In Transient

Crypto market decline led to over $1 billion in leveraged positions liquidation, revealing unprepared merchants.

A steep decline within the crypto market occurred, and inside a day, leveraged positions value over $1 billion have been liquidated. After a month of strong bullish momentum, this occasion demonstrated how unprepared merchants have been for unexpected market disruptions.

However the setback, some analysts speculate that this won’t be the start of a long-term slide however somewhat a short lived correction.

Results of Liquidation and Market Responses

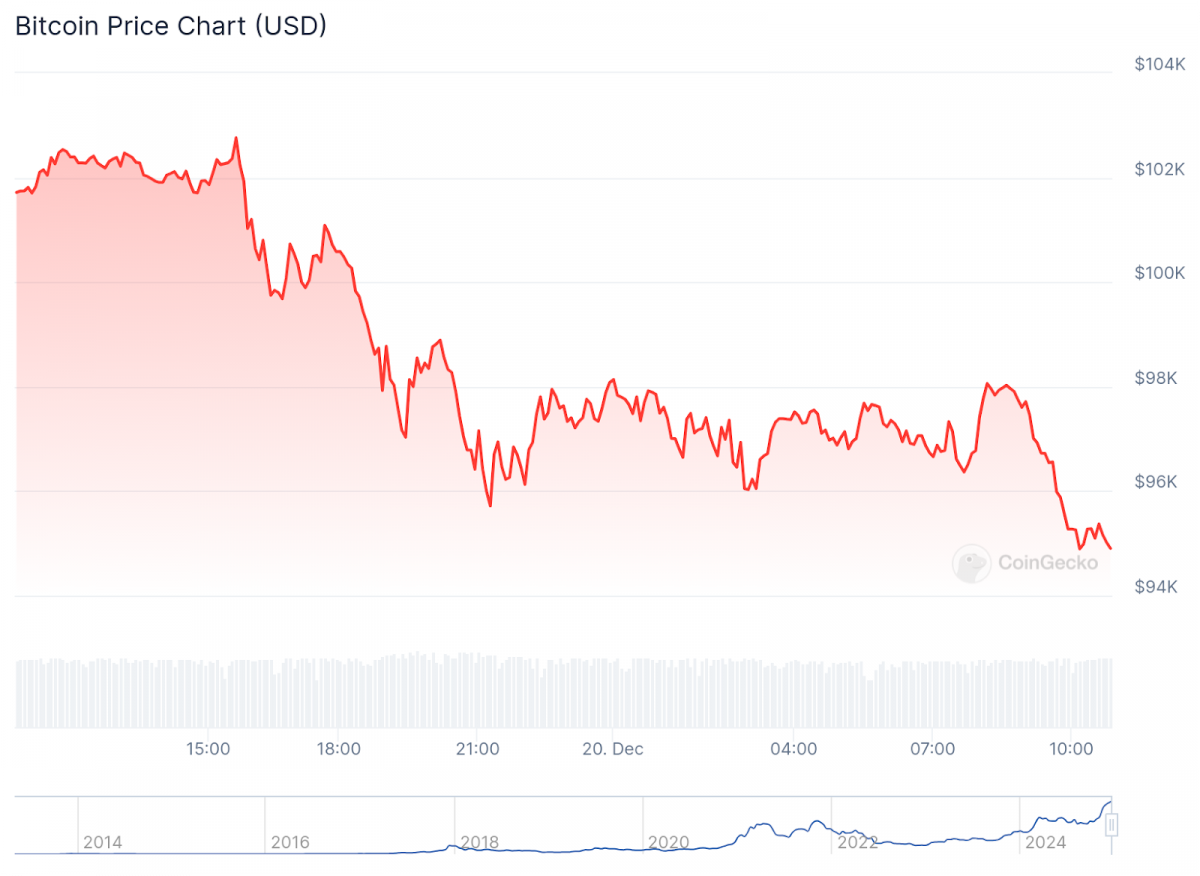

Bitcoin, which noticed its value fall and settle at $94,971 on the time of writing, was the chief of the liquidation wave.

