RSI is limping alongside close to 39, and worth motion continues to be caught under its 50-SMA at $2,199, displaying little signal of power.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

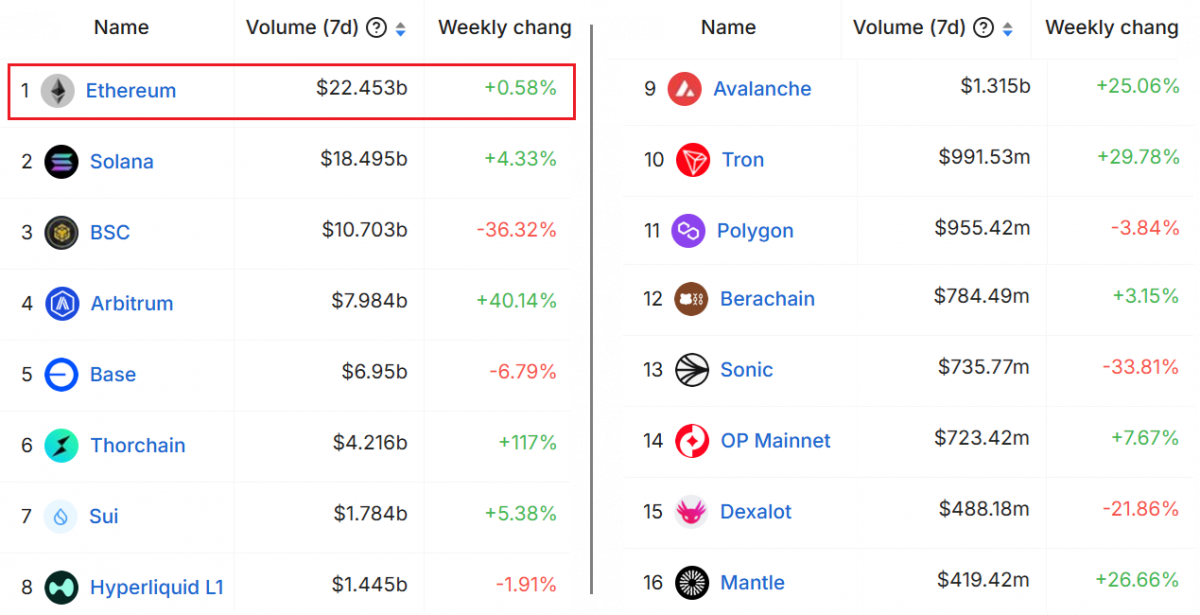

An enormous a part of ETH’s stoop is tied to the broader market’s response to the underwhelming Trump Bitcoin reserve information — however Ethereum’s additionally bought its personal baggage. DeFi and staking exercise have been sluggish this week, elevating questions on on-chain demand. Plus, there’s rising chatter about delays to the Pectra improve, which isn’t serving to confidence.

7-day decentralized exchanges volumes, USD. Supply: DefiLlama

One other blow: Trump’s Bitcoin reserve pitch made zero point out of Ethereum, dashing hopes that ETH would get a slice of the “strategic asset” narrative. For ETH holders who have been relying on some institutional nod, that was a chilly shoulder.

Proper now, Ethereum continues to be transferring in lockstep with Bitcoin, so except BTC finds its footing, ETH seems to be prefer it may take one other run at that $2,000 psychological degree. On the flip aspect, if macro circumstances shift — say, if price reduce hopes return — Ethereum’s shut proximity to long-term help may set it up for a pointy bounce. However for now, merchants are eyeing $2,000 as the road within the sand.

Toncoin (TON)

Toncoin (TON) has been having a fair harder time than the majors, sliding steadily from round $3.40 right down to $2.68 — and with RSI crushed right down to 24.0, it’s deep in oversold territory. However to date, there’s no actual signal of a bounce. The drop mirrors the broader risk-off vibe throughout crypto, however TON’s slide is sharper, partly as a result of it was ignored of the US reserve speak that, no less than for a second, propped up Bitcoin — and to a lesser extent, Ethereum.

