Behavioral economics is a discipline that explores the results of psychological elements on financial decision-making. This department of research is very pertinent whereas designing a token since person notion can considerably influence a token’s adoption.

We’ll delve into how token design decisions, resembling staking yields, token inflation, and lock-up periods, affect client habits. Research studies reveal that essentially the most vital issue for a token’s attractiveness isn’t its performance, however its previous value efficiency. This underscores the influence of speculative elements. Tokens which have proven earlier value will increase are most well-liked over these with extra helpful financial options.

Understanding Behavioral Tokenomics

Understanding Consumer Motivations

The design of a cryptocurrency token can considerably affect person habits by leveraging widespread cognitive biases and decision-making processes. As an illustration, the idea of “shortage” can create a perceived worth improve, prompting customers to purchase or maintain a token in anticipation of future positive aspects. Equally, “loss aversion,” a foundational precept of behavioral economics, means that the ache of shedding is psychologically extra impactful than the pleasure of an equal acquire. In token design, mechanisms that reduce perceived losses (e.g. anti-dumping measures) can encourage long-term holding.

Incentives and Rewards

Behavioral economics additionally gives perception into how incentives may be structured to maximise person participation. Cryptocurrencies typically use tokens as a type of reward for numerous behaviors, together with mining, staking, or taking part in governance by way of voting. The best way these rewards are framed and distributed can significantly have an effect on their effectiveness. For instance, providing tokens as rewards for attaining sure milestones can faucet into the ‘endowment impact,’ the place folks ascribe extra worth to issues just because they personal them.

Social Proof and Community Results

Social proof, the place people copy the habits of others, performs a vital position within the adoption of tokens. Tokens which might be seen getting used and promoted by influential figures throughout the neighborhood can rapidly acquire traction, as new customers emulate profitable buyers. The network effect additional amplifies this, the place the worth of a token will increase as extra folks begin utilizing it. This may be seen within the speedy progress of tokens like Ethereum, the place the broad adoption of its sensible contract performance created a snowball impact, attracting much more builders and customers.

Token Utility and Behavioral Levers

The utility of a token—what it may be used for—can be essential. Tokens designed to supply real-world functions past mere monetary hypothesis can present extra steady worth retention. Integrating behavioral economics into utility design entails creating tokens that not solely serve sensible functions but additionally resonate on an emotional stage with customers, encouraging engagement and funding. For instance, tokens that provide governance rights may enchantment to customers’ want for management and affect inside a platform, encouraging them to carry reasonably than promote.

Understanding Behavioral Tokenomics

Intersection of Behavioral Economics and Tokenomics

Behavioral economics examines how psychological influences, numerous biases, and the way in which during which info is framed have an effect on particular person choices. In tokenomics, these elements can considerably influence the success or failure of a cryptocurrency by influencing person habits in the direction of funding

Affect of Psychological Components on Token Attraction

A current research noticed that the attractiveness of a token typically hinges extra on its historic value efficiency than on intrinsic advantages like yield returns or revolutionary financial fashions. This emphasizes the truth that the cryptocurrency sector remains to be younger, and due to this fact topic to speculative behaviors.

The Impact of Presentation and Context

One other attention-grabbing discovering from the research is the influence of how tokens are introduced. In situations the place tokens are evaluated individually, the affect of their financial attributes on client choices is minimal. Nonetheless, when tokens are assessed facet by facet, these attributes grow to be considerably extra persuasive. This highlights the significance of context in financial decision-making—a core precept of behavioral economics. It’s simple to translate this into real-life instance – simply take into consideration the idea of staking yields. When advised that the yield on e.g. Cardano is 5% you may not suppose a lot of it. However, for those who have been concurrently advised that Anchor’s yield is nineteen%, then that 5% looks as if a tragic deal.

Implications for Token Designers

The applying of behavioral economics to the design of cryptocurrency tokens entails leveraging human psychology to encourage desired behaviors. Listed below are a number of core ideas of behavioral economics and the way they are often successfully utilized in token design:

Leveraging Value Efficiency

Research present clearly: “value going up” tends to draw customers greater than most different token attributes. This discovering implies that token designers have to deal with methods that may showcase their financial results within the type of value will increase. Which means e.g. it might be extra helpful to conduct a buy-back program than to conduct an airdrop.

Shortage and Perceived Worth

Shortage triggers a way of urgency and will increase perceived worth. Cryptocurrency tokens may be designed to have a restricted provide, mimicking the shortage of sources like gold. This not solely boosts the perceived rarity and worth of the tokens but additionally drives demand as a result of “worry of lacking out” (FOMO). By setting a cap on the whole variety of tokens, builders can create a pure shortage that will encourage early adoption and long-term holding.

Preliminary Provide Issues

The preliminary provide represents the variety of tokens which might be out there in circulation instantly following the token’s launch. The chosen quantity can affect early market perceptions. As an illustration, a big preliminary provide may recommend a decrease worth per token, which may appeal to speculators. Information reveals that tokens with low nominal worth are extremely unstable and usually underperform. Understanding how the preliminary provide can affect investor habits is essential for guaranteeing the token’s stability.

Managing Most Provide and Inflation

A finite most provide can safeguard the token in opposition to inflation, doubtlessly enhancing its worth by guaranteeing shortage. However, the inflation charge, which defines the tempo at which new tokens are launched, influences the token’s worth and person belief.

