Prior to now couple of years, Uniswap DAO has deployed univ3 on many L2s. Liquidity Suppliers ought to have extra information about which L2s have been probably the most worthwhile for particular token pairs. That is our try to demystify a few of it.

Chains tracked: Ethereum, Arbitrum, Optimism, Polygon, Base, Celo

BNB and Avalanche weren’t included on this analysis as a result of their being their very own L1 chains.

On this analysis, we first took the highest swimming pools from every chain and made the widespread high swimming pools a part of our analysis. Aside from Base and Celo, the highest swimming pools on all the opposite chains have been comparable.

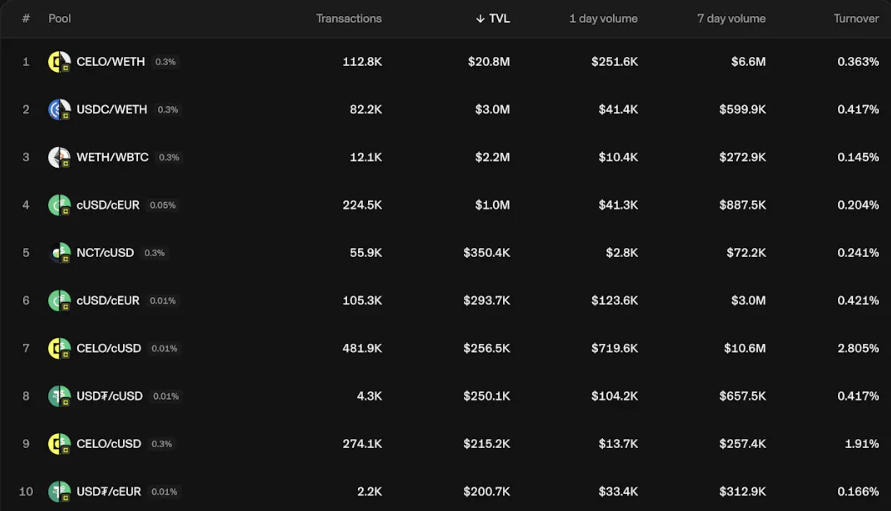

On Base, blue chip tokens struggled to make it to the highest 10. Here’s a snapshot of the highest swimming pools by 7D quantity on Base:

Celo has a variety of native swimming pools within the high 10 which have been once more not made a part of this analysis.

Within the case of Arbitrum, Optimism, and Polygon, liquidity and quantity have been fragmented between USDC and USDC.e (bridged from Ethereum), and each variations of the stablecoin are a part of this analysis to assist LPs make a greater choice.

How Was This Analysis Performed?

~$100 price of liquidity was supplied in every pool on 25 February 2024 till 25 March 2024. Please observe that this analysis doesn’t think about impermanent loss or LVR. The one focus is on payment technology.

Swimming pools And Their Ranges

ETH-Steady Pairs

Decrease Tick: 2993.974 USD per ETH

Higher Tick: 4410.486 USD per ETH

ETH-WBTC Pairs

Decrease Tick: 0.0499 WBTC per ETH

Higher Tick: 0.0588 WBTC per ETH

ETH-wstETH Pairs

Decrease Tick: 0.845 wstETH per ETH

Higher Tick: 0.882 wstETH per ETH

WBTC-Steady Pairs

Decrease Tick: 57907.855 USD per WBTC

Higher Tick: 84184.290 USD per WBTC

USDC-USDT Pairs

Decrease Tick: 0.990 USDT per USDC

Higher Tick: 1.015 USDT per USDC

You’ll find all associated pool information right here:

https://docs.google.com/spreadsheets/d/15e4W9N0bm6zYJ-eY-nogSiADnxqfYvtOrUbkRYgakcI/edit?usp=sharing

ETH-USDC

ETH-USDC

Polygon’s ETH-USDC 0.3% pool produced the best payment return at $18.9 adopted by Polygon’s ETH-USDC 0.05% pool. Base’s swimming pools carried out the worst. Ethereum, Arbitrum, and Optmism have been on par with one another.

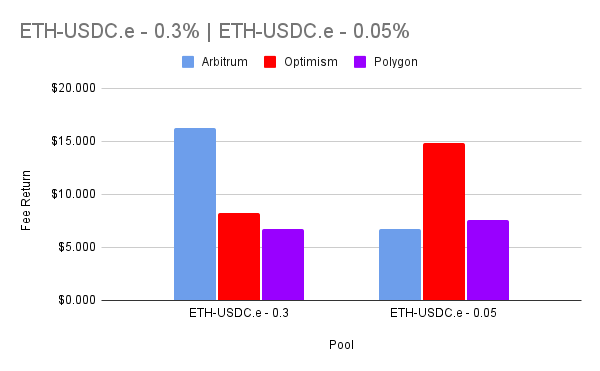

ETH-USDC.e

Arbitrum’s 0.3% pool carried out the very best with $16.2 in payment technology with Optimism’s 0.05% pool at virtually $15 being shut second.

ETH-USDbC / ETH-USDCET

ETH-USDbC pool on Base generated $3.57 and $4.3 respectively.

Celo’s ETH-USDCET generated $8.9.