TON/USD 4H Chart. Supply: TradingView

Not like BTC and ETH, TON doesn’t have that massive institutional cash behind it, so when the entire market begins de-risking, TON tends to get hit more durable. If Bitcoin can’t maintain regular, TON may simply slide additional, with merchants eyeing the $2.50–$2.60 zone as the following doubtless touchdown spot. Nonetheless, with RSI this overwhelmed down, even a small reduction rally in Bitcoin or Ethereum may set off a pointy, quick bounce in TON — however that will doubtless be extra of a tactical commerce than a longer-term restoration sign.

Supply: TON Weblog

In the meantime, there’s lots happening beneath the hood within the TON ecosystem. TON Core simply rolled out its Accelerator improve, pushing community capability previous 100,000 TPS — and now engaged on reducing transaction latency to enhance person expertise. However whereas these are stable technical milestones, they haven’t translated into worth power — no less than not but.

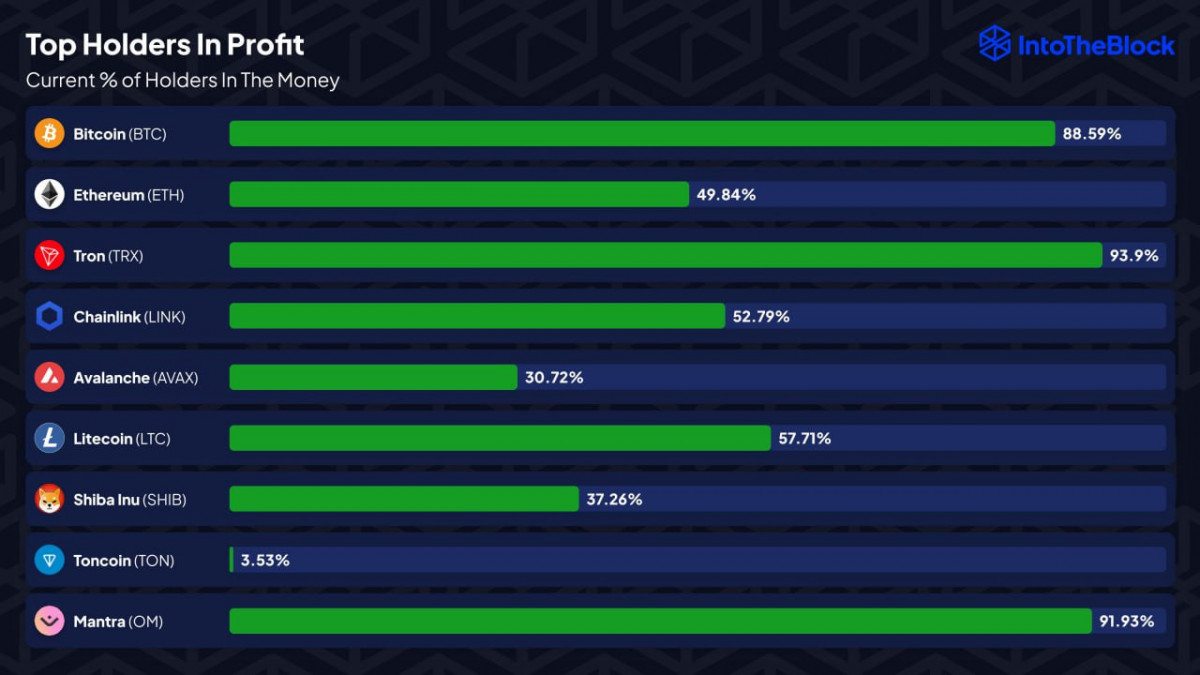

Supply: IntoTheBlock

Including to the bearish temper, solely about 3.5% of TON holders are at the moment in revenue — making it probably the most underwater amongst main blockchains.

Lastly, there are some long-term performs brewing, like TON Ventures’ new AI and crypto analysis initiative, and even Telegram including paid DMs, which may tie again into the TON ecosystem. However proper now, the chart’s telling the true story — and except Bitcoin finds its footing quickly, TON seems to be set to remain beneath stress, even when it’s primed for a short-term bounce on any broader market reduction.

Disclaimer

In step with the Trust Project guidelines, please word that the data supplied on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation you probably have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.