In Temporary

Bitcoin (BTC)

The second week of 2025 is simply previous us, and now let’s zoom in on how the crypto 2025 is shaping up to date. Final week kicked off on a excessive observe with Bitcoin breaking by the $100,000 barrier – as soon as once more – on January 6.

BTC/USD 1D Chart, Coinbase. Supply: TradingView

This expectedly reignited bullish sentiment throughout the market. Sturdy institutional strikes adopted shortly – MicroStrategy introduced plans to purchase up extra BTC, and inflows into spot ETFs have been steadily surging. For a second, it appeared just like the market was poised to journey a wave of momentum to even larger heights.

Supply: Michael Saylor

However the rally wasn’t constructed to final – a minimum of not but. Rising Treasury yields and stronger-than-expected U.S. financial knowledge rapidly cooled the joy.

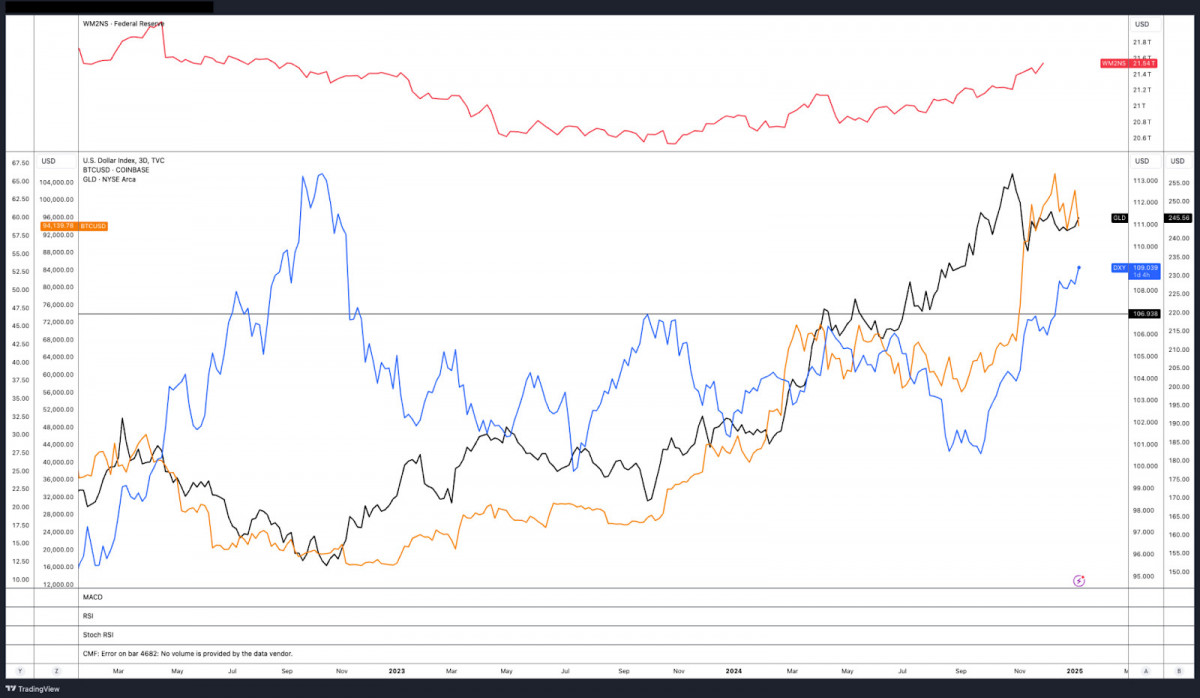

DXY vs BTC 3-day chart. Supply: TradingView

By midweek, it had slipped beneath $95,000 and even examined $92,000, shaking confidence and prompting hypothesis about whether or not a deeper correction may be on the horizon. There are additionally considerations over how Trump’s incoming administration may steer Federal Reserve coverage – which may largely form Bitcoin’s trajectory for 2025, and never essentially in a great way.

