Anthony Butler is a Chainlink advisor, and former CTO of IBM Providers, Center East and Africa.

Central Financial institution Digital Currencies (CBDCs) proceed to be the topic of intensive analysis, experimentation, and evaluation globally as central banks think about what the way forward for cash could appear like and whether or not tokenised central financial institution cash ought to play a task in that future. This journey didn’t start, in fact, in 2024 however goes again a few years: with the CBDC idea evolving considerably from the earliest home experimentations by means of to cross-border experimentation and now, the emergent idea of a “finternet” that seeks to weave collectively the worlds of tokenised and non-tokenised belongings into a typical material.

Historical past of CBDCs

The primary CBDC experiments seem to return to 2014 when the Central Financial institution of Uruguay and China experimented with the e-Peso and e-CNY respectively. This was adopted by numerous experiments resembling Canada’s Project Jasper, South Africa’s Khoka, Financial Authority of Singapore’s Ubin, and others. A few of these tasks sought to duplicate a type of digital money (i.e. retail CBDC) and others sought to duplicate the options and features of the RTGS (i.e. wholesale CBDC).

A lot of this early section of experimentation was targeted on understanding this new know-how known as “blockchain” and whether or not there was a possible to create one thing in a regulated context that resembled the improvements that had been occurring throughout the crypto ecosystem with Bitcoin, Ethereum, and so forth.

These home experiments had been shortly adopted by multi-jurisdictional experiments the place the aperture was broadened to contemplate how CBDC could possibly be used as devices of cross-border settlement. For instance, Hong Kong and Thailand’s Project Lionrock, Saudi Central Financial institution and UAE Central Financial institution’s Project Aber, Canada and Singapore’s integration of Jasper and Ubin (often called Jasper-Ubin), and Project Dunbar through which the BIS introduced collectively the central banks of Australia, Malaysia, Singapore and South Africa to check a number of CBDCs on a single shared platform. This latter challenge demonstrated the efficacy of CBDCs for worldwide settlement and led to Project mBridge.

The drivers for cross-border experimentation had been completely different, with the first objective of those initiatives being to handle inefficiencies in worldwide funds and remittances, which are sometimes sluggish, pricey, and opaque. For instance, cross-border funds often take 3-5 days to clear and banks “proceed to be the most costly channel for sending remittances,” with a mean value of 12.1% based on the World Bank.

Present CBDC panorama

Right this moment, there are nonetheless experiments being performed domestically and cross-border and there are a small variety of nations which have, having seen tasks present important effectivity, programmability, and composability benefits, decided to maneuver ahead with CBDCs. On the identical time, there are actually many examples of personal cash being tokenised too, such because the tokenised deposits which are issued as tokenised claims towards industrial financial institution stability sheets. As with wCBDC, many of those are exploring cross-border eventualities too.

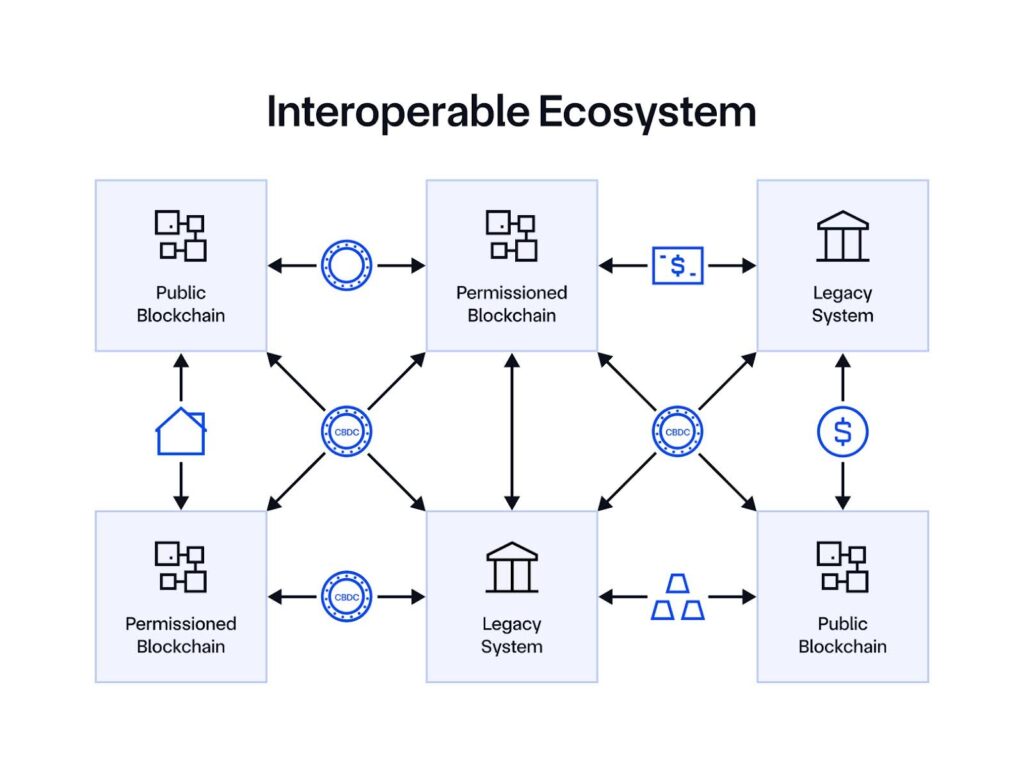

As we have a look at the evolution of this area and the efforts underway globally, it’s clear that it’s extremely unbelievable that the world will converge on a single blockchain platform that may span the globe and be the “common ledger” onto which all belongings and types of cash shall be tokenised.

