Desk of Contents:

- The Core Advantages of Utilizing DeFi Platforms

- DeFi vs. Conventional Finance

- Why DeFi is Gaining Momentum?

- DeFi’s Position within the Way forward for Finance

Decentralized finance, or DeFi, is greater than only a pattern; it’s a monetary transformation that’s breaking down boundaries, redefining accessibility, and making waves throughout the globe. Not like conventional finance, which is laden with intermediaries and rules, DeFi affords a extra clear, accessible, and inclusive monetary panorama. In the event you’re interested by why DeFi has generated such a buzz or questioning the way it compares to conventional finance, you’re in the proper place. Let’s discover the true advantages of DeFi and see the way it’s reshaping our monetary future.

The Core Advantages of Utilizing DeFi Platforms:

Decentralized finance offers a number of benefits that make it stand out, whether or not you’re a seasoned investor or somebody new to finance. Listed here are the core the reason why persons are flocking to DeFi.

1. Accessibility:

Imagine a future the place alternatives for monetary functions have been introduced inside the realms of the web. At DeFi, a protracted historical past with a specific financial institution shouldn’t be essential. With DeFi, the folks dwelling within the distant and even under-served areas face the identical monetary alternatives as these from large cities. This shall be very helpful to the “unbanked” inhabitants of the world the place, as a consequence of numerous elements, folks can’t entry companies from the normal banking industries.

2. Transparency:

Transparency is among the foundational options of DeFi. Each transaction executed on DeFi platforms is recorded on public blockchains, making it attainable for anybody to confirm transactions and protocols. Good contracts implement the foundations transparently. This is much better than conventional finance, the place shoppers not often get a transparent view of charges, lending practices, or different essential info.

3. Management Over Belongings:

While you use a DeFi platform, you stay accountable for your belongings. Conventional banks or monetary establishments act as custodians of your cash, which means they’ve management over your funds. In DeFi, you keep full management by personal keys, enabling you to commerce, lend, or make investments as you see match, with out requiring permission from any middleman.

4. Decrease Charges and Sooner Transactions:

Take into consideration how a lot it prices to wire cash internationally or the charges related to bank card transactions. DeFi eliminates many of those prices by eradicating intermediaries. Transactions occur instantly between events, usually for a fraction of the associated fee and with virtually instantaneous processing instances. This discount in charges and transaction time could be a game-changer for people and companies alike.

5. Modern Monetary Merchandise:

DeFi has opened up a world of economic merchandise that conventional finance by no means provided. From yield farming and liquidity swimming pools to decentralized exchanges and lending protocols, DeFi platforms present revolutionary methods to develop wealth. These merchandise provide larger flexibility and, usually, larger yields than conventional financial savings or funding accounts.

6. Enhanced Safety By means of Blockchain:

DeFi platforms leverage blockchain technology to secure transactions, providing a decentralized and immutable record that’s nearly impossible to alter. While no system is entirely without risk, the transparency and decentralization of DeFi offer enhanced security compared to the traditional financial system’s centralized databases that can be susceptible to hacks or data breaches.

Real-World Case Studies: DeFi in Action

Let’s take a look at a few real-world examples where DeFi has demonstrated clear benefits, transforming lives and industries along the way.

Case Study 1: Uniswap – Decentralizing Trading

Uniswap is one of the very most popular decentralized exchanges in existence. It lets crypto traders trade without using any middlemen. Before DeFi, people had to go through centralized exchanges where account verification took days and there were high fees on the platform and potential account freezes. So Uniswap changed all that, making users switch their tokens directly and enjoy smaller fees as well as instant access to funds.

One user story highlights a small business owner who used Uniswap to swap Ethereum-based tokens for investment purposes. With no centralized exchange blocking his funds, he was able to move his money seamlessly and quickly, reinvesting profits and paying less in transaction fees than if he’d used traditional channels. Uniswap is a clear example of how DeFi platforms make it possible to trade with fewer restrictions and greater freedom.

Case Study 2: Compound-A Better Way to Earn Interest

Compound is a DeFi protocol. Its users lend and borrow the cryptocurrencies with it so as to earn interest on their deposited assets. Unlike banks in the old way that could only provide minimal interest, Compound made sure that its users would earn interest more frequently due to it being decentralized and because of how competitive borrowers were.

For example, a college student with a small savings fund decided to deposit his funds into Compound. Instead of earning 0.01% in a traditional savings account, he earned several percentage points annually on Compound. His funds grew at a faster rate, helping him save more for his future. Compound’s success shows how DeFi is democratizing interest-earning opportunities, enabling even small investors to grow their wealth.

Case Study 3: Aave – Democratizing Access to Loans

The other popular lending platform via DeFi is Aave. It allows people to borrow without any kind of credit check or approval. The loans here are mainly backed up by crypto assets where interest rates are based on the supply and demand of the market. For someone who has a lot of crypto but is lacking in cash flow, Aave comes very in handy.

One story involves a tech entrepreneur who used Aave to access funding for his business expansion. Instead of waiting weeks for bank approval or risking credit rejection, he collateralized his Ethereum holdings and borrowed stablecoins, securing funds quickly. This flexibility allowed him to seize a business opportunity and repay the loan once his cash flow increased. Aave showcases how DeFi can provide fast, hassle-free access to loans.