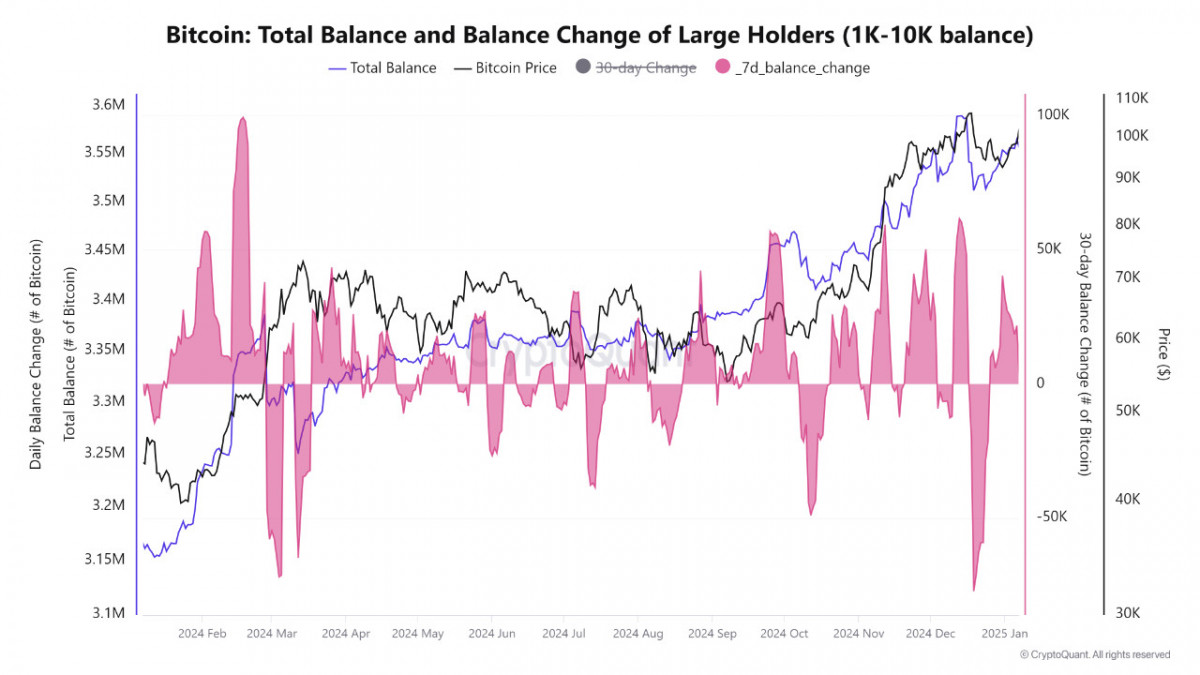

Regardless of the dip, the market isn’t with out hope. Whales and establishments have been quietly shopping for up Bitcoin at these decrease ranges, signaling that the urge for food for BTC hasn’t gone away.

Bitcoin seven-day steadiness change has flipped constructive after a virtually 80,000 BTC sell-off in late December. Supply: CryptoQuant

Analysts are cut up on what comes subsequent. Some see this as a textbook “purchase the dip” second, whereas others warn that the macro atmosphere – particularly rising yields and a stronger greenback – may hold Bitcoin underneath stress for some time longer.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

So, the large image stays a tug-of-war between short-term uncertainty and long-term optimism. With establishments nonetheless energetic, spot ETF inflows regular, and the psychological $100,000 mark now again in play, there’s a way that the market is gearing up for an additional massive transfer.

Ethereum (ETH)

Ethereum (ETH) has additionally had a reasonably wild week, with loads occurring each underneath the hood and available in the market.

Supply: Binance

The Pectra improve is getting numerous consideration – this replace is about to make the community sooner and extra environment friendly, and individuals are hyped about its potential. Toss in a pro-crypto administration within the U.S. and rising ETF adoption, and a few analysts are saying ETH may very well be gearing up for an enormous transfer this yr.