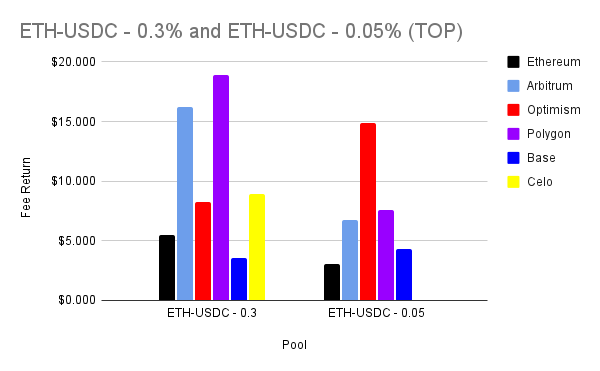

ETH-USDC (High Swimming pools)

The chart above combines and compares all of the top-performing ETH-USDC swimming pools on all six chains. This chart doesn’t distinguish between the completely different variations of USDC. For extra detailed data on the completely different variations of USDC, see the charts above.

Right here Polygon’s 0.3%, Arbitrum’s 0.3% pool, and Optimism’s 0.05% pool are the highest 3 performing swimming pools. Ethereum’s payment technology is missing far behind them.

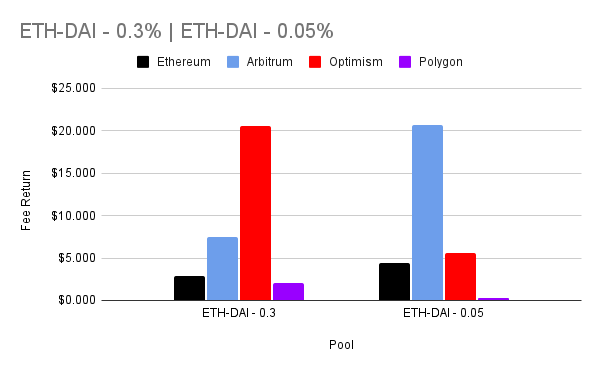

ETH-DAI

Ethereum’s and Polygon’s ETH-DAI swimming pools are lagging far behind Arbitrum’s ETH-DAI 0.3% pool with $20.7 generated and Optimism’s ETH-DAI pool with $20.5 generated.

ETH-USDT

Arbitrum’s ETH-USDT 0.05% pool takes the cake with the best charges generated at $9 adopted by Polygon’s ETH-USDT 0.3% pool at $6.7

ETH-WBTC

Arbitrum wins right here hands-down in ETH-WBTC 0.3% and ETH-WBTC 0.05% with payment technology of $10.3 and $6.87 respectively.

ETH-wstETH

That is the primary and solely LST pair in our analysis. We thought this pair was an excellent proxy for the general buying and selling quantity within the LST house.

Ethereum’s quantity right here just isn’t a shock given that the majority LST belongings are nonetheless on Ethereum. What’s stunning is that Base has generated probably the most charges within the given timeframe with the 0.05% pool producing $1.32, maybe that is an outlier and Base gained’t have the ability to sustain with Ethereum on this pair within the subsequent few months.

WBTC-USDC

WBTC-USDC

Optimism’s each swimming pools generated extra charges than Ethereum with 0.3% at $10.2 and 0.05% at $11.6.

WBTC-USDC.e

Optimism once more takes the win right here with the 0.3% pool producing $23.3.

WBTC-USDC (High Swimming pools)

The chart above combines and compares all of the top-performing WBTC-USDC swimming pools. This chart doesn’t distinguish between the completely different variations of USDC. For extra detailed data on the completely different variations of USDC, see the charts above.

Right here Optimism’s 0.3% pool, Optimism’s 0.05% pool, and Ethereum’s 0.3% are the highest performing when it comes to payment technology.

USDC-USDT

USDC-USDT

That is the primary time that Ethereum has generated extra charges on any token pairs. Maybe the majority of the stablecoin buying and selling remains to be taking place on Ethereum.

Ethereum’s 0.05% pool generated $0.15 and the 0.01% pool generated $0.06.

USDC.e-USDT

Polygon’s 0.05% is the top-performing pool right here.

USDC-USDT (High Swimming pools)

The chart above combines and compares all of the top-performing USDC-USDT swimming pools. This chart doesn’t distinguish between the completely different variations of USDC. For extra detailed data on the completely different variations of USDC, see the charts above.

Ethereum is the clear winner in each payment tiers with the 0.05% pool at $0.15 and the 0.01% pool at $0.06.

Abstract

In our analysis with the restricted swimming pools, L2s payment technology has outperformed Ethereum L1. Though TVL and general quantity are nonetheless increased on Ethereum, however LPing is extra worthwhile on L2s. LPs ought to think about the previous information earlier than deciding which chain to deploy the liquidity on. Polygon led the ETH-USDC swimming pools, Arbitrum led the ETH-DAI, ETH-USDT, and ETH-WBTC swimming pools, Ethereum ETH-wstETH and USDC-USDT swimming pools and Optimism led the charges technology on WBTC-USDC swimming pools.

Additionally learn: Optimism Bedrock: An Early Guide

You might also like

More from Web3

America’s Biggest Banks Consider Teaming Up to Challenge $245B Stablecoin Market: WSJ

Briefly Main U.S. banks, together with JPMorgan and Financial institution of America, are reportedly exploring a shared stablecoin challenge. The transfer …

Solving the AI & Crypto Data

The crypto area is evolving quick, and AI brokers have gotten smarter day by day. However there’s a elementary …