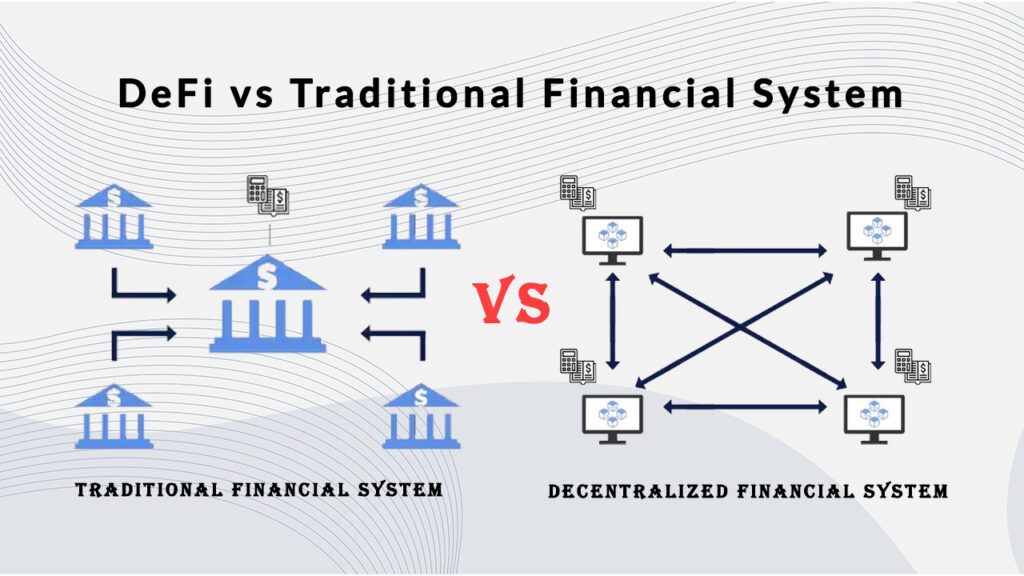

DeFi vs. Traditional Finance: A Benefits Showdown

Source: thecryptoape.com

DeFi has its unique strengths, and while it doesn’t entirely replace traditional finance, it offers several advantages over it. Here’s how they stack up:

| Aspect | DeFi | Traditional Finance (CeFi) |

| Access | Open to anyone with internet access | Requires approval from banks or institutions |

| Control | Users control their own assets | Banks and institutions control user funds |

| Transparency | Full transparency via public blockchains | Limited transparency, records often private |

| Intermediaries | No middlemen rely on smart contracts | Centralized control with intermediaries |

| Transaction Speed | 24/7 availability, faster settlements | Business hours only, slower settlements |

| Fees | Lower fees, but gas fees may vary | Higher fees due to intermediaries and regulations |

| Security | Secure, but smart contracts can be vulnerable | Generally secure, but prone to central point failures |

Why DeFi is Gaining Momentum?

One reason DeFi is growing rapidly is its ability to adapt to the needs of a diverse range of users, from those seeking high returns on their assets to those in need of faster, more accessible loan options. By offering a flexible alternative to conventional finance, DeFi platforms attract users looking for freedom from traditional barriers, higher transparency, and lower fees.

Moreover, the rapid advancement of blockchain technology fuels DeFi’s expansion, continually improving the safety, usability, and diversity of DeFi products. For individuals, businesses, and even governments interested in harnessing these benefits, DeFi represents an exciting frontier with possibilities that traditional finance struggles to match.

Is DeFi Right for You?

While DeFi presents plenty of opportunities, it’s essential to weigh the risks, as DeFi platforms aren’t immune to volatility, hacks, or regulatory challenges. DeFi’s decentralized nature means it operates in a less regulated environment, which, while beneficial in many ways, also introduces unique risks.

However, as more protocols and tools emerge to secure user funds and protect against potential vulnerabilities, DeFi is becoming an increasingly attractive option. If you’re interested in exploring DeFi, start with small investments, take time to understand the protocols, and only use trusted platforms with proven track records.

DeFi’s Role in the Future of Finance:

Source: forkast.news

DeFi has sparked a financial revolution, and as blockchain technology matures, the possibilities for further innovation seem endless. By providing greater inclusivity, transparency, control, and earning potential, DeFi is reshaping the financial world and giving people unprecedented opportunities to manage and grow their wealth.

So, what’s your take on DeFi? Do you think it will become the primary way we handle finance, or do you think traditional finance will adapt and catch up? Let’s hear your thoughts—comment below and join the conversation on the future of finance! Subscribe to our newsletter for the latest updates, trends, and insights—let’s navigate the world of Web3 together!

You might also like

More from Web3

Atos Group receives confirmatory offer from the French State to acquire part of its former Advanced Computing business

Press launchAtos Group receives confirmatory provide from the French State to accumulate a part of its formerSuperior Computing enterpriseImaginative …

SEC Raises Legal Questions Over Proposed Ethereum, Solana ETFs

In short The SEC raised considerations about whether or not the REX-Osprey ETH and SOL ETFs qualify beneath the Funding …

Best Short-Form AI Video Generator? Kling 2.1 vs Google Veo 3

In short Kling 2.1 launched to compete immediately with Google's Veo 3 within the AI video era market. Testing reveals Kling …