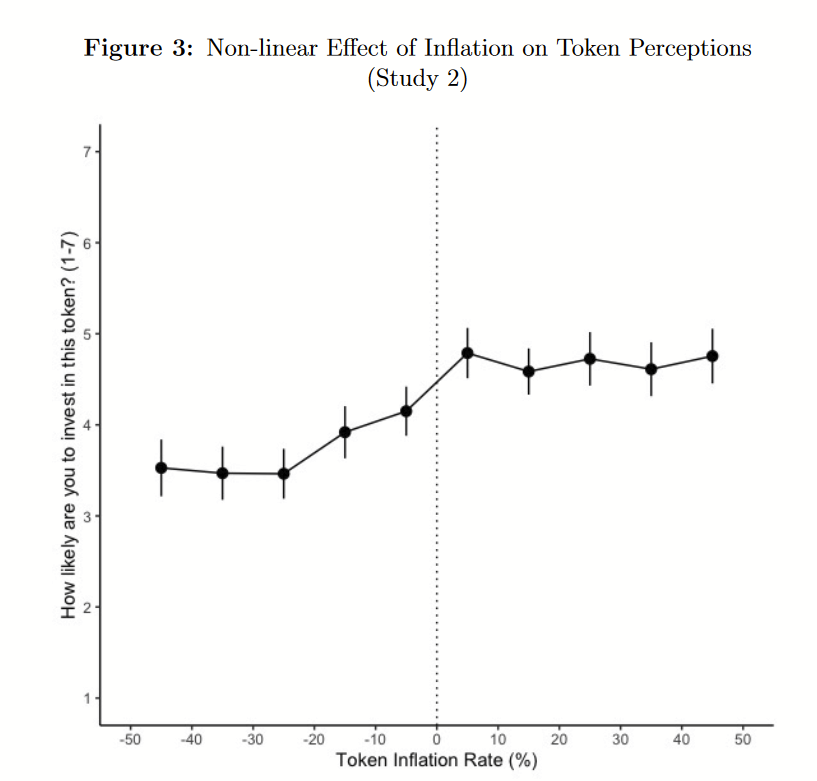

Buyers in cryptocurrency markets present a notable aversion to deflationary tokenomics. Members are much less prone to spend money on tokens with a deflationary framework, viewing them as riskier and doubtlessly much less worthwhile. Analysis means that whereas average inflation may be perceived neutrally and even positively, excessive inflation doesn’t improve attractiveness, and deflation is distinctly unfavorable.

These findings recommend that token designers ought to keep away from excessive deflation charges, which may deter funding and person engagement. As a substitute, a balanced method to inflation, avoiding extremes, seems to be most well-liked amongst cryptocurrency buyers.

Loss Aversion

Individuals are likely to choose avoiding losses to buying equal positive aspects; this is named loss aversion. In token design, this may be leveraged by introducing mechanisms that defend in opposition to losses, resembling staking rewards that provide constant returns or options that reduce value volatility. Moreover, creating tokens that customers can “earn” by way of participation or contribution to the community can faucet into this precept by making customers really feel they’re safeguarding an funding or including protecting layers to their holdings.

Social Proof

Social proof is a robust motivator in person adoption and engagement. When potential customers see others adopting a token, particularly influential figures or friends, they’re extra prone to understand it as useful and reliable. Integrating social proof into token advertising methods, resembling showcasing high-profile endorsements or neighborhood assist, can considerably improve person acquisition and retention.

Psychological Accounting

Psychological accounting entails how folks categorize and deal with cash otherwise relying on its supply or supposed use. Tokens may be designed to encourage particular spending behaviors by being categorized for sure varieties of transactions—like tokens which might be particularly for governance, others for staking, and others nonetheless for transaction charges. By distinguishing tokens on this method, customers can extra simply rationalize holding or spending them based mostly on their designated functions.

Endowment Impact

The endowment impact happens when folks worth one thing extra extremely just because they personal it. For tokenomics, creating alternatives for customers to really feel possession can improve attachment and perceived worth. This may be carried out by way of mechanisms that reward customers with tokens for participation or contribution, thus making them extra reluctant to half with their holdings as a result of they worth them extra extremely.

Conclusion

By contemplating how behavioral elements affect market notion, token engineers can create way more efficient ecosystems. Guaranteeing excessive demand for the token, means guaranteeing correct funding for the challenge usually.

Should you’re trying to create a strong tokenomics mannequin and undergo institutional-grade testing please attain out to contact@nextrope.com. Our workforce is prepared that will help you with the token engineering course of and guarantee your challenge’s resilience in the long run.

FAQ

How does the preliminary provide of a token affect its market notion?

- The preliminary provide units the perceived worth of a token; a bigger provide may recommend a decrease per-token worth.

Why is the utmost provide essential in token design?

- A finite most provide alerts shortage, serving to defend in opposition to inflation and improve long-term worth.

How do buyers understand inflation and deflation in cryptocurrencies?

- Buyers usually dislike deflationary tokens and consider them as dangerous. Average inflation is seen neutrally or positively, whereas excessive inflation isn’t favored.

Source link

You might also like

More from Web3

Hyperscale Data Centers: Who are the Hyperscalers?

Hyperscale Information Heart Market Obtain Pattern: https://www.theinsightpartners.com/sample/TIPRE00023893/?utm_source=openPR&utm_medium=10642(Use Company Mail Id for Fast Response)Hyperscale knowledge facilities, with their monumental computing, …

7 Ways to Protect Yourself From Violent Crypto Attacks (Without a Shotgun)

Briefly Use multisig wallets or different methods to create time delays. Observe a script you’d use beneath coercion (“The pockets is …

Healthcare Payer BPO Market May See Big Move | TCS, Genpact, EXL Service, HCL Technologies

Healthcare Payer BPO Marke HTF MI just lately launched International Healthcare Payer BPO Market examine with 143+ pages in-depth …