ETH/USD 1D Chart, Coinbase. Supply: TradingView

That mentioned, the value hasn’t precisely been cooperating. On the each day chart, ETH has been sliding since Bitcoin bought smacked down at $100,000 on January 8, which despatched shockwaves by the entire market. Proper now, ETH is sitting round $3,174, simply above its current lows. The 50-day shifting common is method up at $3,569, underlining how a lot floor ETH has misplaced.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

The 4-hour chart doesn’t look a lot better, exhibiting a gentle drift decrease after a interval of consolidation. The RSI is down in oversold territory at 32, which could set the stage for a short-term bounce – however the greater image nonetheless feels fairly bearish.

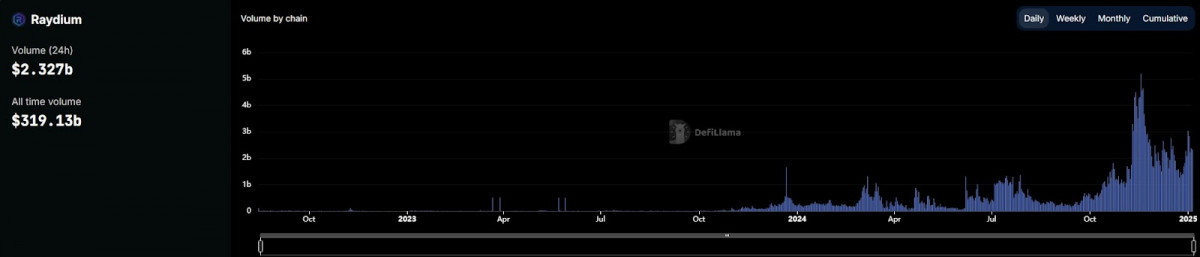

Raydium buying and selling quantity. Supply: DefiLlama

In the meantime, Solana has been making some noise, with its 24-hour DEX quantity outpacing Ethereum and Base mixed. That’s a wake-up name for Ethereum, exhibiting that its dominance in DeFi can’t be taken as a right. Even so, Ethereum’s ecosystem nonetheless has its wins. For one, Ripple is about to combine Chainlink value feeds on Ethereum – one other reminder of how central it stays to DeFi, at the same time as rivals circle.

General, there’s a mixture of warning and hope round ETH proper now. The worth motion has been tough, however there’s nonetheless a way that ETH may shock us in the long term.

TON (Toncoin)

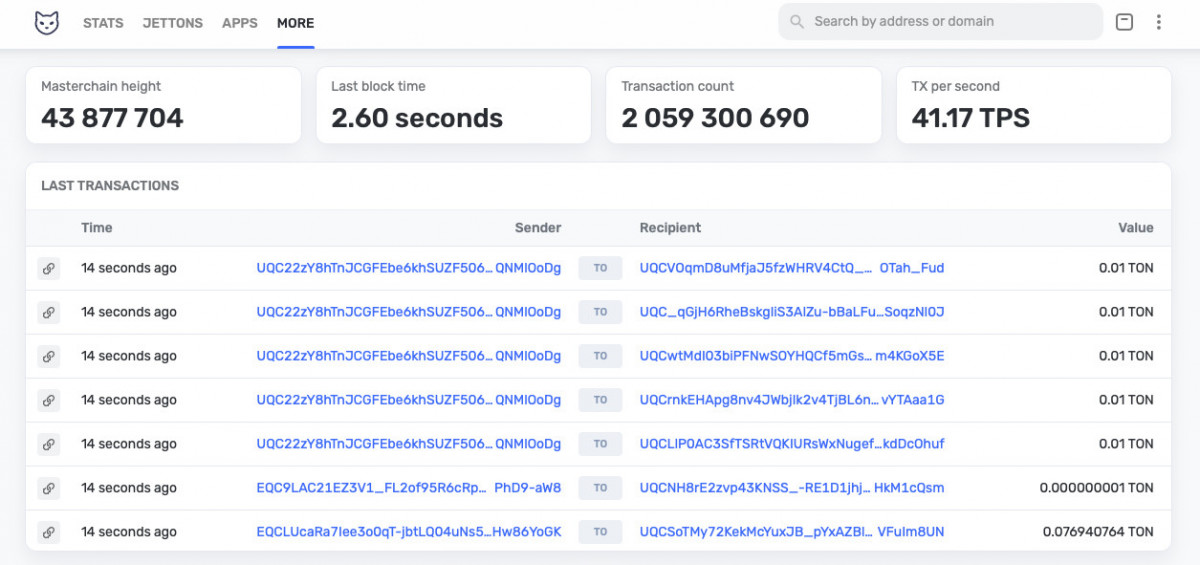

Now let’s discuss how the TON camp is doing. The TON Core crew made waves by slicing block technology instances practically in half, from 4.8 seconds to 2.8 seconds – that’s an enormous leap for transaction velocity.