Key explanation why a singular “common ledger” is not going to be realised:

- Not all nations will transfer in direction of tokenisation on the identical time or identical tempo, so there shall be a necessity for coexistence between the legacy and new methods for an prolonged period of time.

- The selection of protocol or know-how to tokenize an asset, resembling permissioned or zero-knowledge primarily based chains for privateness, fast-finality options for funds, and public blockchains for decentralized safety, shall be knowledgeable by the native jurisdictional necessities, the kind of asset being tokenised, the kinds of markets that the asset will should be listed in, and a myriad of different useful and non-functional necessities that may lead in direction of a selected know-how. It’s possible, for instance, that completely different industrial banks could select to make use of completely different applied sciences for tokenised deposits, central banks could use different applied sciences for his or her CBDCs, belongings shall be tokenised on a variety of different heterogenous networks primarily based on the place there may be demand and liquidity, and every system might want to interconnect with a myriad of different methods exterior their jurisdiction resembling the varied DLT and non-DLT primarily based messaging and cross-border funds methods.

- The know-how is evolving shortly with scalability options that may help mass adoption and the obstacles to entry are being lowered such that it’s conceivable that, sooner or later sooner or later, instantiating a blockchain community shall be analogous to the instantiation of a relational database right this moment; a scenario that may additional result in proliferation of networks.

- There are already rising regional and different blocs through which completely different jurisdictions are coming collectively to construct their very own cross-border networks targeted on a selected set of corridors or a selected area.

The top result’s fragmentation, silos, and islands that, with out bridges, will be unable to ship on the unique promise of blockchain.

We are able to discover synergies within the origins of the Web. Within the early days of the Internet, there have been distinct networks that emerged to service completely different communities. There was ARPANET, CSNET, and NSFNET, for instance, and a variety of different networks that emerged in different elements of the world. They didn’t have any option to talk with one another and had been, like the varied DLT networks of right this moment, islands. On January 1st, 1983, this may change after they would undertake a typical “language” often called Switch Management Protocol/Internetwork Protocol or TCP/IP as it’s generally recognized right this moment. It was the adoption of this common language that led to the start of the Web.

As we see the varied DLT-based monetary networks following an identical trajectory with islands rising, the query that have to be requested is how will we resolve the interoperability problem? What, one may ask, is the TCP/IP of the blockchain period that may enable the TradFi and DeFi worlds to interoperate but additionally, inside every, enable the varied tokenised belongings, deposits, and CBDC platforms to speak to one another? As with the Web, it’s only by means of the seamless integration of those networks that the true worth might be realised.

What would a TCP/IP of the blockchain world want to supply?

Firstly, this protocol ought to allow tokens—the “packets” of blockchain-based finance (onchain finance) containing worth and knowledge—to maneuver securely between networks, even heterogenous protocols, resembling public and permissioned. It ought to achieve this in a method that ensures safety and the integrity of the system. For instance, it might clearly be problematic if some tokenised cash was moved from one community to a different but it continued to persist within the authentic community since this may allow “doubling spending” and would undermine the integrity of your entire system.

Second, good contracts ought to have the ability to govern and orchestrate the motion of those tokens such that refined settlement use instances might be executed, such because the switch of a CBDC from one community to a different happens solely contingent on the switch of a tokenised safety from one community to a different; or numerous cost versus cost eventualities resembling exchanging CBDC on one community in a single forex for CBDC on one other community and in one other forex. With the intention to help complicated operations cross-chain, the interoperability answer have to be programmable, embedding each tokens and directions on what to do with these tokens in a single cross-chain transaction.

Thirdly, these tokens could also be created as representations of some bodily or “real-world assets”, resembling a safety or actual property. On the time of being created, this hyperlink shall be established and, because the token strikes between networks or cross-border, this hyperlink shouldn’t be damaged however ought to proceed to make sure that the token-holder has visibility and might have faith within the linkage between the digital and bodily worlds by means of real-time proof of reserve verifications. Additional, as attributes of the bodily asset change over time, the token also needs to be up to date with offchain knowledge being injected into the token’s good contract to replicate these altering values.

Fourth, while TCP/IP was primarily based on the motion of packets with out consideration for what data was embedded in them, a TCP/IP of the blockchain world must take into consideration that a lot of what’s being moved is of actual monetary worth and is topic to a spread of complicated regulatory and different concerns. There must be an applicable oracle-based privateness and permissions mechanism that ensures the safety of the system whereas additionally supporting compliance with numerous rules, enabling establishments to use predefined controls and limits throughout transactional exercise, together with insurance policies round identification, AML/KYC, authorized necessities, organizational restrictions, and extra.

Fifth, there must be a recognition that so-called legacy methods might want to co-exist and synchronize with the brand new methods and due to this fact the protocol ought to allow the seamless motion of worth and knowledge between these legacy worlds and the tokenised world—and vice versa.

Lastly, as CBDCs or different tokenized belongings transfer throughout chains by means of their lifecycle, they have to be frequently up to date with key worth, reserves possession, compliance, and different knowledge, no matter which surroundings they’re transferred to. This may allow the creation of a unified golden document—a single supply of reality that every one stakeholders can learn from.

You might also like

More from Web3

What Are Internet Capital Markets? Why Companies Are Launching Meme Coins

In short Web capital markets contain firms elevating cash or selling their enterprise utilizing digital-native monetary devices. These devices typically exhibit …

XRP News: Vaultro Finance Presale on XRP ledger Skyrockets Past 50%, As Investors Race to Own $VLT Token

SINGAPORE , June 15, 2025 (GLOBE NEWSWIRE) — Vaultro Finance has simply introduced a landmark achievement in its public …

Why I left Web2 for Web3 – and why you might, too

The next article is a visitor submit and opinion of Yurii Kovalchuk, Senior Blockchain Engineer at Forte Group.Three and …