Because the web3 subject grows in complexity, conventional analytical instruments usually fall quick in capturing the dynamics of digital markets. That is the place Monte Carlo simulations come into play, providing a mathematical approach to mannequin programs fraught with uncertainty.

Monte Carlo simulations make use of random sampling to know possible outcomes in processes which might be too complicated for simple analytic options. By simulating hundreds, and even thousands and thousands, of situations, Monte Carlo strategies can present insights into the chance of various outcomes, serving to stakeholders make knowledgeable selections below circumstances of uncertainty.

On this article, we’ll discover the function of Monte Carlo simulations throughout the context of tokenomics. illustrating how they’re employed to forecast market dynamics, assess danger, and optimize methods within the risky realm of cryptocurrencies. By integrating this highly effective device, companies and traders can improve their analytical capabilities, paving the way in which for extra resilient and adaptable financial fashions within the digital age.

Understanding Monte Carlo Simulations

The Monte Carlo methodology is an method to fixing issues that contain random sampling to know possible outcomes. This system was first developed within the Nineteen Forties by scientists engaged on the atomic bomb in the course of the Manhattan Undertaking. The tactic was designed to simplify the complicated simulations of neutron diffusion, but it surely has since developed to handle a broad spectrum of issues throughout varied fields together with finance, engineering, and analysis.

Random Sampling and Statistical Experimentation

On the coronary heart of Monte Carlo simulations is the idea of random sampling from a likelihood distribution to compute outcomes. This methodology doesn’t search a singular exact reply however somewhat a likelihood distribution of attainable outcomes. By performing numerous trials with random variables, these simulations mimic the real-life fluctuations and uncertainties inherent in complicated programs.

Function of Randomness and Chance Distributions in Simulations

Monte Carlo simulations leverage the ability of likelihood distributions to mannequin potential situations in processes the place precise outcomes can’t be decided resulting from uncertainty. Every simulation iteration makes use of randomly generated values that comply with a selected statistical distribution to mannequin totally different outcomes. This methodology permits analysts to quantify and visualize the likelihood of various situations occurring.