Supply: Tonscan

On prime of that, staking yields shot as much as 5.5%, up from 3.7% final summer time, making TON staking a extra attractive choice. Add to this a noticeable uptick in new pockets addresses, and also you’d assume the market could be buzzing with optimism.

Supply: CryptoQuant

For a second, it was – TON managed to push previous the $5.25 resistance stage, sparking hopes of a broader restoration.

TON/USD 1D Chart. Supply: TradingView

However the pleasure was short-lived. Regardless of the technical upgrades and rising consumer adoption, buying and selling quantity slipped barely, and investor confidence nonetheless feels shaky. Bitcoin’s struggles have forged an extended shadow over the altcoin market, together with TON, dragging it again down towards the $5 help stage.

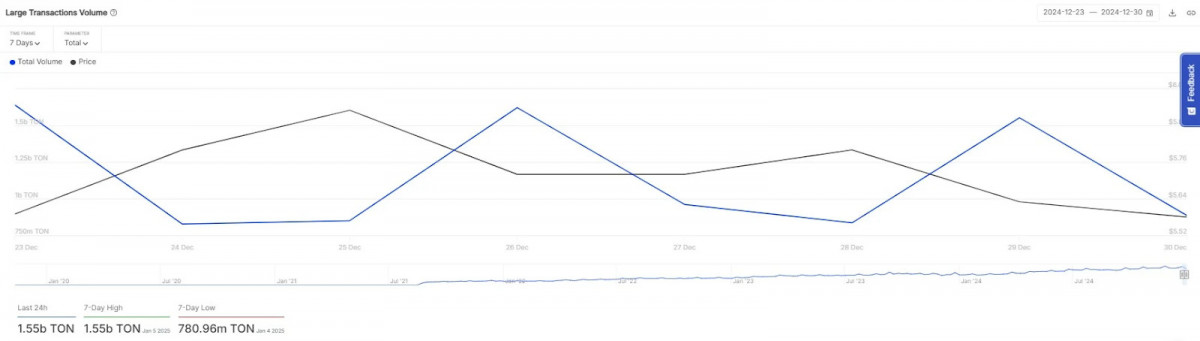

Toncoin Massive Transactions. Supply: CoinMarketCap

Even so, whales have been stepping in to prop issues up – large transactions totaling 1.55 billion TON (valued at $8.86 billion) have saved the coin from falling off a cliff. With out this exercise, we’d probably be taking a look at a extra important drop by now.

TON/USD 1D Chart. Supply: TradingView

On the charts, although, the image nonetheless isn’t fairly – TON is caught in a stable downtrend, buying and selling beneath its 20-day and 50-day SMAs on the each day. Dropping the $5.50 stage has solely added to the stress, and all eyes at the moment are on the $5.00 psychological help. If that stage offers method, a drop to $4.75 may very well be on the playing cards, however reclaiming $5.50 could be a much-needed sign for a possible turnaround.

TON/USD 4H Chart. Supply: TradingView

On the 4-hour chart, there’s a flicker of hope because the RSI edges towards oversold territory – a short-term bounce may be brewing. That mentioned, resistance round $5.32 and $5.50 stays formidable, and any aid rally may fizzle out rapidly. If patrons don’t step up quickly, the broader bearish momentum is more likely to push costs decrease, particularly with Bitcoin’s current struggles dragging the market down. For now, it’s all about whether or not TON can maintain the road at $5.00 or face deeper declines.

Disclaimer

Consistent with the Trust Project guidelines, please observe that the data offered on this web page just isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional info, we advise referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.

Victoria d’Este

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.