Photograph: CoinGecko

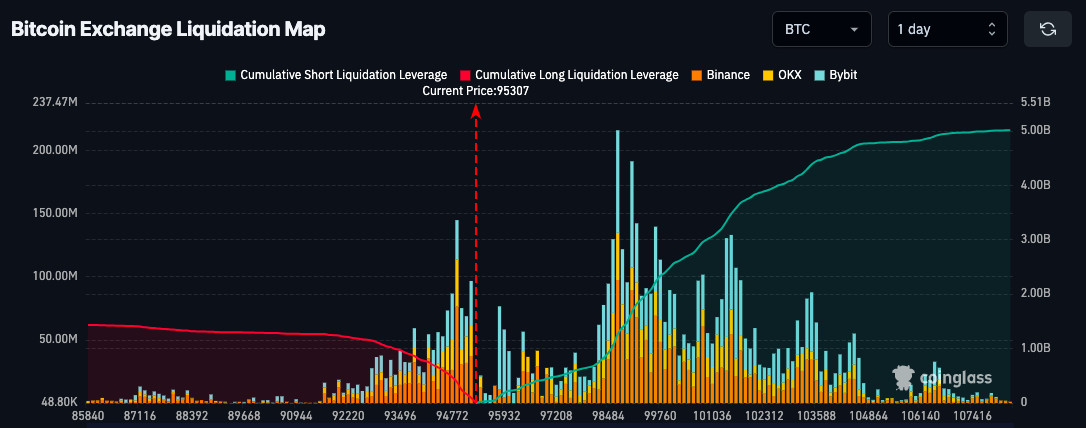

Based on CoinGlass information, lengthy positions included about $856.7 million of the $1.02 billion liquidated on December 19.

Photograph: CoinGlass

This incident was the month’s second main liquidation. On December 5, Bitcoin’s value fell 5.47% beneath $93,000, wiping away $300 million in a matter of minutes. Days later, on December 10, extra over $1.7 billion in leveraged positions have been eradicated in a single day attributable to a wider market hunch. The inherent volatility of the cryptocurrency market and the hazards of leveraged buying and selling are each mirrored in these incidents.

Caleb Franzen, a cryptocurrency market skilled, mentioned that comparable pullbacks have occurred in previous cycles and defined this volatility as typical conduct throughout a bull run. His observations present the current drop couldn’t portend a deeper drop however somewhat an episodic correction attribute of upward market tendencies.

Hawkish Federal Reserve Indicators Contribute to Market Strain

The cryptocurrency market is now rather more difficult because of current steps by the Federal Reserve. The Fed introduced a quarter-percentage-point drop to its principal rate of interest on December 18, its third in a row. Nevertheless, market confidence was tempered by its cautious method to additional cutbacks.

For dangerous belongings like cryptocurrencies, the central financial institution’s determination to limit charge cuts till 2025 has generated uncertainty. Though cryptocurrencies are more and more being seen as a hedge towards inflation, their excessive volatility nonetheless poses an issue in developed international locations, in line with Ruslan Lienkha, Chief of Markets at YouHodler.

Bearish sentiment within the cryptocurrency market was fueled by the Fed’s measures that restricted liquidity. Nevertheless, Lienkha mentioned that by growing liquidity within the banking sector, faster charge reductions may increase the worth of cryptocurrencies.

Leverage Dangers Are Highlighted by Lengthy Liquidations

The dangers of high-leverage buying and selling in erratic markets are highlighted by the $856.7 million lengthy place liquidation. In a December 19 X submit, Bitcoin maximalist Fred Krueger highlighted this subject and cautioned that leverage remains to be the first method to “screw up” buying and selling Bitcoin.

The temper is indicative of the broader risks that leverage presents to merchants, each institutional and particular person. Leveraged holdings are notably dangerous amid sudden modifications available in the market since they improve each doable positive aspects and losses.

Expectations for the Santa Rally Regardless of Volatility

Some market gamers are nonetheless eager for a year-end revival regardless of the current upheaval. The thought of a “Santa rally,” through which asset values improve throughout the Christmas season, has been alluded to by analysts similar to Pav Hundal of Swyftx and Jamie Coutts of Actual Imaginative and prescient.

Hundal described at present’s state of state of affairs as “short-term angst,” implying that the bullish temper of the earlier month would reappear. He mentioned that extra volatility or a rebound is perhaps fueled by the market’s response to current occasions, similar to Federal Reserve insurance policies and conjecture round Donald Trump’s upcoming administration.

In step with previous tendencies when pullbacks throughout bull runs have been adopted by larger highs, Coutts and different analysts see the present decline as a doable shopping for alternative. Over the last Bitcoin bull run, Franzen famous 9 such drops that preceded new all-time highs.

Market Expectations Are Formed by Political Elements

Past present market situations, cryptocurrency buyers are listening to Donald Trump’s coming inauguration because the forty seventh president of america in January 2025. A U.S. Bitcoin strategic reserve is without doubt one of the doable regulatory modifications that market gamers are interested by.

Hundal mentioned that when companies take into account expectations for crypto regulation and extra common financial measures, there would doubtless be volatility round Trump’s administration. Within the upcoming months, this uncertainty might trigger the cryptocurrency market to fluctuate much more.

Some analysts advise warning, whereas others see this pullback as a traditional half of a bigger bull market. The subsequent stage of cryptocurrency value modifications will most likely be formed by the interplay of market temper, political occasions, and Federal Reserve coverage.

Merchants and buyers should stability the doable advantages of partaking in an erratic but rapidly altering market towards the hazards of leveraging positions when confronted with uncertainty. It stays to be seen if the market undergoes a protracted decline or if the anticipated Santa rally happens. The takeaways from this incident, nevertheless, are unmistakable: danger administration and planning are essential for surviving within the unstable cryptocurrency market.

Disclaimer

In step with the Trust Project guidelines, please observe that the knowledge supplied on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional info, we recommend referring to the phrases and situations in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.