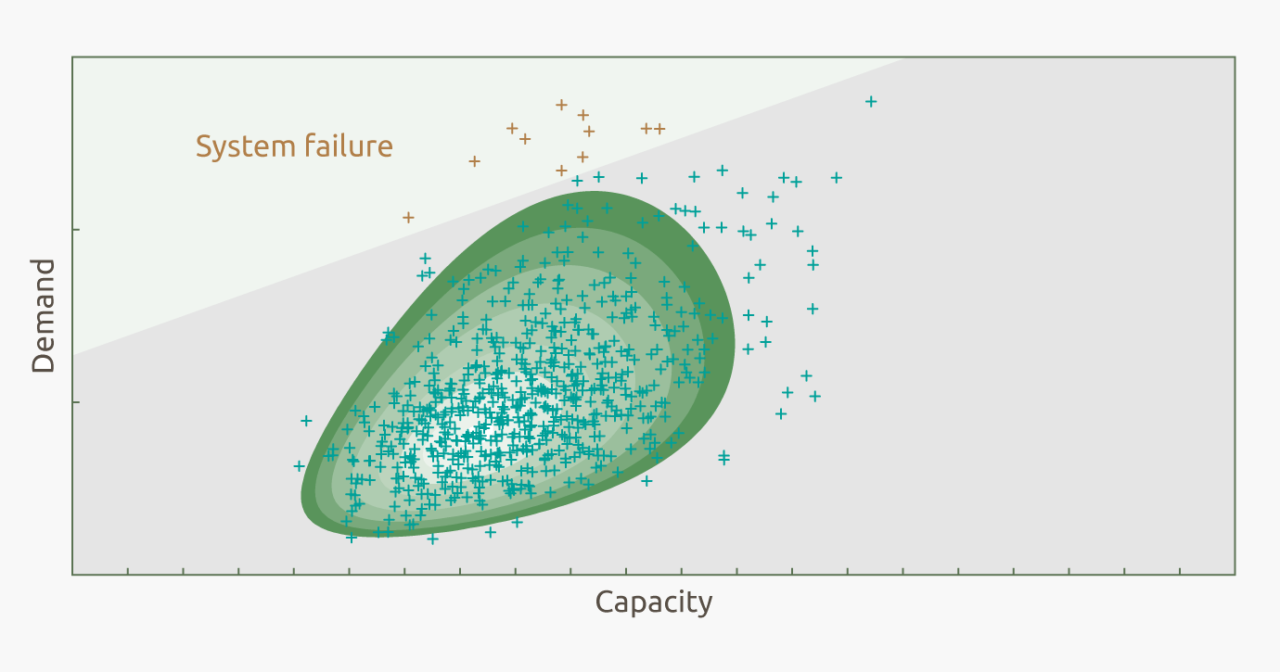

The power of Monte Carlo simulations lies within the perception they provide into potential dangers. They permit modelers to see into the probabilistic “what-if” situations that extra intently mimic real-world circumstances.

Monte Carlo Simulations in Tokenomics

Monte Carlo simulations are instrumental device for token engineers. They’re so helpful resulting from their means to mannequin emergent behaviors. Listed here are some key areas the place these simulations are utilized:

Pricing and Valuation of Tokens

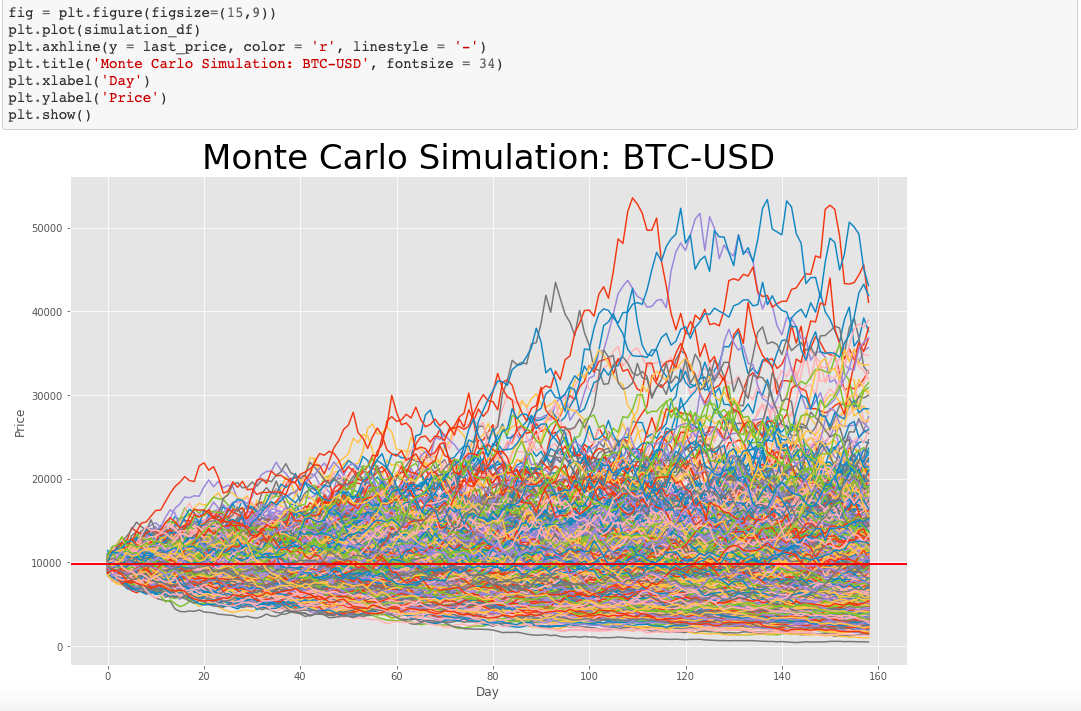

Figuring out the worth of a brand new token could be difficult as a result of risky nature of cryptocurrency markets. Monte Carlo simulations assist by modeling varied market situations and value fluctuations over time, permitting analysts to estimate a token’s potential future worth below totally different circumstances.

Assessing Market Dynamics and Investor Conduct

Cryptocurrency markets are influenced by a myriad of things together with regulatory modifications, technological developments, and shifts in investor sentiment. Monte Carlo strategies permit researchers to simulate these variables in an built-in setting to see how they could affect token economics, from general market cap fluctuations to liquidity issues.

Assesing Attainable Dangers

By operating numerous simulations it’s attainable to stress-test the mission in a number of situations and establish emergent dangers. That is maybe a very powerful operate of Monte Carlo Course of, since these dangers can’t be assessed another means.

Advantages of Utilizing Monte Carlo Simulations

By producing a variety of attainable outcomes and their possibilities, Monte Carlo simulations assist decision-makers within the cryptocurrency area anticipate potential futures and make knowledgeable strategic selections. This functionality is invaluable for planning token launches, managing provide mechanisms, and designing advertising and marketing methods to optimize market penetration.

Utilizing Monte Carlo simulations, stakeholders within the tokenomics subject can’t solely perceive and mitigate dangers but additionally discover the potential affect of various strategic selections. This predictive energy helps extra sturdy financial fashions and may result in extra secure and profitable token launches.

Implementing Monte Carlo Simulations

A number of instruments and software program packages can facilitate the implementation of Monte Carlo simulations in tokenomics. Some of the notable is cadCAD, a Python library that gives a versatile and highly effective setting for simulating complicated programs.

Overview of cadCAD configuration Elements

To raised perceive how Monte Carlo simulations work in apply, let’s check out the cadCAD code snippet:

sim_config = {

'T': vary(200), # variety of timesteps

'N': 3, # variety of Monte Carlo runs

'M': params # mannequin parameters

}Clarification of Simulation Configuration Elements

T: Variety of Time Steps

- Definition: The ‘T’ parameter in CadCAD configurations specifies the variety of time steps the simulation ought to execute. Every time step represents one iteration of the mannequin, throughout which the system is up to date. That replace is predicated on varied guidelines outlined by token engineers in different elements of the code. For instance: we’d assume that one iteration = sooner or later, and outline data-based features that predict token demand on that day.

N: Variety of Monte Carlo Runs

- Definition: The ‘N’ parameter units the variety of Monte Carlo runs. Every run represents a whole execution of the simulation from begin to end, utilizing doubtlessly totally different random seeds for every run. That is important for capturing variability and understanding the distribution of attainable outcomes. For instance, we will acknowledge that token’s value shall be correlated with the broad cryptocurrency market, which acts considerably unpredictably.

M: Mannequin Parameters

- Definition: The ‘M’ key comprises the mannequin parameters, that are variables that affect system’s conduct however don’t change dynamically with every time step. These parameters could be constants or distributions which might be used throughout the coverage and replace features to mannequin the exterior and inner components affecting the system.

Significance of These Elements

Collectively, these parts outline the skeleton of your Monte Carlo simulation in CadCAD. The mix of a number of time steps and Monte Carlo runs permits for a complete exploration of the stochastic nature of the modeled system. By various the variety of timesteps (T) and runs (N), you possibly can alter the depth and breadth of the exploration, respectively. The parameters (M) present the required context and be certain that every simulation is reasonable.

Conclusion

Monte Carlo simulations symbolize a strong analytical device within the arsenal of token engineers. By leveraging the rules of statistics, these simulations present deep insights into the complicated dynamics of token-based programs. This methodology permits for a nuanced understanding of potential future situations and helps with making knowledgeable selections.

We encourage all stakeholders within the blockchain and cryptocurrency area to contemplate implementing Monte Carlo simulations. The insights gained from such analytical strategies can result in simpler and resilient financial fashions, paving the way in which for the sustainable development and success of digital currencies.

In the event you’re seeking to create a sturdy tokenomics mannequin and undergo institutional-grade testing please attain out to contact@nextrope.com. Our staff is prepared that can assist you with the token engineering course of and guarantee your mission’s resilience in the long run.

FAQ

What’s a Monte Carlo simulation in tokenomics context?

- It is a mathematical methodology that makes use of random sampling to foretell unsure outcomes.

What are the advantages of utilizing Monte Carlo simulations in tokenomics?

- These simulations assist foresee potential market situations, aiding in strategic planning and danger administration for token launches.

Why are Monte Carlo simulations distinctive in cryptocurrency evaluation?

- They supply probabilistic outcomes somewhat than mounted predictions, successfully simulating real-world market variability and danger.

Source link

You might also like

More from Web3

Trump’s Win Boosted Bitcoin Adoption by ‘Decades,’ Says Blockstream’s Adam Back

In short Blockstream CEO Adam Again says Trump’s presidency is accelerating authorities curiosity in Bitcoin by many years. Again, a veteran …

Cantor’s $2 Billion Bitcoin Lending Business Makes First Transactions

In short Cantor's new Bitcoin lending enterprise has carried out its first transactions. The enterprise expects to make as much as …